Bonds

Bonds drifted lower again today but is starting to slow down. With bullish divergence building on the intraday chart of the CCI, I think we are pretty close to the end of this move. A move above 121^13 probably means a reversal up has taken place.

Crude Oil

Crude pushed down to just short of the 71.40 level on the daily chart and bounced with some force. Now to see if any reaction to resist at 74.10 results in a higher lower and an eventual push to 75.90 or 76.70 for a lower high.

Dollar Index

DX managed higher again today, but I still expect a consolidation to form prior to another advance.

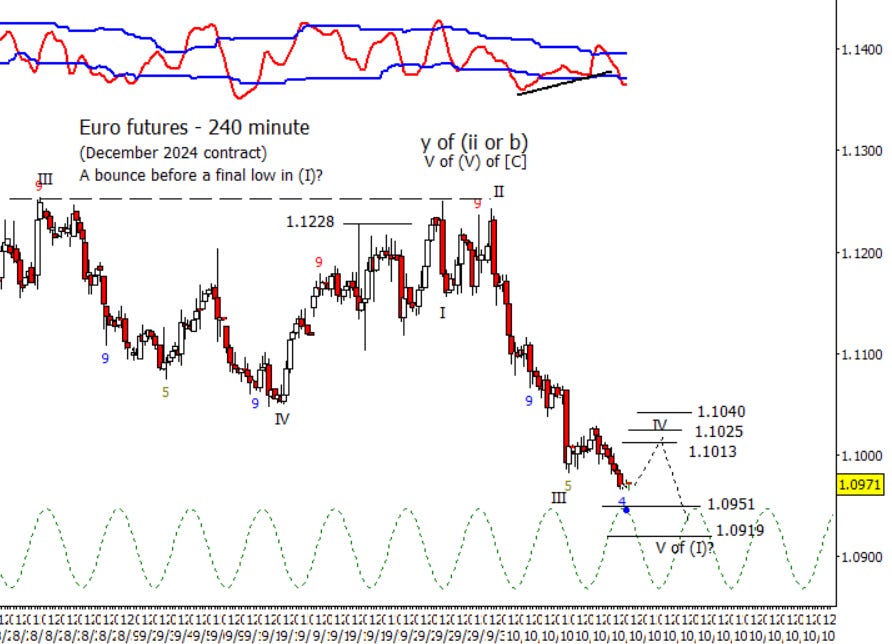

Euro

Euro moved lower but I’m not convinced that we have seen the end of the wave IV bounce as it should be roughly equivalent in time to the wave II hence, I’m assuming a bounce before the last wave down to complete the impulse for (I).

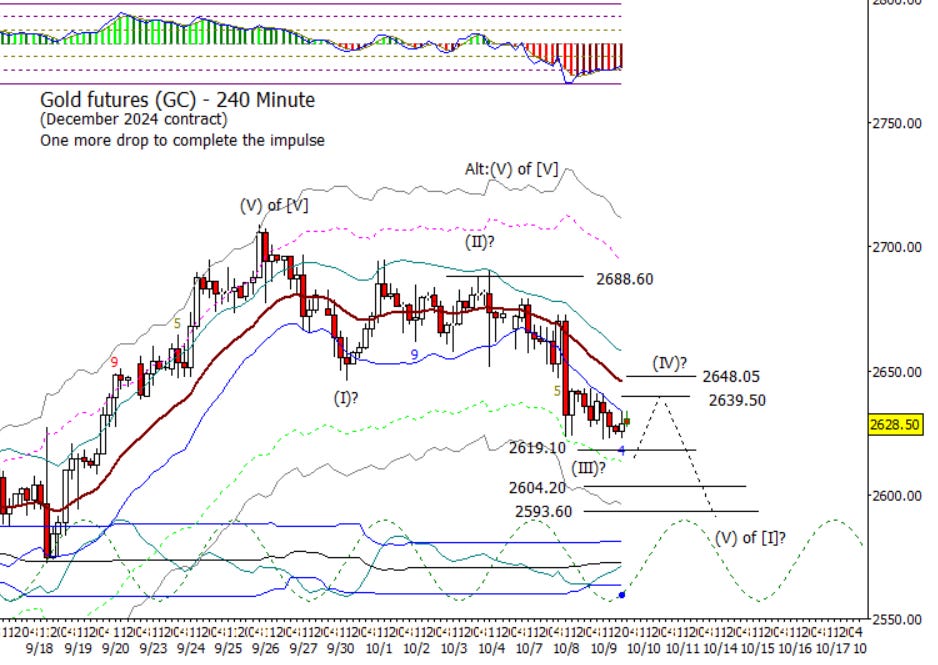

Gold

Gold spent the day sideways to slightly lower. I’m assuming that this is part of a wave (IV) that should have resistance at 2639.50 and 2648.05. The next move after the consolidation should be a thrust lower to complete (V) of [I].

S&P 500 Futures

The S&P 500 made it to a new high today. I know I was cagey yesterday not committing to a breakup from the consolidation and I still stand by it. I think this is a very precarious position for the S&P 500. Yes, it might still extend higher but I can count out a completed impulse from the low on the 7th now. Net, I wouldn’t be in a hurry to buy a retrace. Sell? Well, probably good to see futures drop back under at least 5828 if not 5810.75 first.

I might point out that the Nasdaq 100 still has lower highs. The bearish count is something like the following. Can argue that it would look better with a retest or slight new high to that of September 26th.