Bonds

ZB did a good job pushing up away from the daily moving averages on Tuesday. I think it best to assume a push up over the June highs to around 121^04 or 121^25 before much of a retrace.

Crude Oil

CL has slipped enough that I have to favor that the ‘y of (b)’ high has been set and early in the development of (c) down. For the moment, I’m treating the current leg down from July 12th as a (B) wave of [II]. The alternate is this leg is a wave [III] in development.

Dollar Index

DX hasn’t move much in the last couple of days. Perhaps it is waiting for the ECB rate decision on Thursday morning.

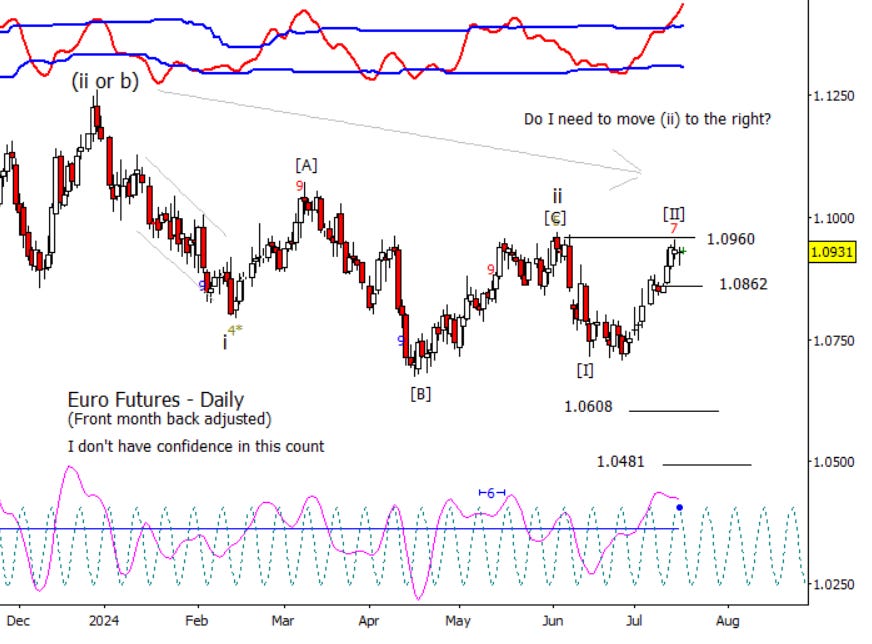

Euro

While the Euro is putting stress on the bearish wave [II] idea, it is still alive as it is still under 1.0968. Bears gain a minor victory if Euro drops under 1.0924.

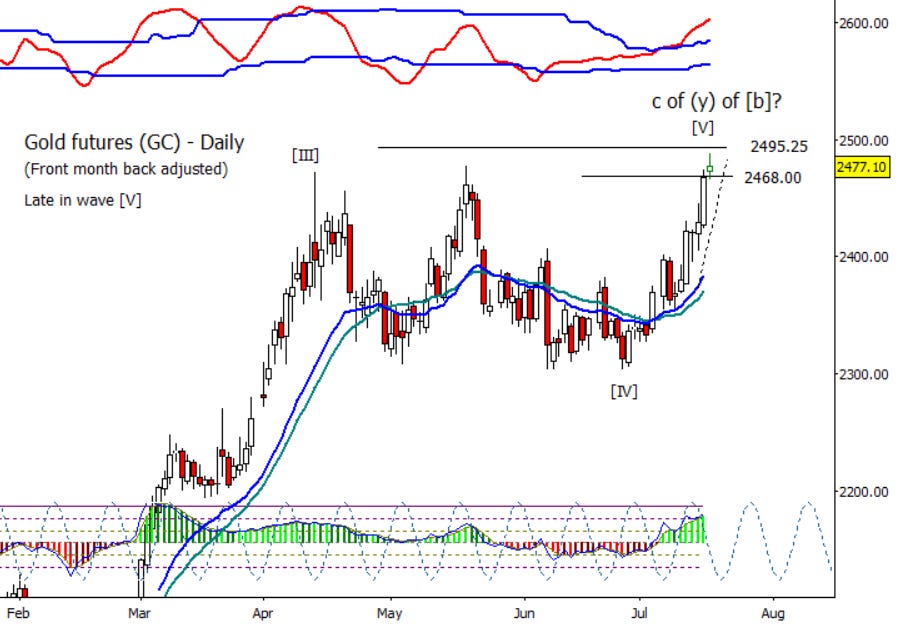

Gold

Gold came through with a new high on Tuesday. I’m marking this down as late in wave (III) of [V]. So far, there has been a brief poke past the 2479.30 target for (III) but I can’t rule out a try for 2495.25 from the daily chart or 2513.00 from the intraday chart on Wednesday. Strikes me as late to be long but too early to short.

S&P 500 Futures

S&P 500 futures were able to make a minor new high on Tuesday late in the day on the back of a strong Dow but are under pressure as I write this early in the morning on Wednesday. Could the high for the year be in? Possible. I think it best to assume bounces are selling opportunities though I can’t rule out another try at a high if 5666.00 holds as support. I would think the first test of 5666.00 could cause a bounce but be careful.