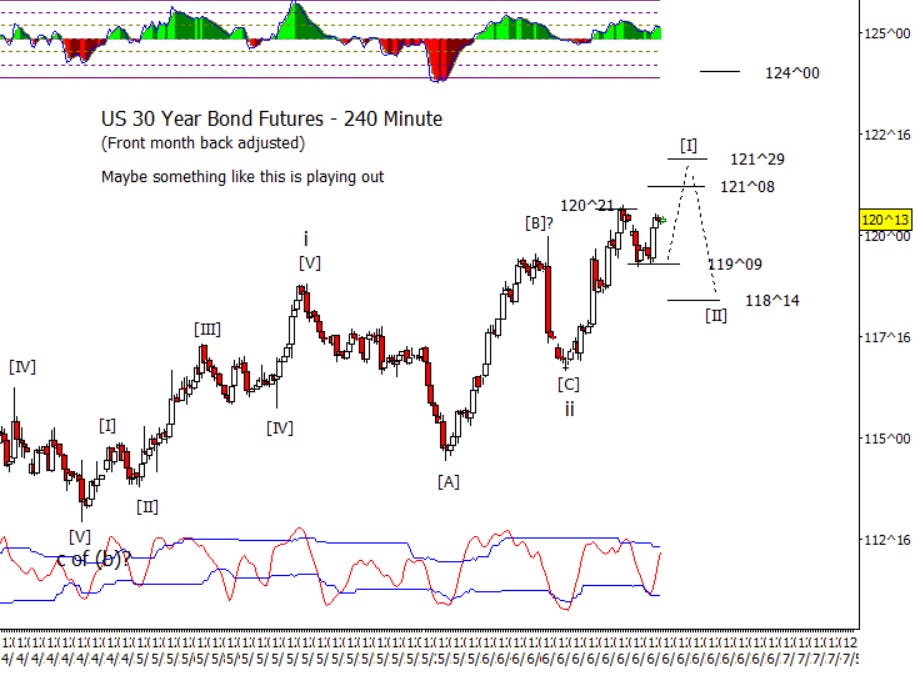

Bonds

When I first looked at the intraday chart, my first thought was maybe a super bullish series of 1’s and 2’s but on further thought, I like what I have depicted on the intraday chart better. Here we treat the drop from May 16th to May 29th as the first wave of ii, with the end of [II] on June 10th. This makes us late in wave [I] of iii with the targets for [I] around 121^08 or 121^29.

Crude Oil

The form off the early June low is impulsive and already in wave ii retracement areas. That made me wonder if the low in June wave a [B] wave and it certainly measures out like one, hence I now think we are pretty close to the end of the wave ii bounce. The [C] of ii could extend as long as 79.65 holds as support but I think it prudent to manage any long positions. Perhaps a little early or too aggressive to fade prior a sign of reversal.

Dollar Index

DX is slowly drifting back from the high late last week but is still holding above 104.90.

Euro

Little has changed from my last post on Euro as it still looks like it could turn down again on the intraday chart though the daily chart already has the RSI near the oversold zone. If the Euro fails to fall late this week, I will have to promote the alternate count to primary and treat the June 14th low as wave [I] of iii.

Gold

GC continues to push up against 2350.40 initial resistance which it needs to clear to open the way for higher in a third. Bulls also want to see a push through 2366.15 which would have it clearing the daily moving averages.

S&P 500 Futures

S&P 500 futures were up on Tuesday but didn’t have enough energy to decisively clear the intraday resistance at 5562.75. I still think it likely to make it to 5587.50 or 5590.25 but will have to wait till Thursday since Wednesday is a US holiday. On a programing note, I will not be posting on Wednesday but will be back on Thursday.