Bonds

ZB has poked above 114^03 again but I’m not certain it can hold above on this attempt as it could still be working on a wave [II].

Crude Oil

The case for a wave [IV] in crude is not dead but is in trouble. Odds are increasing that the (b) wave high in CL has been set. Next intraday target down is at 62.30 which begins to overlap a possible wave [I]. The overlap would be minimal, and I could overlook it if CL rose quickly after testing the support.

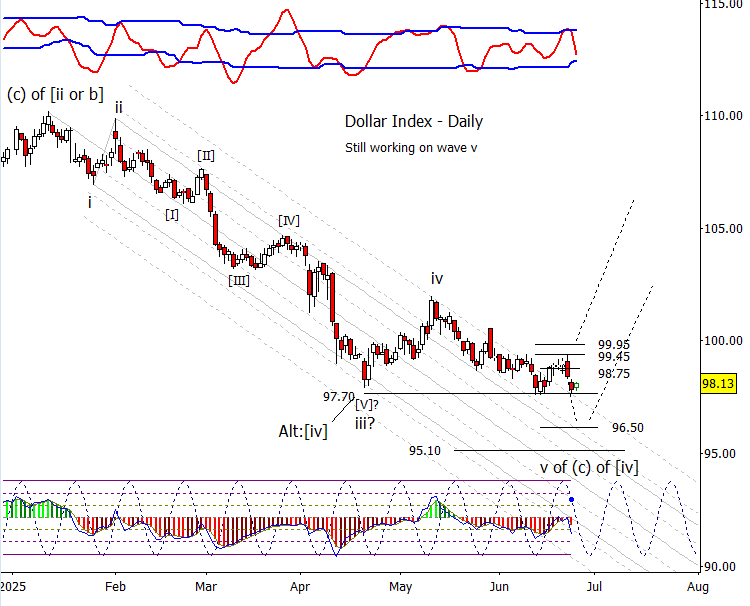

Dollar Index

DX retested the 97.70 support again yesterday. Is that good enough for a completed wave v? Possibly though it would be cleaner with a new swing low.

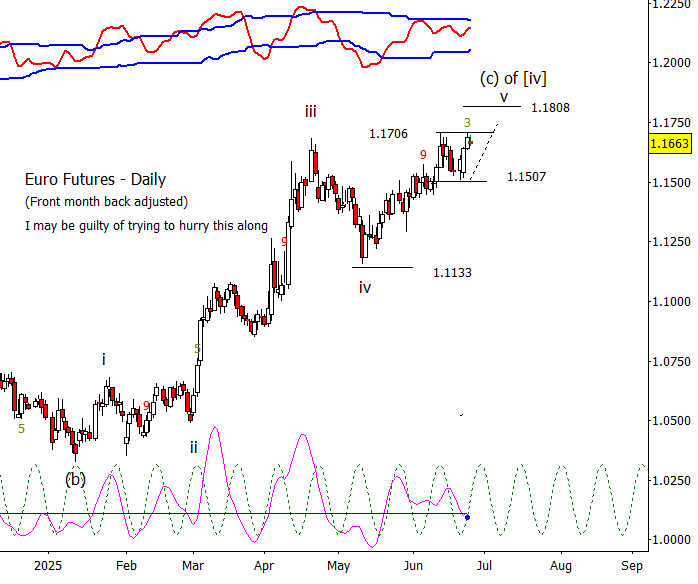

Euro

I prefer a little higher in Euro to complete five waves up from the start of the year, but it is very late in the move. Bulls should be managing their positions up here.

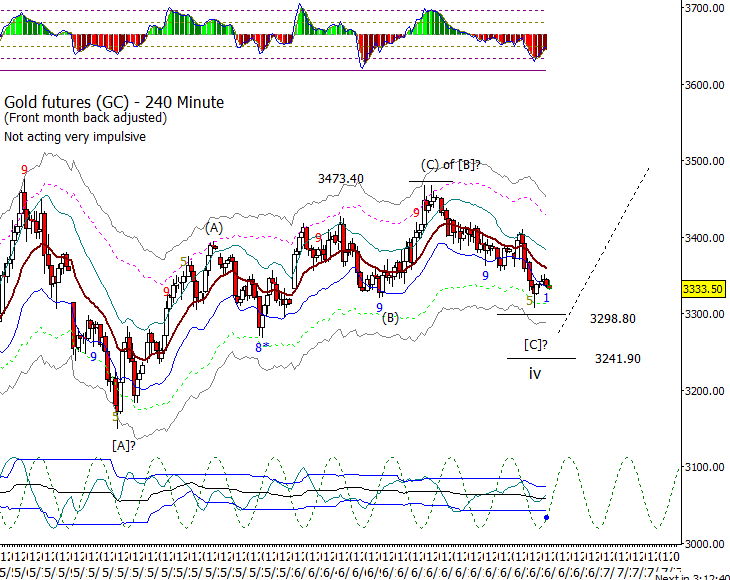

Gold

Gold is under the daily moving averages, but it still looks like a sideways consolidation from the high back in April.

S&P 500 Futures

Nothing really new from yesterday. ES found support from just above 6107.50 and pushed to the next overhead target zone at 6153.50 to 6159.00.