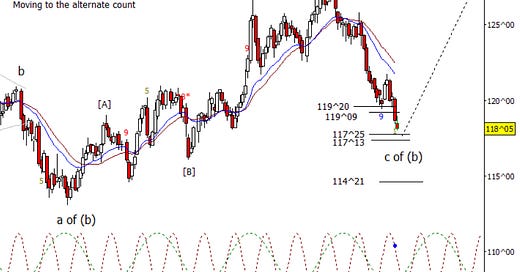

Bonds

I know it is in vogue right now to think ZB is going to fall through the floor, but I think bears are jumping the gun. Yes, in the bigger picture, I think bonds head lower but think that is something for next year. Short-term, ZB should push lower for at least 117^25 and maybe 117^13. Anyone short should be managing into this support zone.

Crude Oil

I was expecting a bounce and bounce we got today in crude. For now, I’m sticking with the idea of this being a wave (IV) bounce, but the alternate is alive as well. If the bounce exceeds 72.65, I’ll promote the alternate count to primary. We will get the EIA number Wednesday at 10:30 so will see if that caps this move. Bears need CL under 70.70 to feel good about a reversal down in (V).

Dollar Index

DX continues to rise but isn’t exactly running away from 104.00. The next projected cycle high is on Thursday.

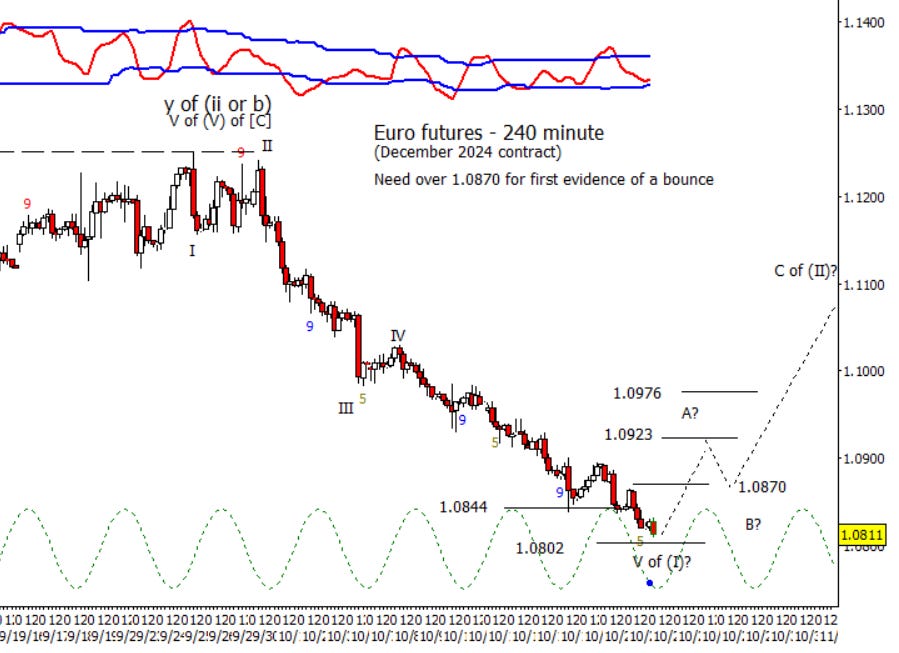

Euro

Euro continues to leak lower. Next intraday target lower is at 1.0802. There is some positive divergence building on a momentum indicator on the daily chart. Both the intraday and daily cycles are projecting a low nearby.

Gold

The gold train can’t be stopped…for now anyway. Gold is certainly behaving like it is in a third with the persistent climb up from the October 10th low. I’m assuming we will need to see a 4-5-4-5 type sequence before gold finally runs out of steam. In the short-term, 2775.00 is the next target up.

S&P 500 Futures

Another day where the S&P 500 traded in the same tight range it has for over a week. The form would look best with one more tiny thrust up but as I have stated before, there is enough complexity present now that it wouldn’t be shocking to see the market begin to move lower.