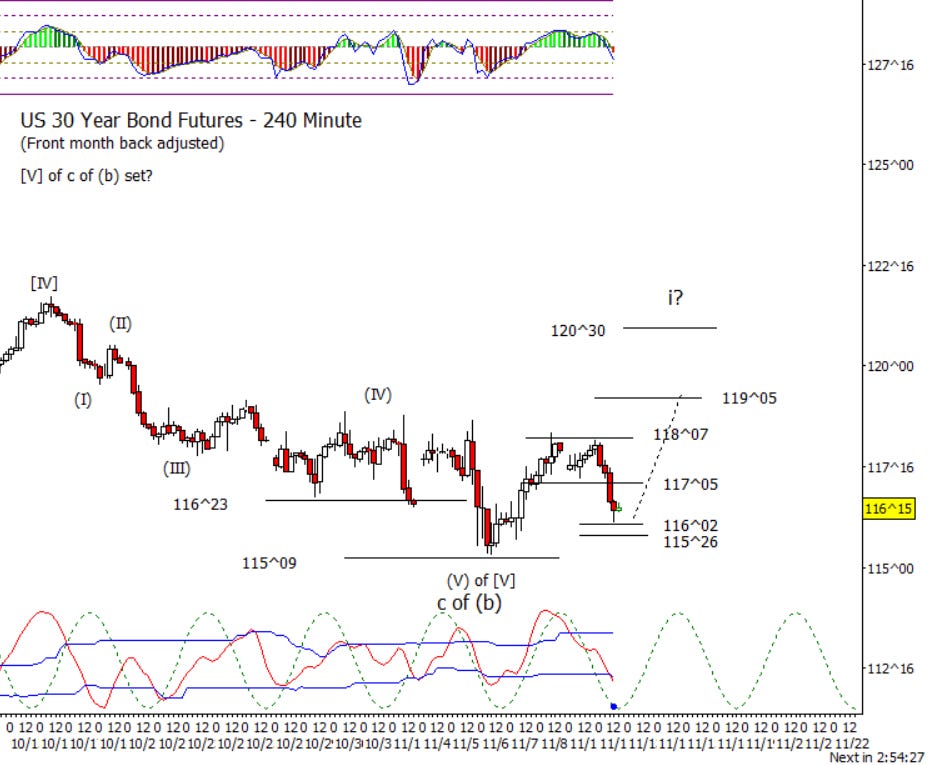

Bonds

Bonds followed the intraday cycle down to what looks like a possible higher low today. I admit that ZB is having a little more difficulty turning the ship around than I prefer but want to see what happens over the next couple of days. Recovering 117^05 is a minor positive but the real number to beat is 118^07.

