Bonds

ZB fell back under 114^03 in what looks like a ‘(C) of [II]’ and could be complete in the 112^30 to 112^13 range.

Crude Oil

I’m backing off of the ‘{I]-[II]-(I)-(II)’ idea up from the April low and instead thinking that the ‘b’ wave low may be at the May low as that was the lowest day session close. That means the wave ‘[III]’ high could be set and now in a choppy back and forth consolidation to run the clock with wave ‘[IV].’

Dollar Index

Minor bias to a little lower in DX to finish off wave ‘v’ but the minimum requirements have been met.

Euro

Euro seems stuck in a low degree fourth between 1.1662 and 1.1589. I’m penciling in the next high as ‘[III] of v’ but may have to wait till after the FOMC tomorrow afternoon.

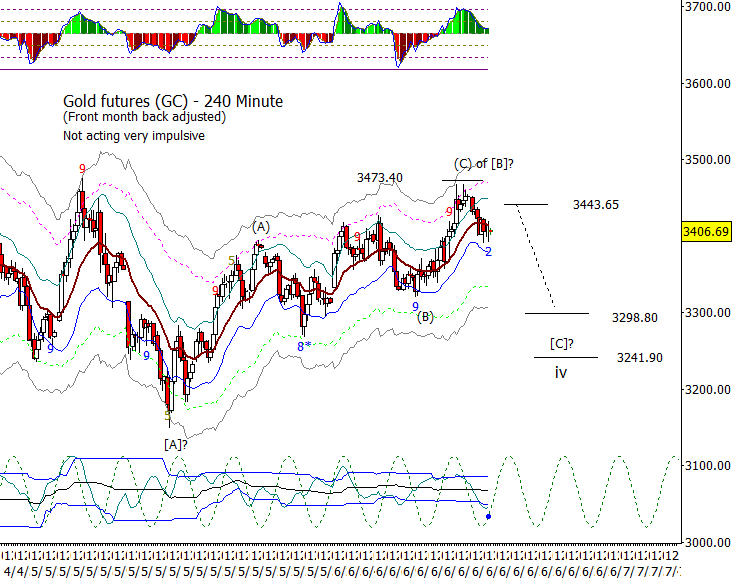

Gold

I worry that gold is not acting very impulsively up from the May low. Perhaps it is still stuck in wave iv.

S&P 500 Futures

SPX explored the recent range yesterday. Since it doesn’t look like an impulse up from the June 12th low, I favor a break under 6052.00 at some point today in an effort to push down to at least 5993.00 and preferably lower.