Bonds

Bonds put in a decent move up today as it jumped up over the daily moving averages and up against an initial low degree target on the intraday chart. The primary hypothesis that the ‘c of (b)’ is set is looking pretty good but will be improved with an eventual push over 119^20.

Crude Oil

Crude fell pretty hard today from the low end of the wave [II] target range. 71.30 to 71.70 is what I would call the minimum for a typical wave [II] retrace and that made me wonder if the wave [II] could have been set at the recent lower high. I had been thinking that there would be a small five-wave structure up from the November 18th low but that wouldn’t be required if wave [II] was of the form 3-3-3. Bears now need any bounce to stay under 70.30 and to break under 68.50 for initial confirmation of a reversal. The primary level that needs to break to get wave [III] down started is at 65.80.

Dollar Index

Some nascent evidence that the relentless DX rise may finally retrace today. Bears need to have DX spend time under 106.80 to feel good about it.

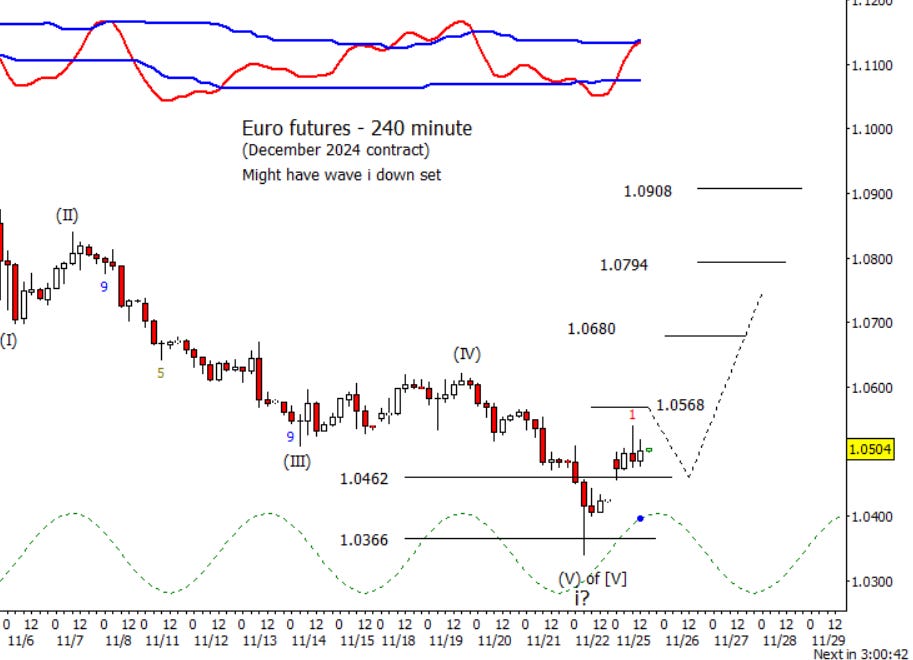

Euro

Euro was up today but bulls have more work to do to prove that a bounce is getting started. Bulls need a higher low and press over 1.0568 to get things started.

Gold

Impressive decline in gold today in what I’m marking down as ‘[B] of ii.’ The current bounce high is in the approximate area to look for a wave ii, but the form is not very complex hence why I’m allowing more time for it to develop.

S&P 500 Futures

SPX poked to a new cash high today before falling back. S&P 500 futures didn’t make a new high. The there was downward pressure in the morning but bounced back after filling the gap from last Friday. I can rationalize the high being set but acknowledge that there is an upward seasonal bias into the end of this week. Probably prudent to have a mild positive bias above 6012.25 and a mild bearish bias if under 5984.00.