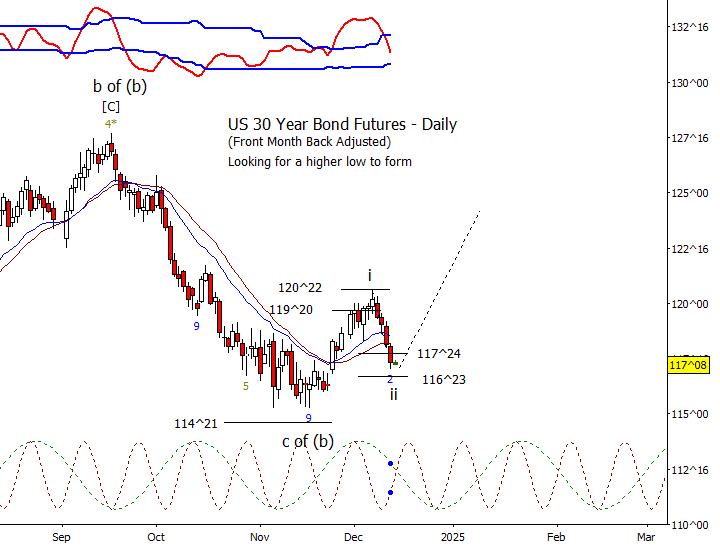

Bonds

Another down day in bonds but should begin to slow and attempt to base. The CCI on the intraday chart is at a very oversold level but I wouldn’t be surprised to see it leak a little lower to hit the 116 handle. There is a gap around 116^12 that bears have their sights set on but should manage at 116^23.

Crude Oil

CL slipped a little today, really more sideways than anything, which is pretty much what I expected. Now we will see if CL can stretch a little higher into early next week to finish the leg up from the December low. Best if 69.55 holds as support for this hypothesis.

Dollar Index

So far, DX is refusing to give me much of a retrace but I remain skeptical that the drop to 105.60 was all of the retrace I’m looking for. It may turn out that it may not drop much more in price, but it should be more complex and burn off more time.

Euro

Euro slipped under the first target for a [B[ wave at 1.0487 and is approaching the next at 1.0444, this time with positive divergence on the RSI from the 240-minute chart.

Gold

Nice drop in gold today which may have marked the expected wave ii high. Bears now need gold to push down through 2681.90 for the next confirmation.

S&P 500 Futures

The price action today is not what bulls had in mind as the market moved lower overnight and throughout the day. I’m still giving bulls a chance to push for the 6140 area as long as 6044.00 holds as support. Perhaps a triangle is forming with the low at the end of the day today as C of the triangle with a D wave up due on Friday.