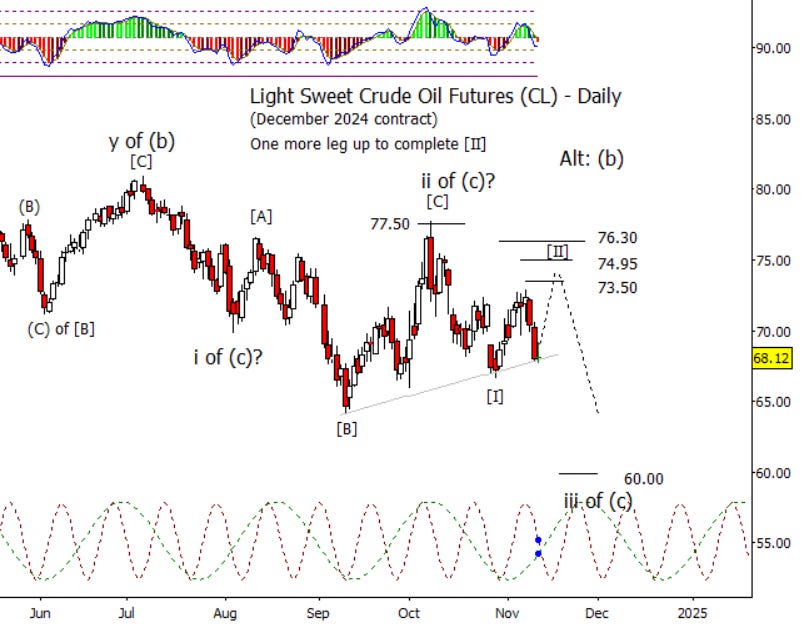

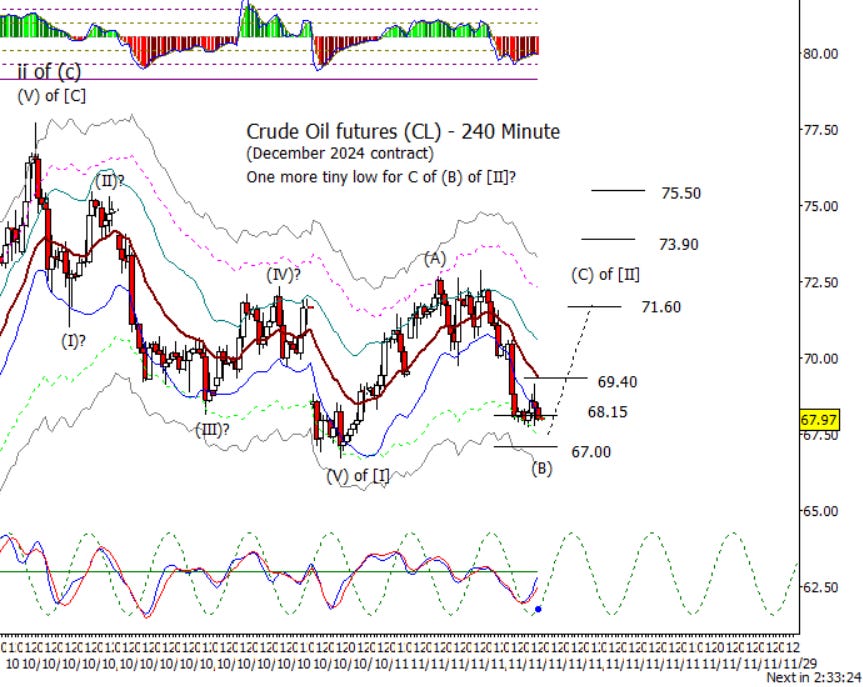

Crude Oil

CL had a weak attempt to bounce up from 68.15 but didn’t really amount to much. I think it best to assume that CL will try to push 67.00 before the next bounce attempt.

Dollar Index

Another day ending in ‘y’ and thus another day of DX rising. I jest but DX continues to evade forming a modest retrace. I expect DX to rise much more but still think a consolidation should be around here somewhere first. The daily cycle is set to turn down into November 19th.

Euro

As would be implied by DX pushing up today, Euro slipped a little lower to test an intraday target and Gann related support at 1.0620 and 1.0606. This is taking place on forecasted cycle lows in both the intraday and daily charts. For form, this still looks like a [B] wave low that should be complete.

