The Day Ahead: PM Edition 2025-01-07

Equities indices a little softer than I prefer but not a serious problem just yet

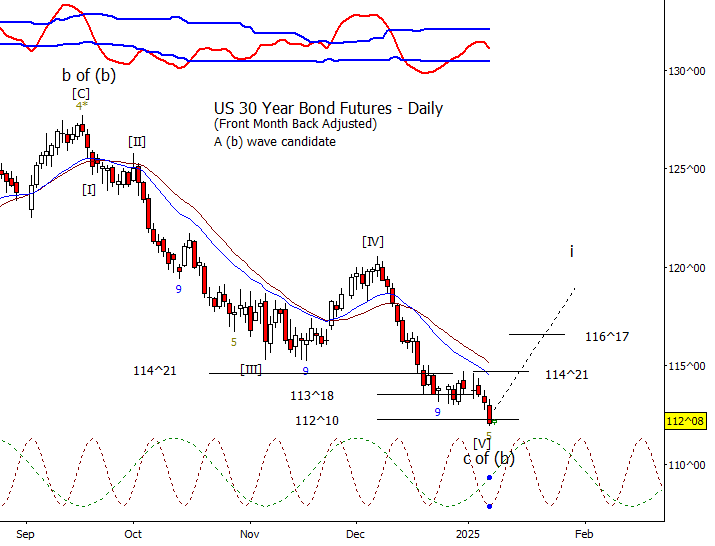

Bonds

ZB dropped lower on Tuesday after the morning econ data. I think it was just a case of the low degree (V) extended past the first target of 112^26 to the next at 112^08 on the intraday chart and testing a larger scale target at 112^10. Also note that this is a cycle low on both the daily and intraday charts. Net, this would make a very good candidate for wave (b). If you are interested in a possible long but are of the cautious type and have reason to be as ZB has been moving down for a month, look for 113^02 to be recovered for first proof of a reversal.

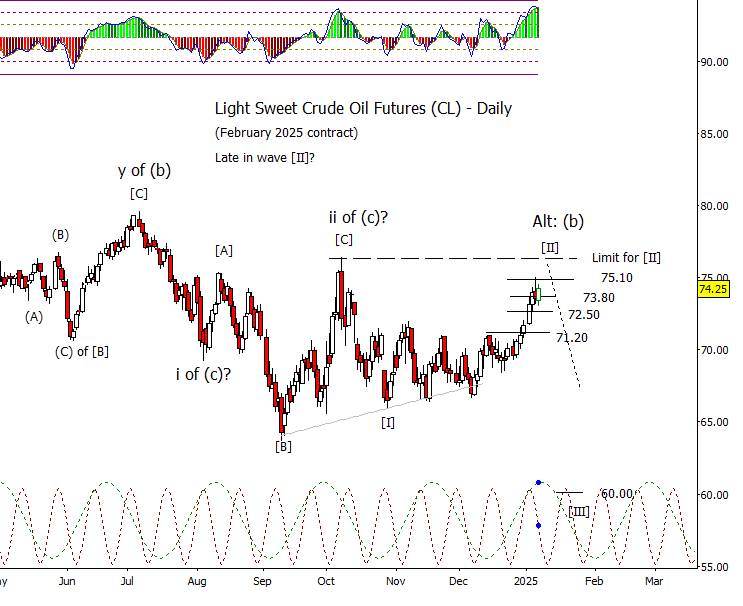

Crude Oil

CL rose from initial intraday support at 73.37 and the 20 period EMA on the 240-minute chart. If long crude, a good idea to raise stops as CL approaches 75.26 and 75.80. Time to short? Probably a little too aggressive as a case can be made that we are still in wave III on the intraday chart.

Dollar Index

DX is holding the first support at 107.95 so far. Will see if it attempts to attack it again over the next week or so.

Euro

Euro is turning down with the intraday cycle is what I’m calling [B] of iv. Initial support at 1.0359 or 1.0320. Not sure if [B] results in a higher low or a new swing low as either are possible.

Gold

I’m not sure what the short-term count is in gold but sticking with the i-ii-[I]-[II] idea for now though that isn’t too helpful in defining a target or where the reversal will be. Everything since the decline from the high to the November low has been choppy.

S&P 500 Futures

While not surprised by the early morning drop, I was a little surprised that it followed-through the end of the day. Does that negate the idea of an eventual new high later in the month? No, but it does mean that I’m not quite as eager to buy till bulls show some resolve and recover 5973 which they are attempting in the very early hours of Wednesday as I type this. If the market reacts well to the early economic news, and bases above 5973, I think it best to have a bullish bias. Net, I’m reluctant to be bearish while the market is above 5862.75.