Bonds

ZB held the 119^14 daily support and bounced hard vindicating the call for at least a bounce in bonds if not something more. Too early to choose between the wave iv idea and the (b) wave low, but as I have said before implications for both are similar in the big picture. The primary difference is that I’m assuming that after a relatively deep bounce up, there can be another move down or movement sideways prior to a steadier rise up. The alternative, that (c) up is starting now, would result in a pretty steady rise to a new swing high.

Crude Oil

Crude is staying on plan as it pushed lower to test 69.10 prior to a bounce attempt. CL is currently just short of the first resistance at 70.80 though wouldn’t be shocked to see an attempt at 71.60 and possibly the 20 EMA on the 240-minute chart.

Dollar Index

DX rose a bit more but I still think a modest correction is in order. Need not be deep, sideways would be fine.

Euro

A relatively dull day in Euro. Yes, it did slip slightly lower but is attempting to hold the intraday target of 1.0919. Also note that we are moving into projected cycle lows on both the intraday and daily charts.

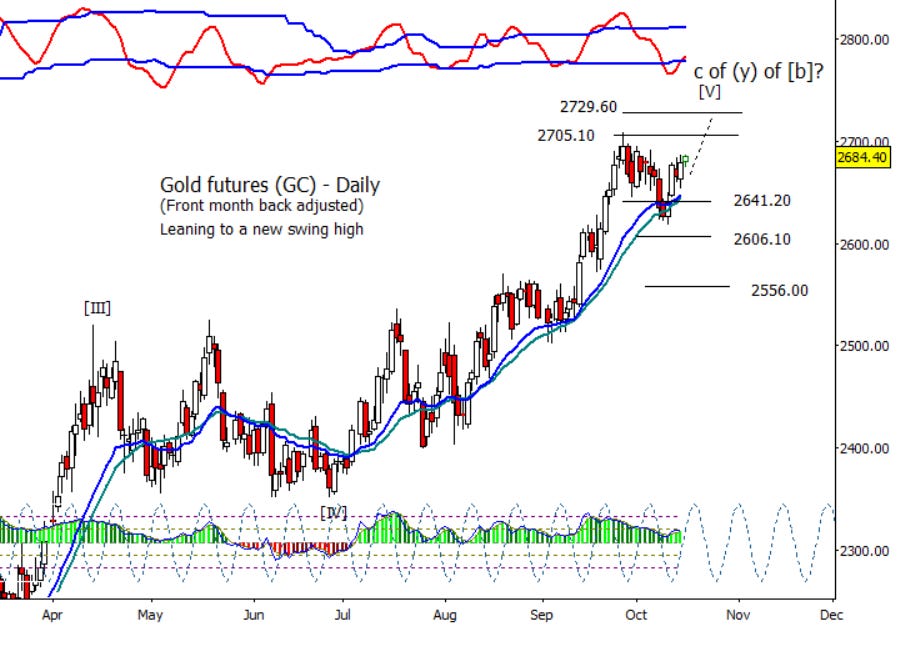

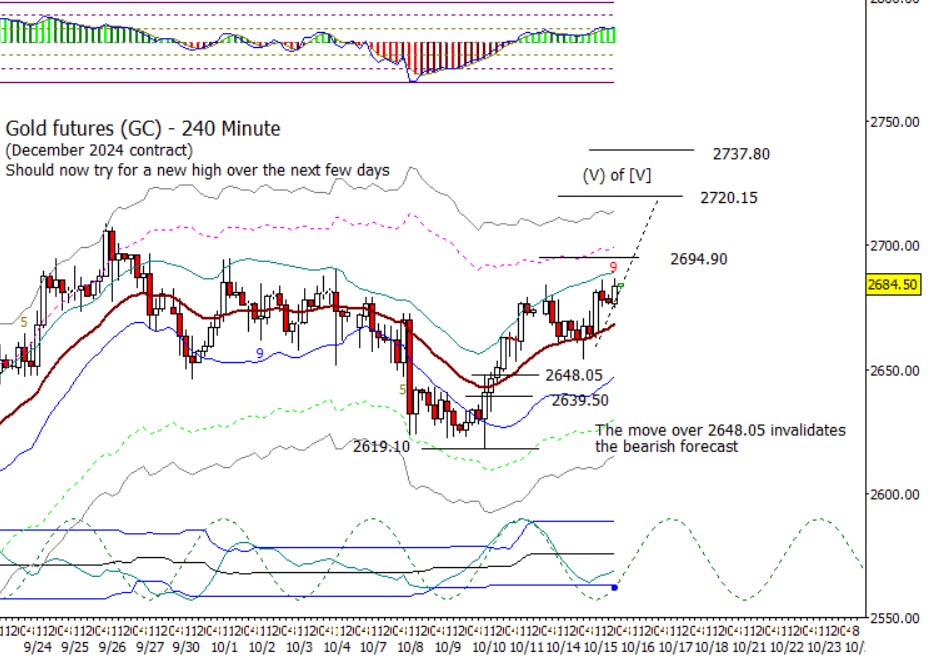

Gold

Gold is on plan with a move high on Tuesday. Not setting any records for speed but that is fine. Next projected cycle high is on Thursday and not that far from the high.

S&P 500 Futures

I thought there would be a retrace in the morning today, but I didn’t expect it to last all day. It is interesting that futures are holding the intraday support at 5850.75 and is above the old resistance zone turned support at 5837.50-5849.25. Could the high be in this time? Maybe but I don’t want to get too excited yet. Short-term, keep an eye on the 5873.50 to 5876.25 level. Over that area invites more of a bounce, say to 5896.25 to 5902.50.