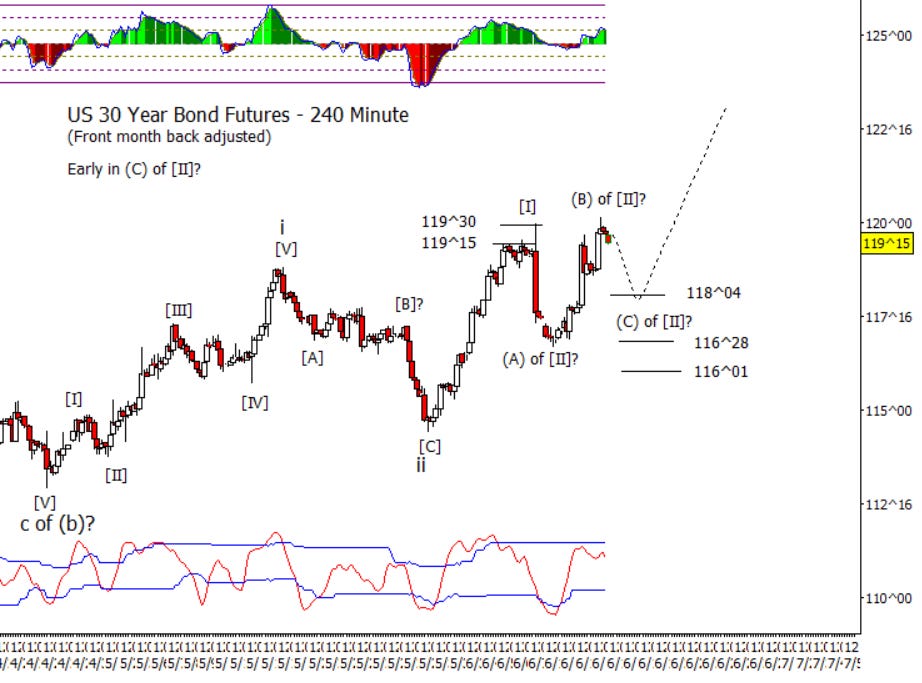

Bonds

Bonds made a minor advance today contra expectation, but I think the theme of a move lower in a (C) is still valid so will see if we can get a move down on Friday.

Crude Oil

CL drifted a little lower on Thursday but not near enough to qualify for the wave [B]. It is a slight negative for the short-term bearish case that CL couldn’t drop under the 20 period EMA on the intraday chart and hence I can’t rule out an attempt at a new swing high before pressing down in [B].

Dollar Index

DX back on plan with a recovery of 104.90. Should now work higher toward 106.80.

Euro

With Euro breaking under 1.0785, it should be moving down in a low degree third. Next major target is at 1.0608 while the next intraday target is at 1.0700.

Gold

The good news is that a higher low did form as per plan though it pushed to the deepest support before bouncing back. GC over 2344.75 should confirm that a wave (III) up is in progress that should target at least 2280.65 but probably higher.

S&P 500 Futures

I’m starting to worry a bit about the S&P 500 up at these levels and the next cycle infection is early next week. That doesn’t mean that bears have a green light to sell but the conditions are starting to ripen such that I don’t think it wise to be in a hurry to buy. In general, I’d like to see if the Dow can catch up to the S&P 500 and Nasdaq 100 but that need not mean that the S&P 500 and Nasdaq rise by much, as they could just begin to chop around. Short-term bulls want ES to hold 5489.25 to enable a push for a new high.