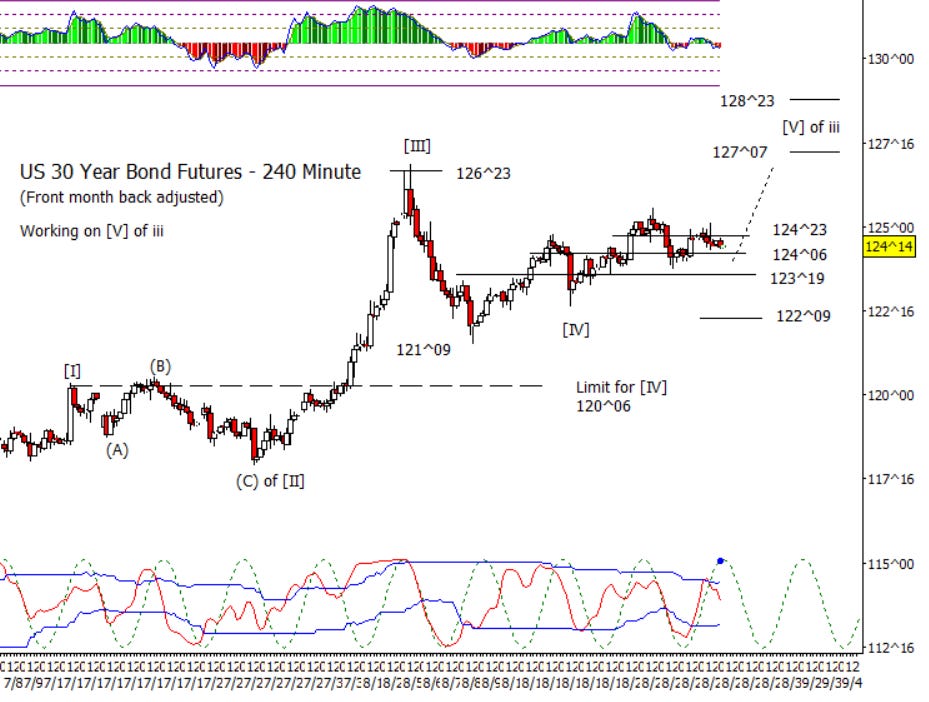

Bonds

A pretty dull day in ZB as it traded sideways in a narrow range. I still think we should see a new swing high prior to the next consolidation.

Crude Oil

Crude is on plan as it pushes up with some force which is typical in a [C] wave. Probably has enough momentum to make it to at least 79.10 to 79.30 and perhaps higher to 81.20 to 81.40.

Dollar Index

I know you are tired of me saying it, but I still think DX should firm up. Yes, I have been wrong for the last week or so expecting DX to firm up. Need to see DX recover old supports like 101.16 or 101.40 for evidence of a reversal.

Euro

Euro may have completed ‘[C] of y of (ii)’ last Friday. Bears need the Euro to continue to slip lower, eventually under 1.1096 for confirmation of a reversal.

Gold

On an intraday chart, a case can be made for another high while above 2539.70 but on the daily chart, you can see on the line on close chart that we may already have a completed pattern.

S&P 500 Futures

The S&P500 set the high for the day at the open and proceeded to be under pressure the rest of the day though the range was relatively narrow. With Nvidia earnings after the bell on Wednesday, I have a minor bias for the market to coast up to retest the high. Is a new high a sure thing? I don’t think so, as the Dow set a new high today, and I wouldn’t be shocked if the Nasdaq 100 and S&P 500 put in a lower high for intermarket divergence.