The Day Ahead: PM Edition 2024-11-20

Equity indices soft in the early morning but recover late in the day

Bonds

ZB slipped back from the 117^05 resistance but did manage to firm up against 116^12. If ZB can base above 116^12 it may be able to finally grind up to put pressure on the daily moving averages.

Crude Oil

Crude advanced in the early morning but gave back that advance through the rest of the day. I’d like to see CL work on a higher low of the next day or two prior to a wave ‘III of (C) of [II]’ next week.

Dollar Index

Nothing really to say in DX as it has been moving sideways for the last few days. As I have mentioned previously, it is possible that there will be a push to a new swing high before the modest retrace that I have been looking for.

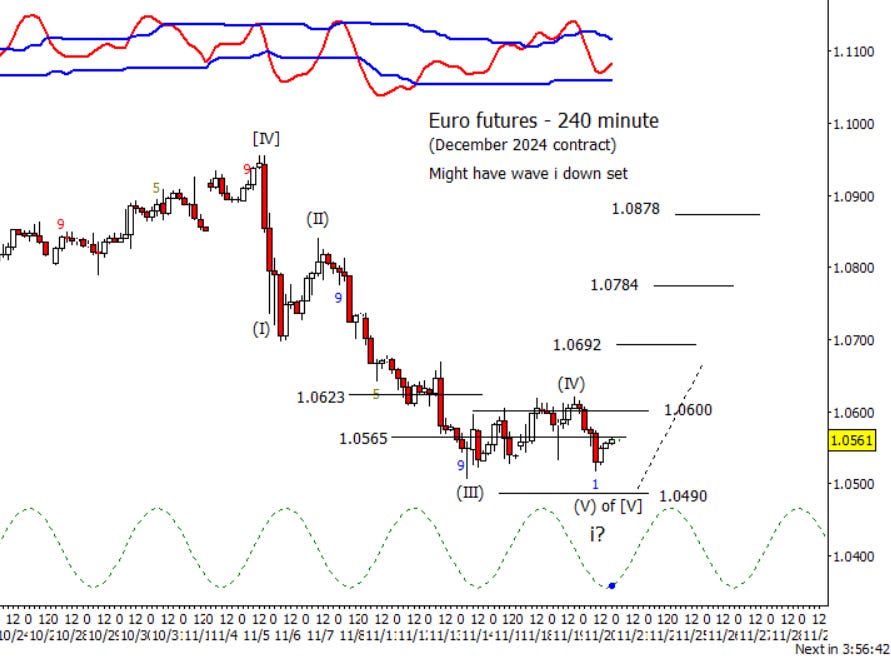

Euro

It looks like Euro took the alternate path that I outlined yesterday where the recent consolidation was wave (IV) and needed a drive down to complete ‘(V) of [V] of i’ which may have completed today. First sign of a bounce is recovering 1.0565 and next is a push over 1.0600.

Gold

Gold has an identifiable five waves up from the low on the 14th as it tests the daily moving averages. Also note that there is a Wave 59 9-5 exhaustion signal on this high which makes this a good candidate for wave ‘[A] of ii.’ Initial support on a retrace down is at 2633.30 though I prefer lower around 2603.50.

S&P 500 Futures

Today was interesting with the geopolitical news driving the market lower early. I was expecting a retrace but was a little surprised by the speed of it. Next the S&P 500 climbed out of the hole and popped up late in the day prior to Nvidia earnings to test initial resistance at 5945.25. There has been some slippage post the Nvidia earnings but I’m not reading much into it yet. We need to see how the market responds to the economic data on Thursday morning. I prefer a push up through 5945.25 but things can go wrong. I’ve added some price targets lower if things go awry and we end up with a deeper (B) wave.