Bonds

ZB fell yesterday but I can’t be too worried about it as it still looks like a higher low late in development to me. Don’t fight a rise if 112^16 is recovered and especially if ZB moves over 113^20.

Crude Oil

Yes, CL is down and yes, I expect it much lower eventually, emphasis on eventually. For now, I think it best to allow for wave ii to become more complex and hence allow for CL to firm and bounce again.

Dollar Index

DX has been doing well over the past couple of weeks. I expect much higher but probably can use a little rest before the next major push up.

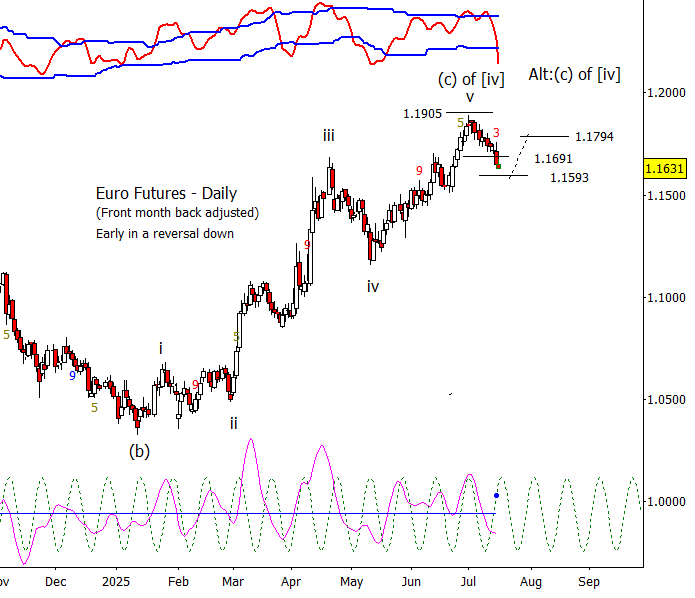

Euro

The drop is the Euro is now looking more like a reversal than a low degree fourth consolidation. Could extend a bit lower but getting long in the tooth in the short-term. Next supports at 1.1593 and 1.1579.

Gold

I’m trying to give gold the benefit of the doubt and allowing for a final thrust up, but I worry about it as it looks like DX is turning up.

S&P 500 Futures

Do I still worry about things going wrong? Yes. That said, path of least resistance is probably up. S&P 500 futures were weaker than I expected yesterday, NQ was more what I was expecting, a choppy day. Today, S&P 500 futures retested the bottom of the range early and are back up into near the middle. There is initial resistance at 6297.00 to 6303.00 which may stall the early morning rise but assume an eventual grind past it.