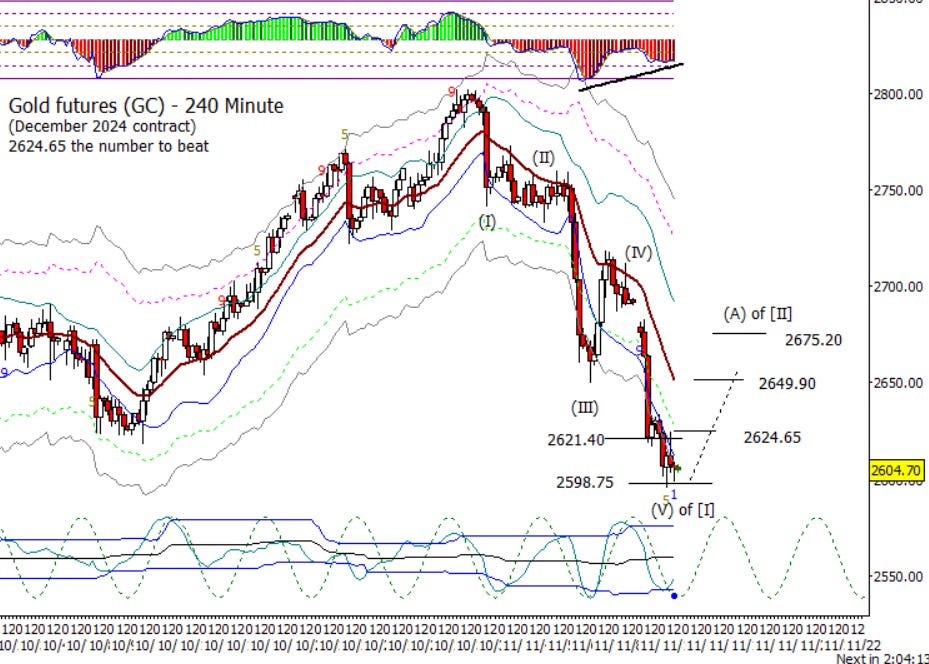

Gold

Gold slipped under 2621.40 today to test the next intraday target for ‘(V) of [I]’ at 2598.75 which corresponds well to a 360 degree move down on the square of nine on the daily chart at 2594.85. I expect a bounce attempt, but short-term bulls need GC above 2624.65 for it to amount to much.

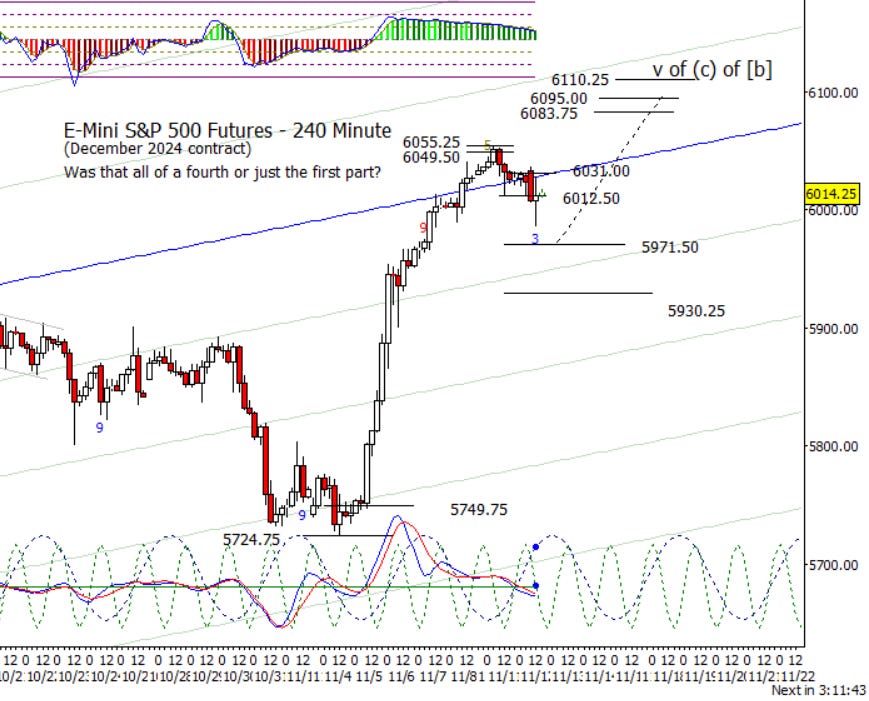

S&P 500 Futures

The S&P 500 leaked lower till it finally spiked down in the early afternoon to test a 1x1.27 extension down. Given that the working hypothesis has been to expect a consolidation for a low degree fourth, the low today can qualify. However, there are a couple of concerns such as the low was short of the next retrace level of 5971.50 and that fourth waves have a tendency to become complex thus the low today may only be the first leg of a fourth. I’m going to give the bulls the benefit of the doubt and just assume we build a five-wave structure up from the low of the day. Aside from 6031.00, the next major overhead target zone to aim for is 6081.00 to 6083.75.