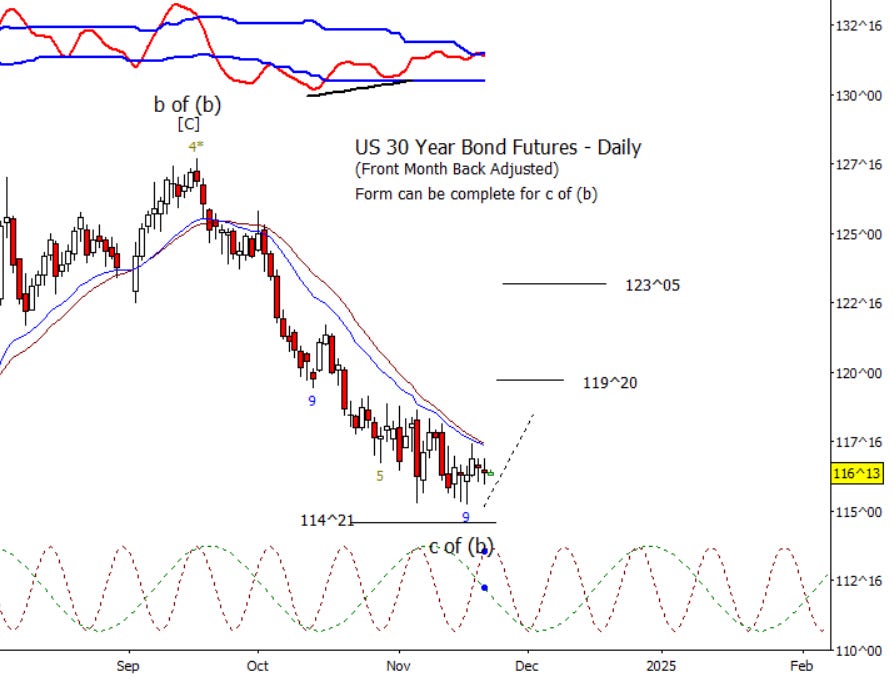

Bonds

Not much to say about ZB today as it was sideways to fractionally lower to yesterday. If ZB can push over 117^05, expect a push for at least 118^05, likely higher.

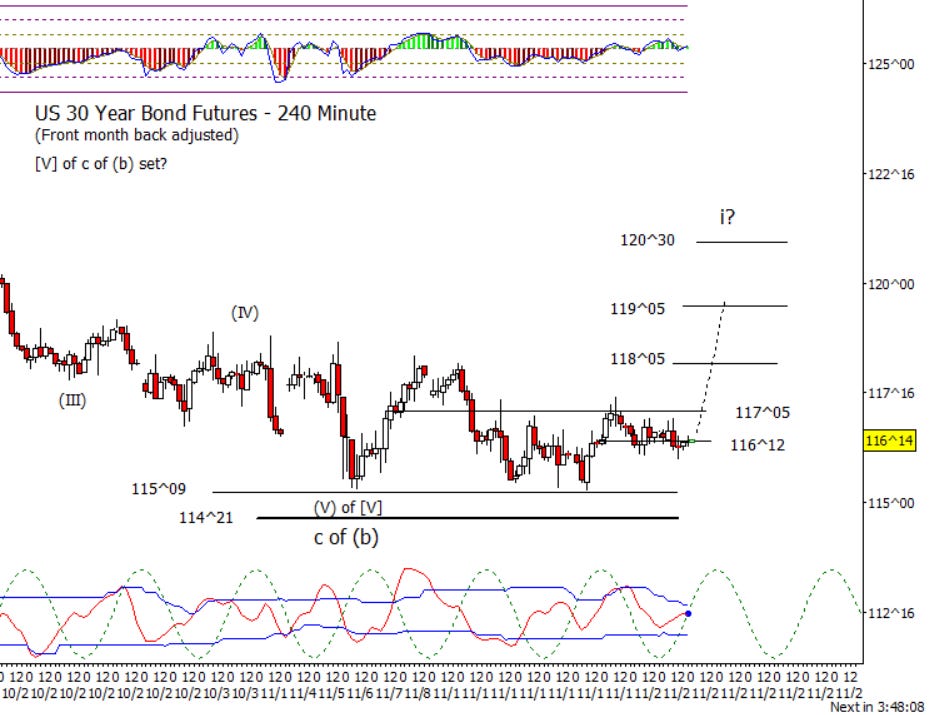

Crude Oil

Crude is sticking to plan as it starts to push up through 70.30. If CL follows the intraday cycle up, it should be bid up into early next week.

