Bonds

ZB attempted to firm a bit around support on the intraday chart at 112^20 but probably needs a minor new swing low that could take it down to around 112^06 or 112^02 before a better bounce.

Crude Oil

CL on plan as it creeps higher toward initial resistance at 69.40 to 69.75. Anyone long should be managing their positions. Not sure if wave [A] is complete but could be. The next expected stage is for a choppy retrace in [B].

Dollar Index

DX is stalling near old support turned resistance at 97.70. I suspect it will be able to push over but maybe not on this attempt or if it does, not by much before forming a small consolidation for about a week.

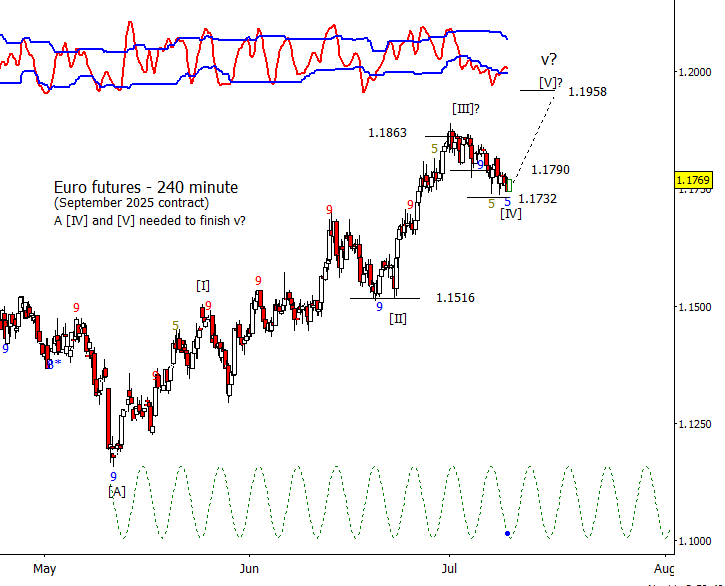

Euro

The Euro is tricky here. Since it has held above 1.1732, there is still a chance for a push to a new swing high but be careful as it is very late in the overall move up from the start of the year.

Gold

GC is softer than I like but still can climb out of the hole if bulls get to work now and push back above 3322.70.

S&P 500 Futures

Yesterday was a pretty uneventful day with little price movement. I lean to low degree fourth being complete and expect a push at least 6334.00 but likely a new high around 6373.75.