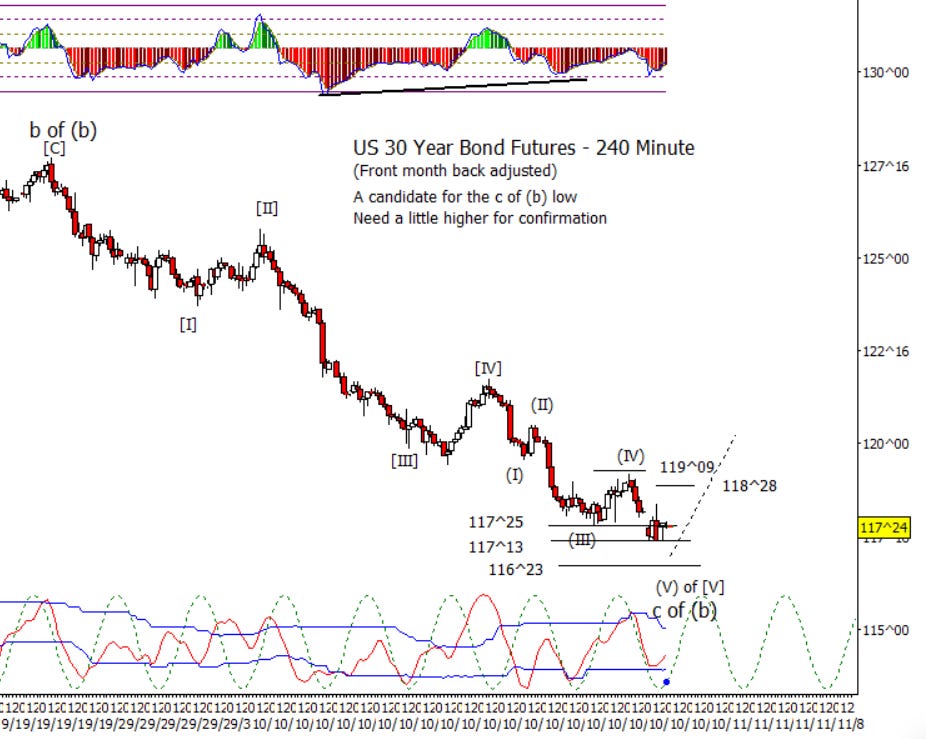

Bonds

While ZB was down early, it did firm up against 117^13 today and is working on recovering 117^23. I think the count down from the September high is pretty well developed at this point and best to allow for a bounce and in my view more. Bulls need ZB above 118^28 for confirmation of a reversal up.

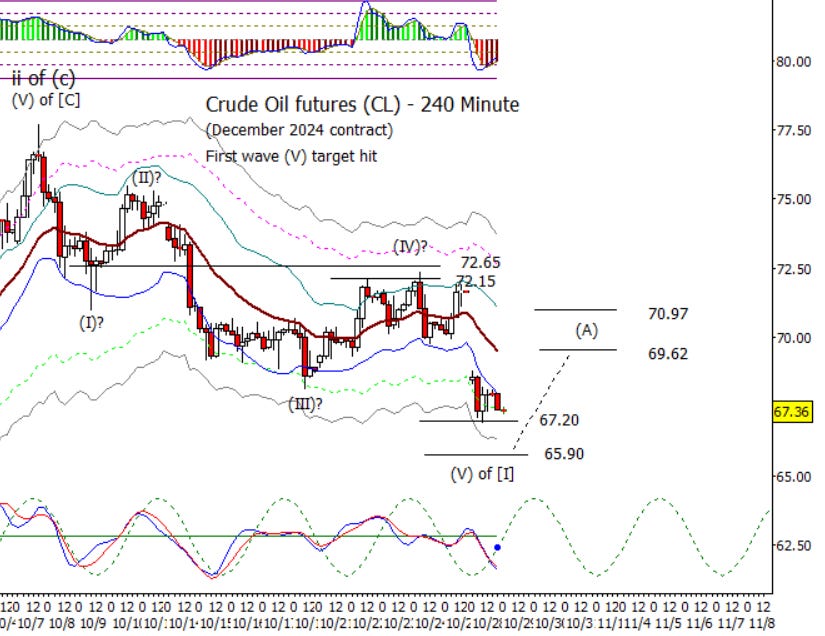

Crude Oil

Crude was putting pressure on the current wave count on Friday but got back on plan today with the gap down to test the first wave ‘(V) of [I]’ target at 67.20. I wouldn’t mind lower to test 65.90 but not a sure thing. If CL recovers 68.27, it is probably working on the first part of a wave [II] retrace.

Dollar Index

DX finally stalling a bit. Prefer at least a shallow retrace to test 102.95 prior to resuming the climb.

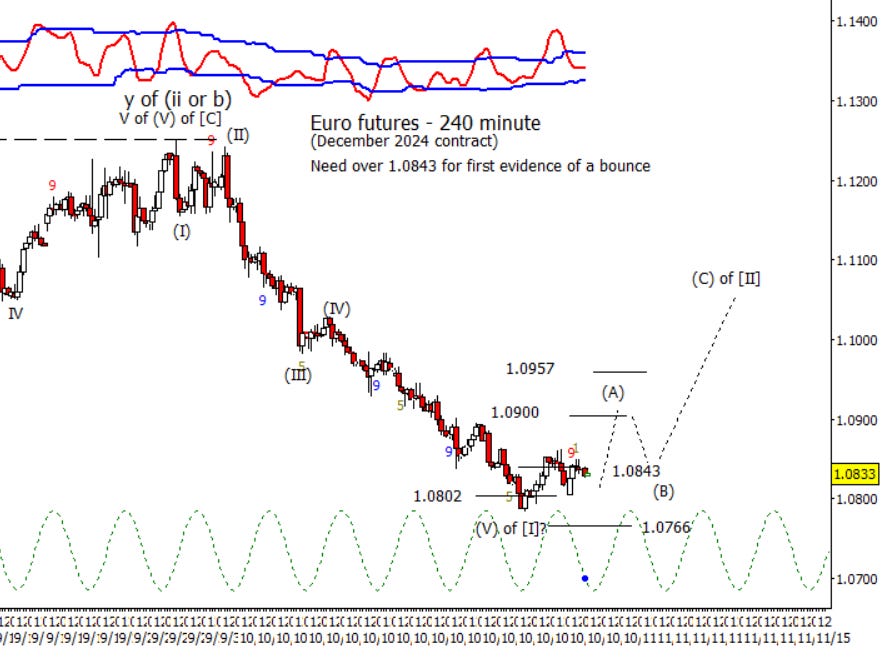

Euro

Euro has bounced but not quite enough to rule out another low till over 1.0843. While under 1.0843 it is possible for Euro to make a press down to test 1.0766.

Gold

Gold is staying on plan to push to at least one more high. Keep an eye on 2775.00 and 2784.90 as possible targets. Post a new high, we will see if there is one more consolidation and high.

S&P 500 Futures

Monday was a relatively dull day where there was a slow drift lower in an attempt to fill the gap from the Friday close. I’m assuming a choppy advance in an ending diagonal up from the October 23rd low. As I have been repeating, we are very late in the form and thus best to be on your toes and flexible. Between tech earnings and the NFP this week, and the FOMC meeting and US election in the near future, there is plenty of news that can move the equity markets.