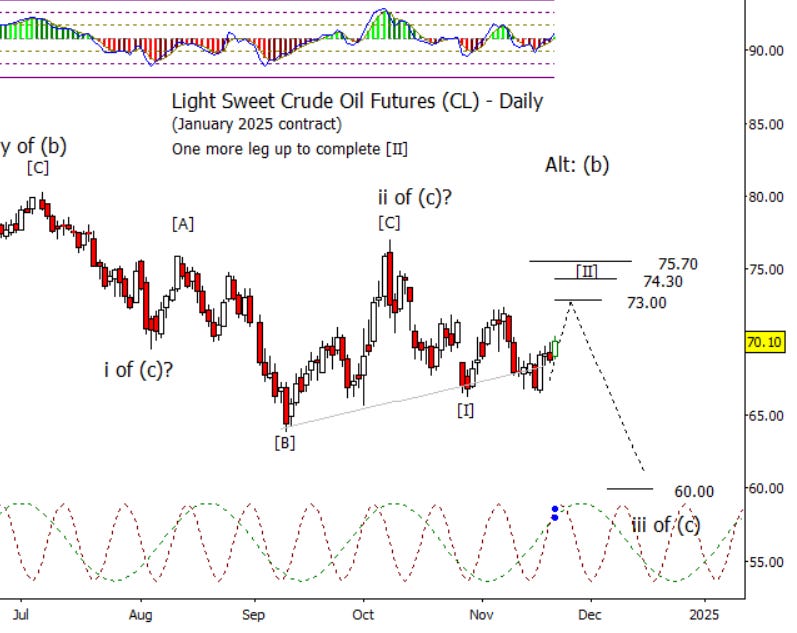

Dollar Index

DX did make a minor new high after about a week of sideways movement. This looks like a completed five waves up from the early November low and thus should be ready for a minor retrace.

