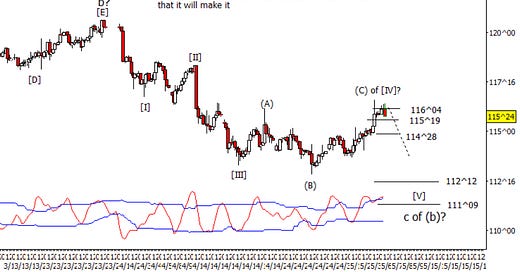

Bonds

The weekly chart I posted last night may be close enough but on the lower time frames, I think ZB would look a little better with one more minor low, but my confidence in lower isn’t high.

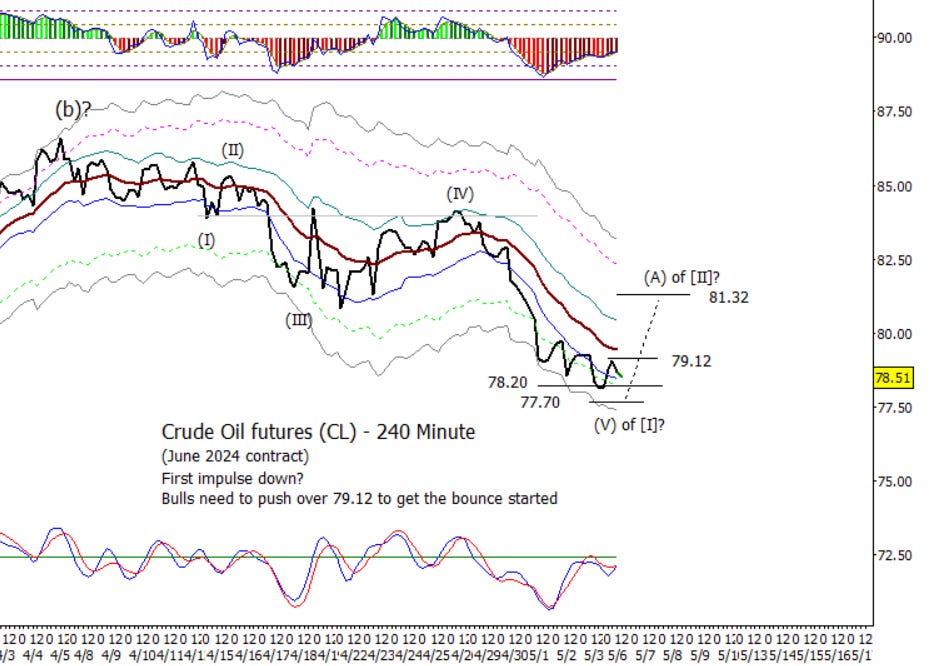

Crude Oil

I’ve switched this intraday chart over to a line-on-close format as I think it adds some clarity in this case. I think a case can be made for a five wave impulse down to complete the first impulse down being done or nearly so. There is positive divergence on the 240-minute chart in momentum at this low. Would be bulls need over 79.12 to get the bounce started.

Euro

I have been torn on the correct way to count the intraday moves in the Euro. One such option here on the 240-minute chart would have the Euro in a i-ii-[I]-[II] type formation. Bears need Euro back under 1.0760 for confirmation of a reversal.

Gold

Gold is acting like it is early in wave [V] up. Initial resistance at 2345.40 and 2361.40.

S&P 500 Futures

S&P 500 futures have been pretty dull today until just now here in the early afternoon. My assumption is that ES is working on a low degree third wave with the next overhead target at 5193.00 after which it may consolidate again in a low degree fourth.