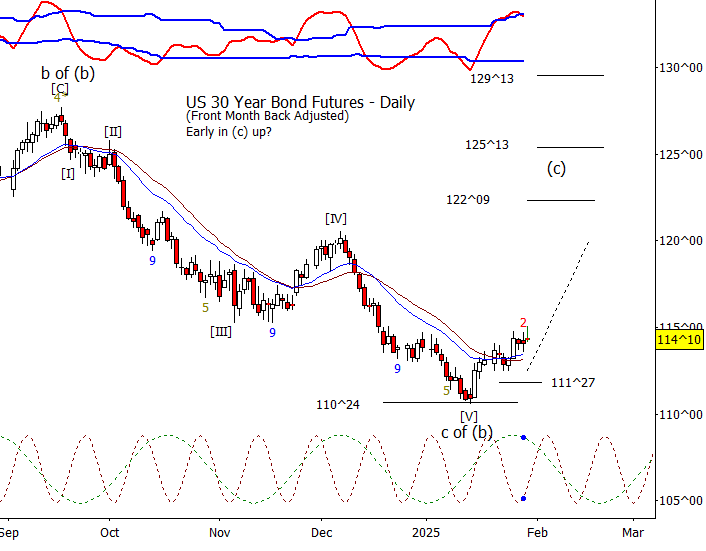

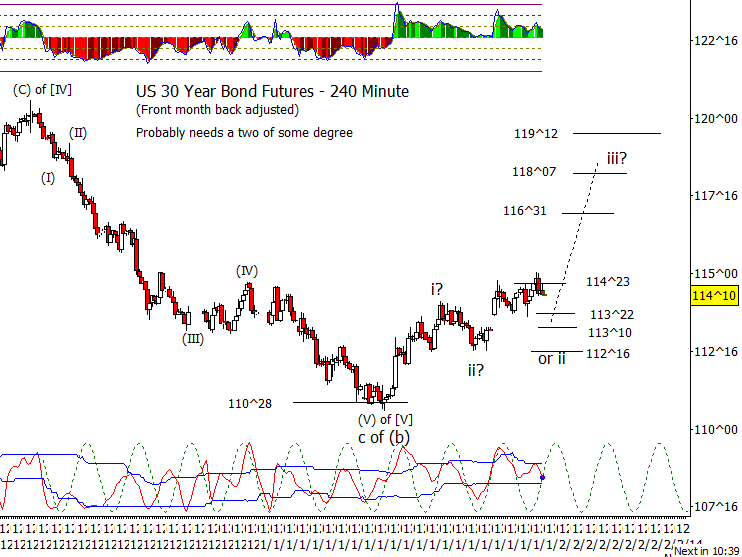

Bonds

Bonds made a new swing high on Thursday, but it looks ZB needs to correct in some degree of two. If a low degree of two, 113^22 or 113^20 should hold. If a higher degree of two, we could see a retrace into the 112 handle.