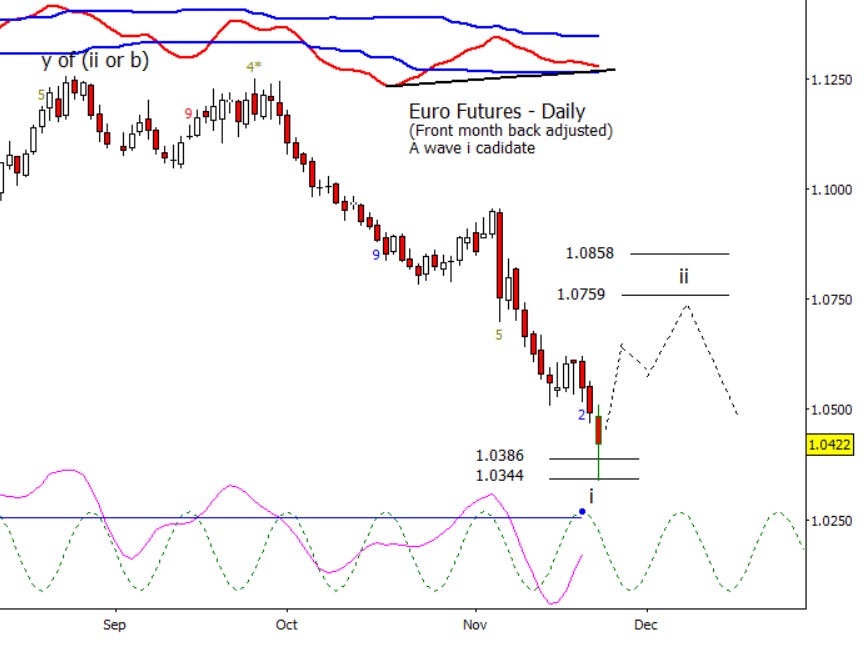

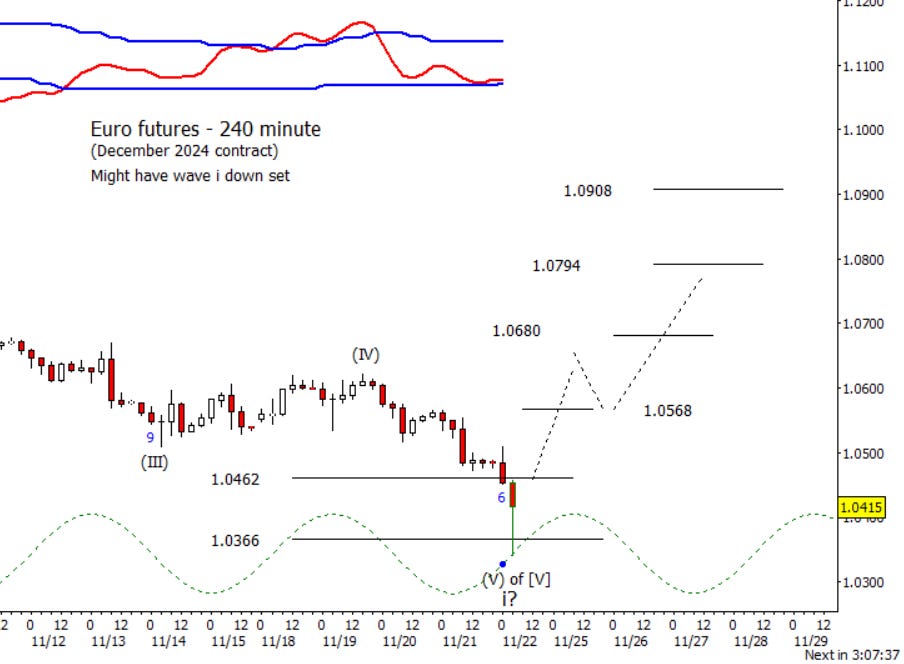

Euro

In the early hours of Friday as I type this, Euro appears to have put in a capitulation move that may finally mark the end of wave ‘i’. The move down from August now counts quite well as a completed impulse from the daily down to the intraday chart. First major indication that a wave ‘ii’ bounce is underway is a recovery of 1.0462.

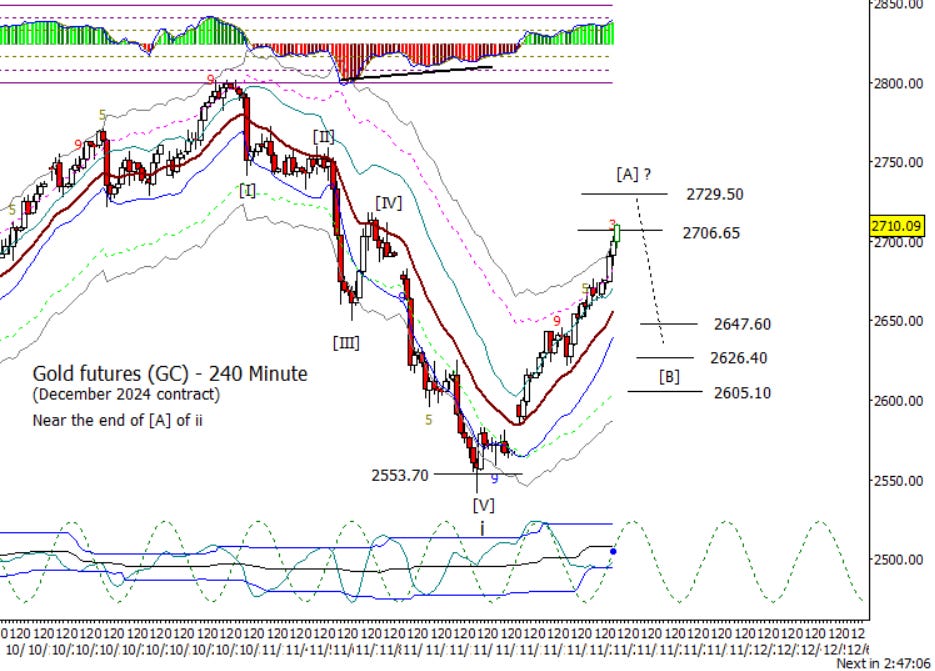

Gold

Gold is now being difficult. It has thrust up over the daily moving averages and now is it the range of a wave ii but the structure doesn’t look complex enough thus I’m still calling this ‘[A] of ii’ instead of all of ii. Next resistance at 2706.65 and 2729.50.

S&P 500 Futures

S&P 500 futures stayed on plan and moved higher on Thursday to test the next overhead target at 5984.00. Now it gets tricky. I can rationalize a try for 6012.25 on lower time frames, but I don’t like the pressure being put on 5945.25 in the early hours of Friday morning. If 5945.25 is lost, I think it best to assume the wave [II] bounce is over and wave [III] down has started.