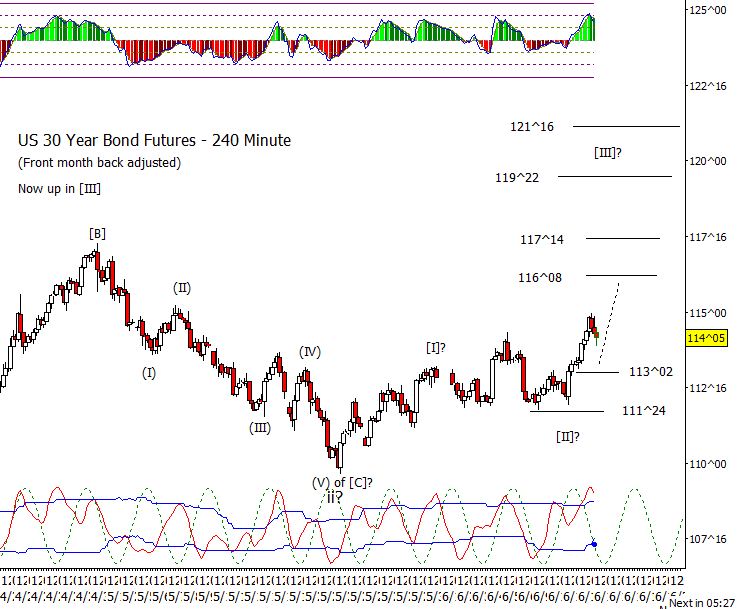

Bonds

As you would expect, bonds are up and putting pressure on the overhead resistance at 114^03. Goal for bulls is to not lose much ground.

Crude Oil

The leap up in Cl overnight has probably invalidated the prior idea of wave (b) being complete at the January high. Probably back to working on a (b) wave high, perhaps into August. In the short-term, it isn’t clear to me that a wave [III] is complete.

Dollar Index

DX is firming up against 97.70. Does that mean the DX low has been set? Maybe but I suggest that it best to see if DX can get over 99.95 before committing to a reversal. Possible that this low is just a low degree ‘b’ wave in a small fourth and that after a bounce a new low forms to complete ‘v of (c) of [iv].’

Euro

I have been vaguely dissatisfied with my attempts to count out the Euro and perhaps the reason is that I have been trying to look for an impulse up from the May low where instead I should think of it as corrective inside a still developing wave iv. Think the goal is to push lower to at least 1.1310 but have initial supports at 1.1486 and 1.1446.

Gold

I may have to adjust my gold count to something similar to Euro above but for now leaving the impulsive count up from the May low. GC should try to stretch for 3492.65 or 3550.20 but a good idea to raise stops if long.

S&P 500 Futures

Is the high for an ‘a’ or ‘iii’ set? Maybe not. Futures are pretty bouncy from the overnight low. Perhaps the rise from May low is an ending diagonal that needs one more high. I suppose bears hope that the high on June 11th was a (B) wave high in say either [IV] or b. I’ll think about it more. If I have more thoughts, I’ll post them.