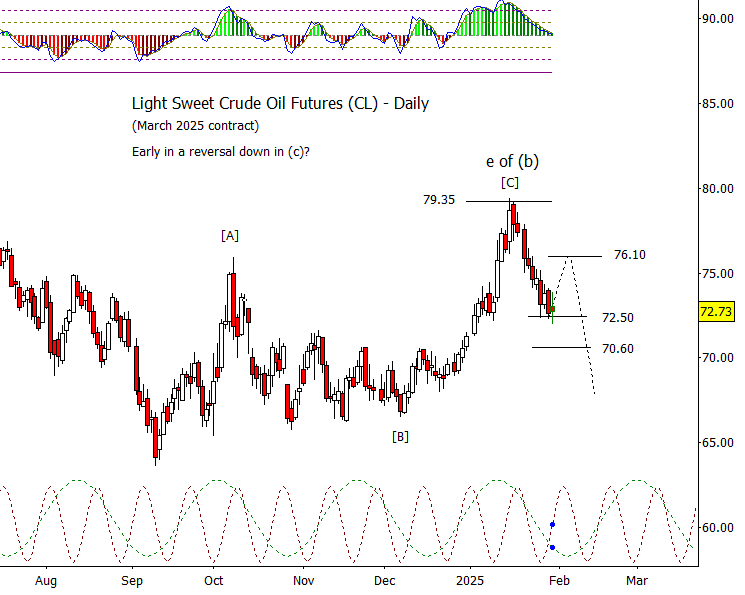

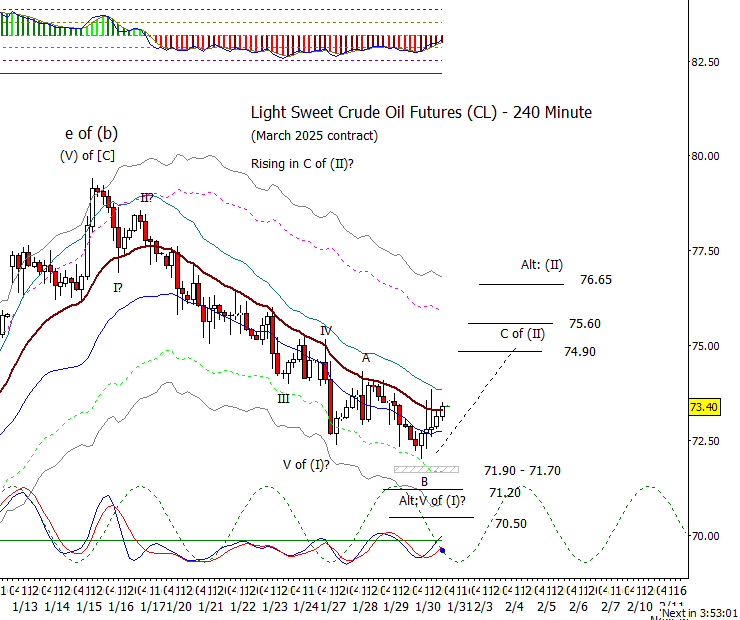

Crude Oil

I’m marking the low today in CL has a ‘B’ wave type low that would imply that it is now rising in ‘C of (II).’ The alternative, treating the low as (I), isn’t that much different other than it allows for a higher bounce.

Dollar Index

DX did a small dip today and recovered closing near the high of the day. Looks on plan rising out of a wave iv low.

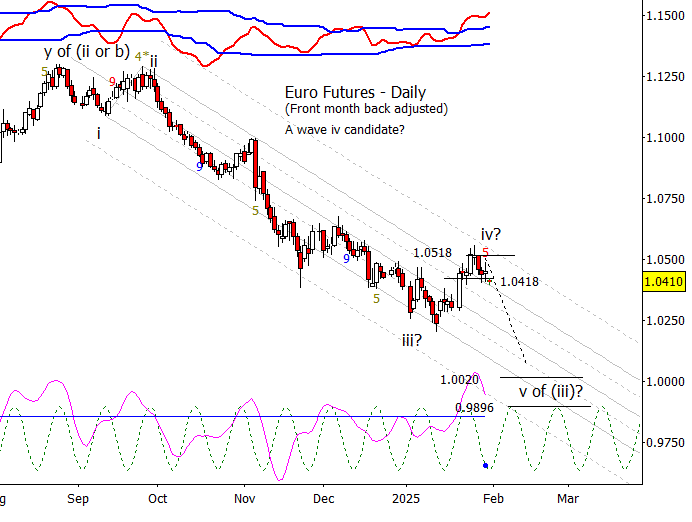

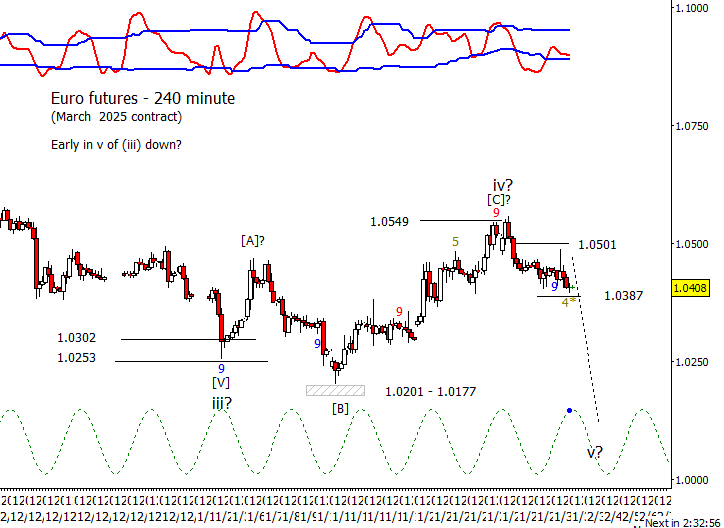

Euro

Euro is starting to slip but bears need it lower, under 1.0387, to feel good about a break lower in wave ‘v of (iii).’

