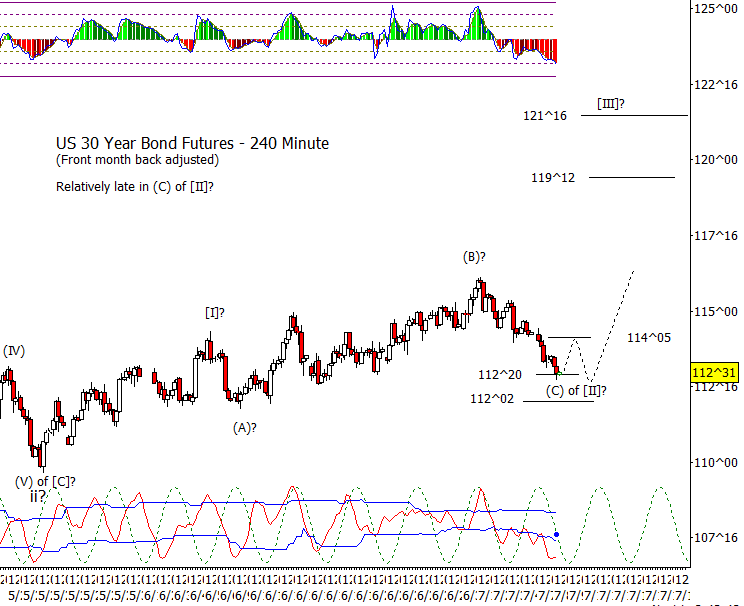

Bonds

ZB has been under pressure for the last few days though I think this is part of the development of a wave [II] for a higher low. Very short-term, I can see a bounce from 112^20 but followed by another low, perhaps around 112^06 or 112^02 before a possible reversal up in [III].

Crude Oil

I had a minor preference for a minor new low before a bounce in CL, but it had other plans. Now probably bouncing in either the first part or all of wave ii. A typical [A] wave target is around 69.40 to 69.75.

Dollar Index

As mentioned in other posts I have made, the minimum requirements for the end of wave v have been met and thus think that the risk is now of a sharp bounce or more in DX. Recovering 97.70 is the first proof of a reversal up.

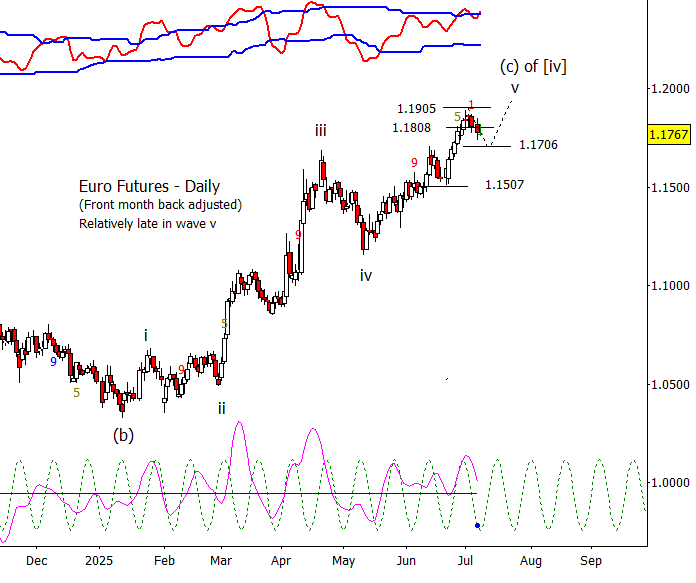

Euro

Euro may have wave v set though I can’t rule out one more minor high while above 1.1732. Net, a good place to manage if long but pretty aggressive to short till supports break.

Gold

I’m starting to worry that gold may have put in a truncated high. Bulls are still alive but need to firm up GC against 3221.90 and push up. The more time they spend under the daily moving averages, the higher the chances of a break lower.

S&P 500 Futures

I worry about things going wrong now that S&P 500 futures made a new high. Yes, there is still a chance to extend but we are in a position that a news item can come along where the dip buyers become scarce. Short-term, futures have support at 6247.50 and 6205.50.