Bonds

Bonds came through with a minor new high today which might be good enough to set the wave iii high. Shorting before a drop under 126^10 is a bit aggressive but not crazy. The next daily cycle inflection point is on Thursday, but this could be close enough.

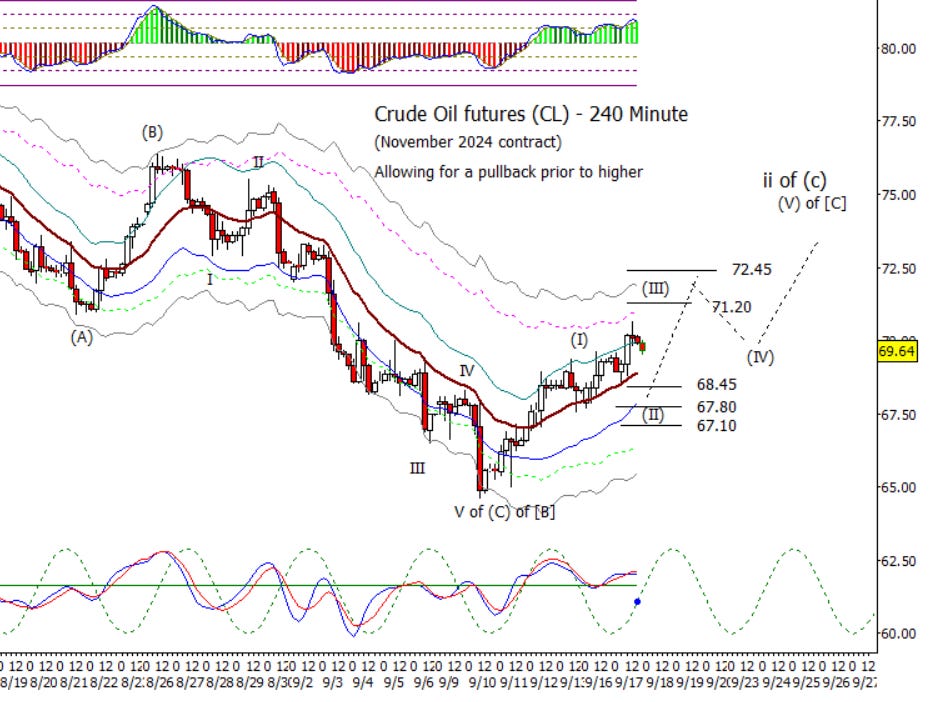

Crude Oil

CL managed higher today but is slowing against 70.15 on the daily chart. I still like a retrace to around at least 68.45 before shopping for a wave (II) low.

Dollar Index

DX has retested the August swing low. I can’t rule out a test of 100.40 or even lower but don’t think it is required. The RSI at the top of chart is in the oversold condition with the CCI at the bottom of the chart on positive divergence.

Euro

Tricky location in Euro as this would be a good place for a lower high. I really don’t know what path it takes from here as I can live with either a lower high or a minor new high.

Gold

GC slipped back a bit today. I think this is very late in form up from the June low but wouldn’t mind one more high on the intraday chart to have five waves up from the early September low.

S&P 500 Futures

Tricky now as cash made a new high today. I’ve done my best to curb my bearish big picture views and stay open to higher, but things can start to go wrong now or soon. Some are talking about a blow-off type top that can run into late in the year. That seems way too optimistic to me. Next major inflection point on the daily composite is October 7th but even that could be a stretch.