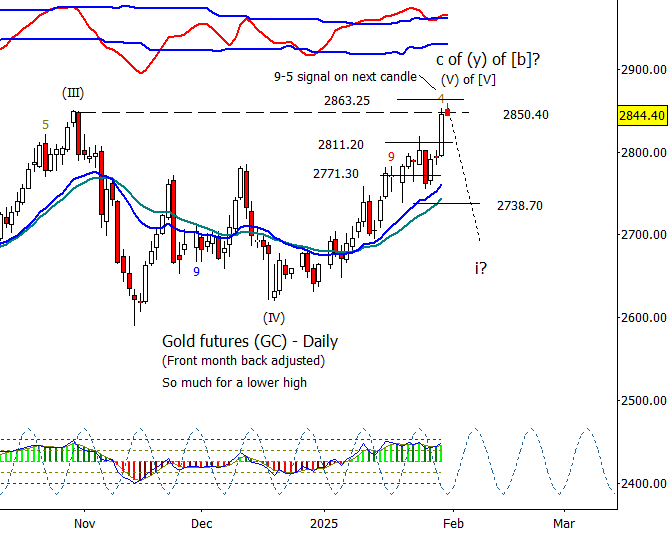

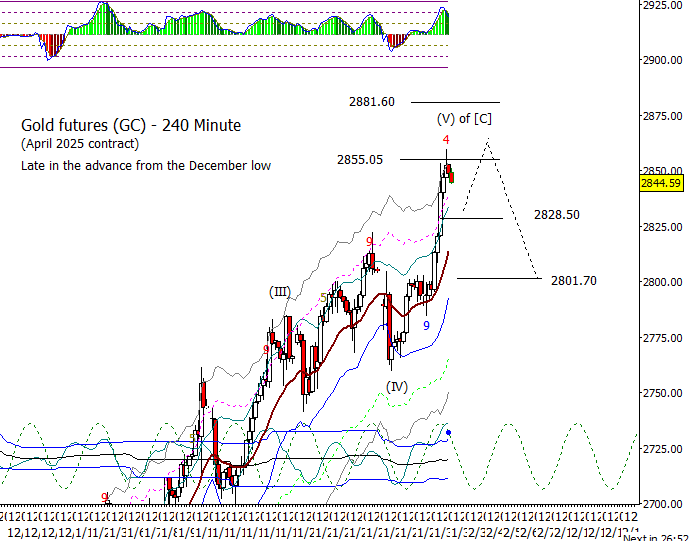

Gold

There is always a problem child and for me it is gold at the moment. My lower high hypothesis was blown out of the water today, but it doesn’t change my view that this is very late in the rise from the December low and consequently can turn into a significant high. There will be an exhaustion signal from the Wave 59 9-5 study on the close of the Friday candle. I understand reluctance to outright fade up here minus evidence, but I would warn reader against chasing and to manage if long. Yes, it moved up quickly on Thursday, but I assure you that it can easily be reversed.

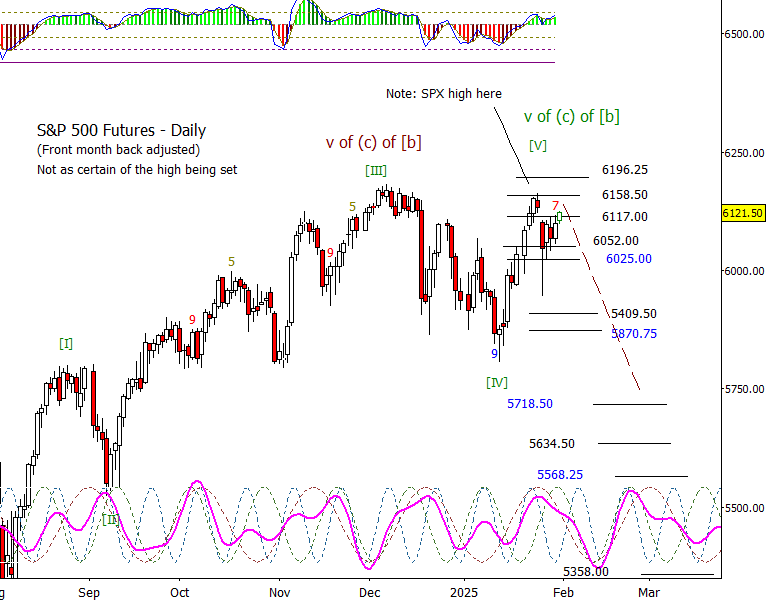

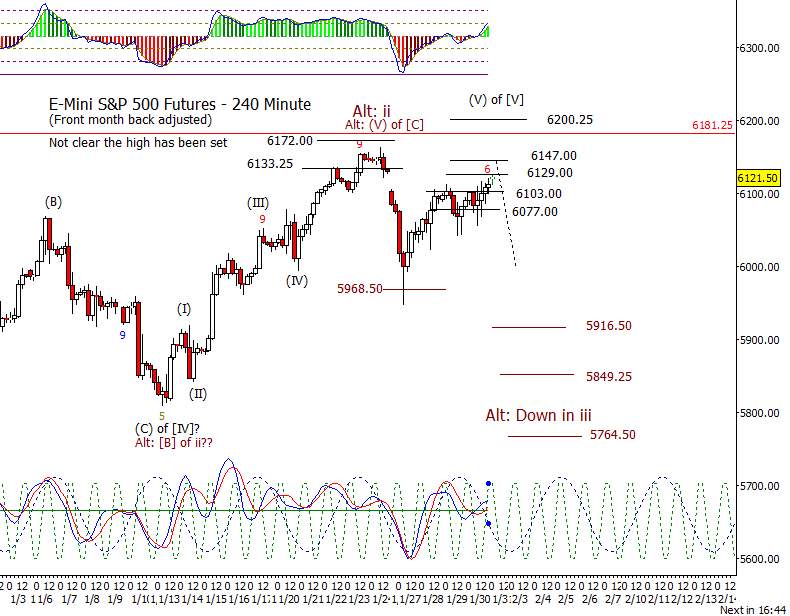

S&P 500 Futures

S&P 500 futures have been stuck in a range for the last several days. Now that futures are moving up overnight and the early hours of Friday, it is fair to first target the overhead gap fill, but I can’t guarantee a new high. I still fear that things can go wrong quickly in this area.