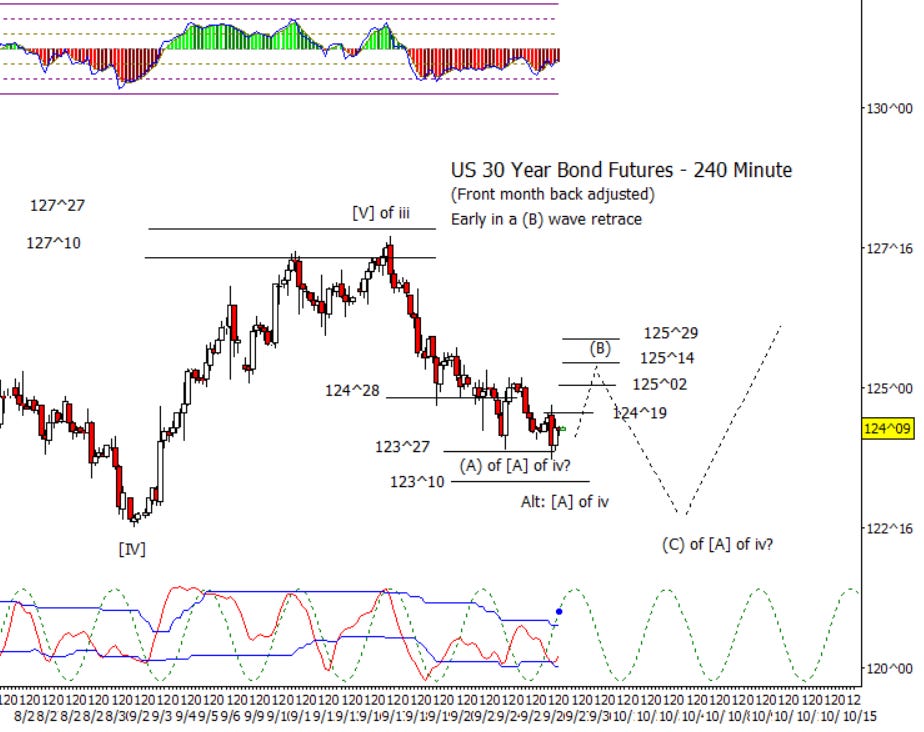

Bonds

ZB is attempting to stabilize, and I think bounce though we need to see ZB back over 124^19 for confirmation. I’m allowing for a very choppy wave iv to develop so plenty of time for up and down in a range. As I previously mentioned, the alternative if we are already in the last stages of ‘[A] of iv’ though I think the retrace down is too shallow to be complete.

Crude Oil

Crude continued lower today but started to form a consolidation against 67.15. I’m treating the consolidation as a low degree fourth and expect another move down to complete the first impulse down from a wave ii provided CL remains under 69.00.

Dollar Index

DX bounce a bit but nothing of not as it is still in the range of the week or so. A new low can’t be ruled out until there is a better move up.

Euro

Until the Euro spends time under 1.1180, it is too early to rule out a push to a new swing high. The form is not particularly clear so I can’t lean on it for too much on direction.

Gold

Gold pushed to a new swing high early then fell back but not enough to confirm a reversal. While GC holds above 2684.50, there can be a push to yet another high, maybe just beyond 2700.

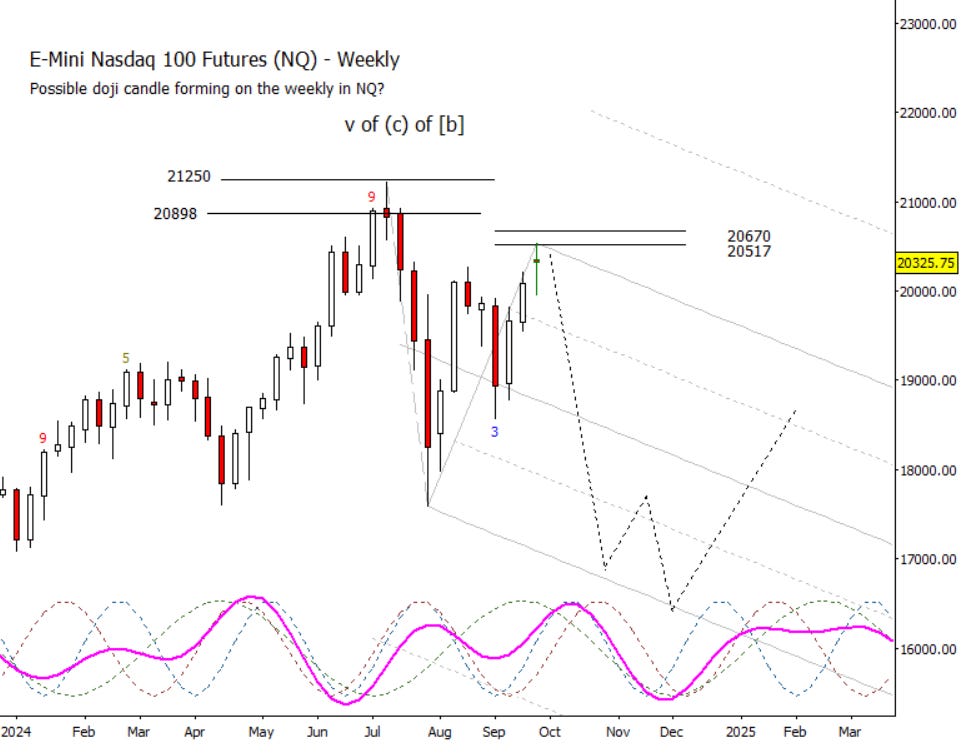

S&P 500 Futures

S&P 500 futures rose throughout the premarket on Thursday but stumbled in the day session though not enough to confirm a reversal. I think it very late in the game and don’t think higher is required but neither can I rule it out while above 5786.25.

Just for reference, I think it is interesting that NQ looks like it has a doji candle forming on the weekly chart.