Bonds

ZB made a slightly deeper foray into the support zone of 111^30 to 111^06 yesterday but I still think it set for a bounce and likely more. First confirmation of a reversal is recovering 112^16 followed by 113^20.

Crude Oil

CL is little changed. I’m sticking with the idea of basing for one more rise into late this month or early next to make a more complex wave ii.

Dollar Index

DX is doing a good job of climbing out of the hole, but I do worry about a minor consolidation or retrace in this area prior to a more forceful move up.

Euro

Euro now has more of a look of an impulse down from the high instead of a correction but at a point that we should expect a bounce attempt. At this point, I am assuming that any bounce results in a lower high.

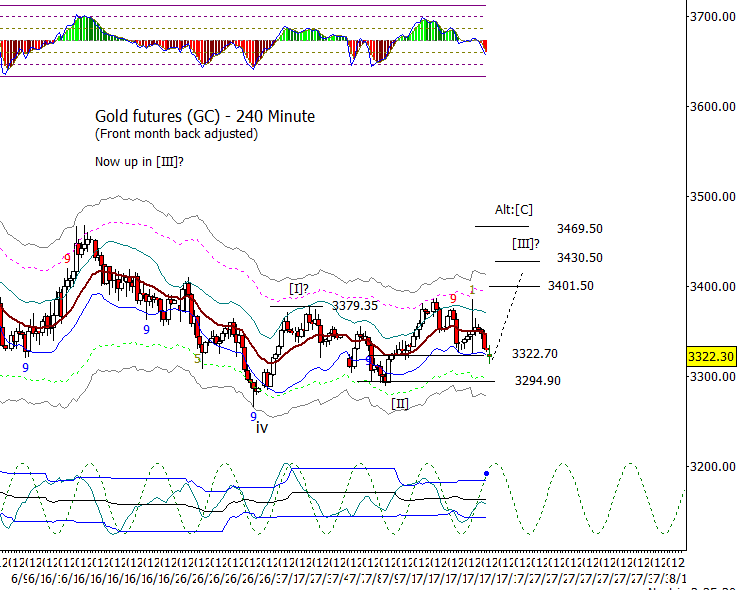

Gold

Gold is still having trouble with the daily moving average but I’m trying to be as generous as I can be giving bulls a chance to get another thrust up. Short-term, GC is coming back to retest the 3322.70 to 3294.90 support zone. Bulls need to get with the program or risk a sneaky reversal down developing.

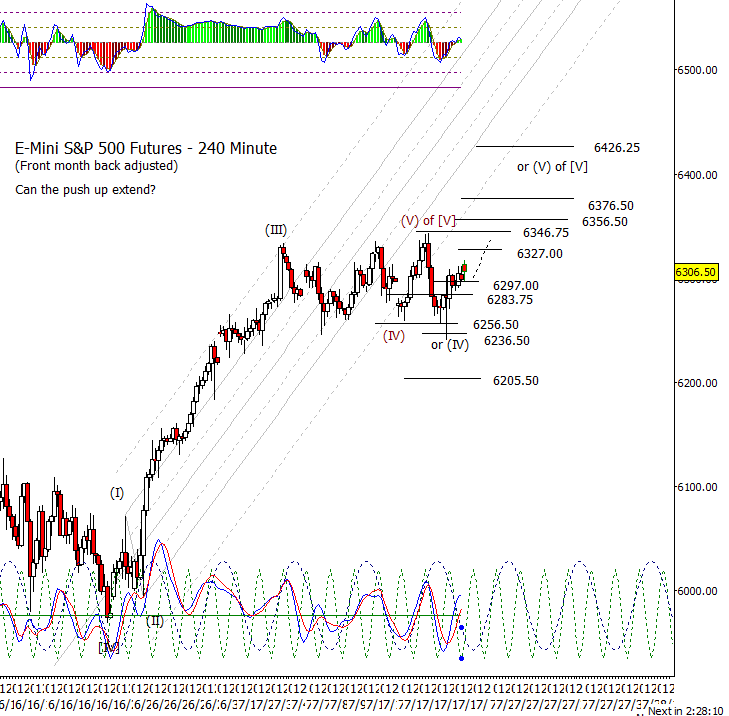

S&P 500 Futures

Some excitement in the morning yesterday on the news/rumors of Powell being fired led to a retest of the bottom of the range before a quick snap back up into it. I still worry about things going wrong but have to assume a mild bias up. Could things go wrong? Yes. Have they done so? Not yet. Short-term, I suppose we could see a retrace or consolidation of the rise up from the low yesterday that may take futures down to at least 6302, maybe 6292 before creeping up again.