Bonds

ZB has a minor positive bias while above 126^11. Next overhead targets at 127^27 and 128^00.

Crude Oil

Probably a good idea to allow for a retrace from 69.40 to 70.15 before advancing in the next leg up of [C].

Dollar Index

DX has glided back down to retest the recent low. I wouldn’t be surprised by a shallow new low in the next day or two at which point we see if DX can climb out of the hole.

Euro

Late last week I gave up on the drop from the August swing high to the September low being a wave iv but as I look at the charts tonight, I think I may have given up too quickly. Euro is now pushing against the upper range of where a lower high would form. I’m now thinking that Euro will push over this area to a new swing high that probably coincides with a new S&P 500 high.

Gold

Gold has been stalled up against 2613.90 to 2614.20 for the last couple of days. Gold looks pretty late in the formation of five waves up from the June low and it makes sense for those that are long gold to manage here. I can justify another high on the intraday chart, but it is getting dicey. A drop under 2580.35 would be a problem for gold bugs.

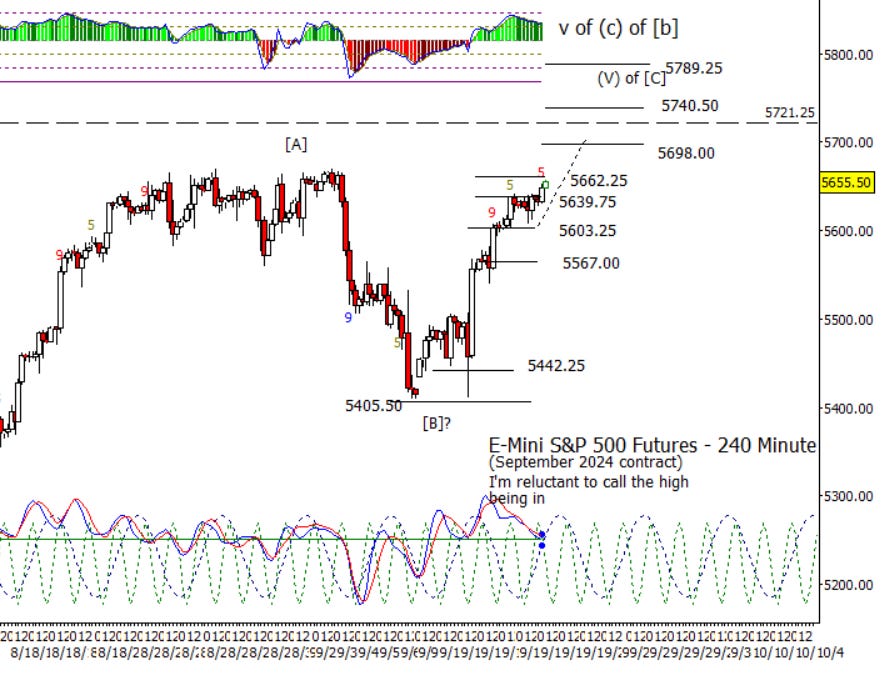

S&P 500 Futures

Not much to say that I haven’t already. The primary thesis is a rise into the FOMC meeting. Whether that sets the high or if the market holds up for a couple of weeks post this Wednesday I don’t know. I’m open to either. Once over 5662.25, I don’t think there is much to get in the way of pushing for 5698.00 to 5708.50 which would be just short of the prior high at 5721.25.