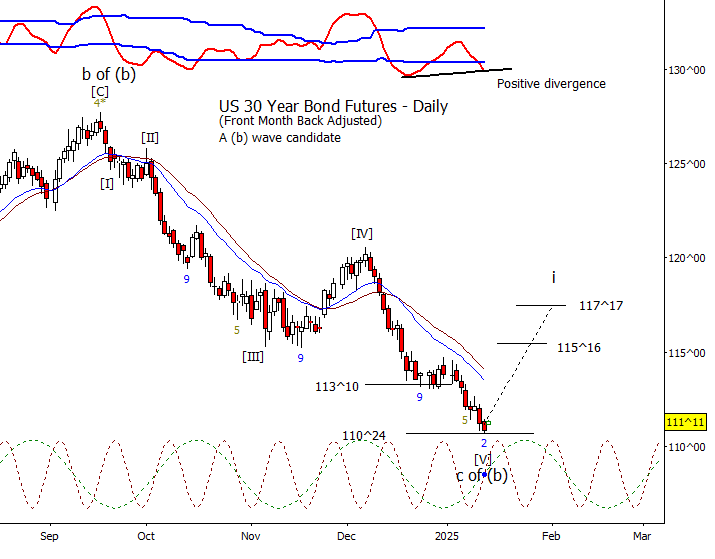

Bonds

ZB fell just under the low from last Friday to test the 110^28 intraday target. I still think this is very late in ‘[V] of c of (b)’ and that a reversal up is due soon. First confirmation of a reversal is recovering 112^01.

Crude Oil

I expected a move up from 72.73 but that was quite the move. This invalidated the wave two idea which leaves this late in a three-wave sequence that should cap (b). Yes, it could be better to count this all as a triangle (b) but the result is the same as this would be ‘e of (b).’ Short-term, bias is up while above 76.95.

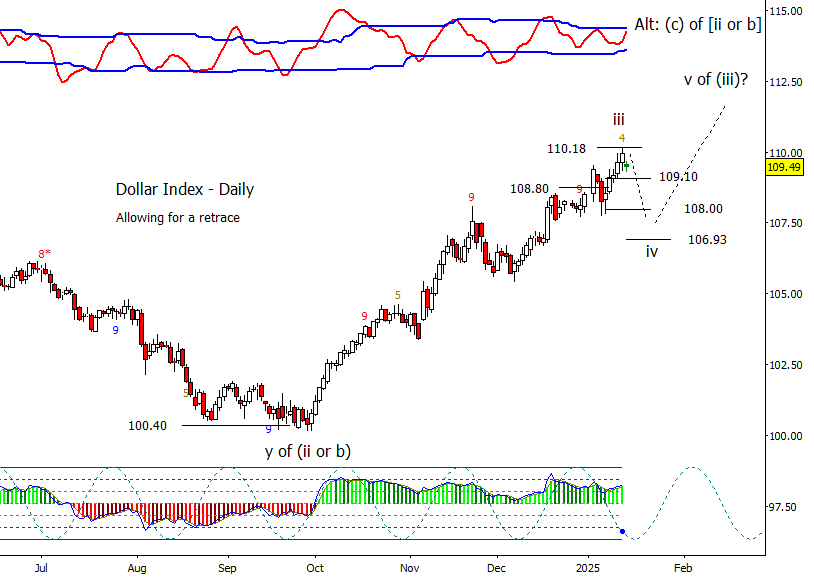

Dollar Index

DX made a minor new swing high on Monday but appears to be late in a third. Note that the Wave 59 9-5 study is on a gold four, just short of an ideal five, which implies exhaustion. There is also negative divergence in both the RSI and CCI.

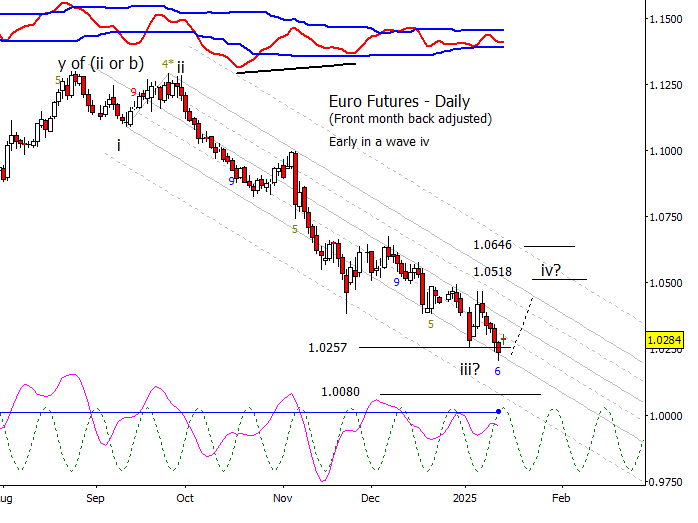

Euro

I’m treating this current low in Euro as a [B] wave low and now early in a [C] wave up to complete iv.

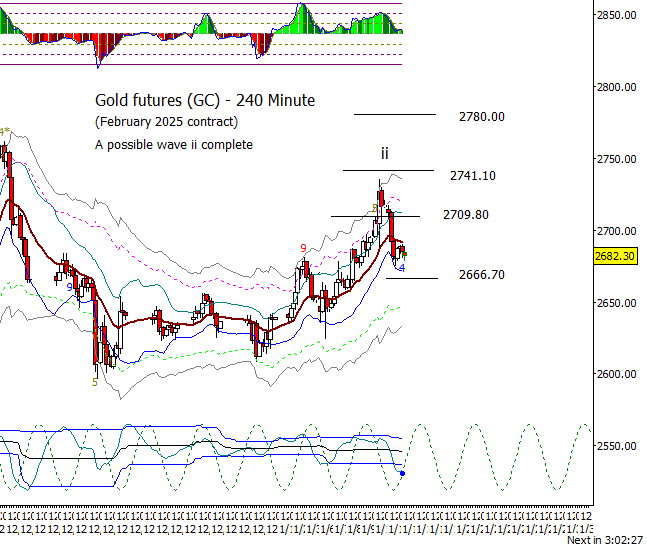

Gold

A promising drop from a wave ii candidate. Probably need a GC to drop under 2670 and the daily moving averages to confirm a reversal.

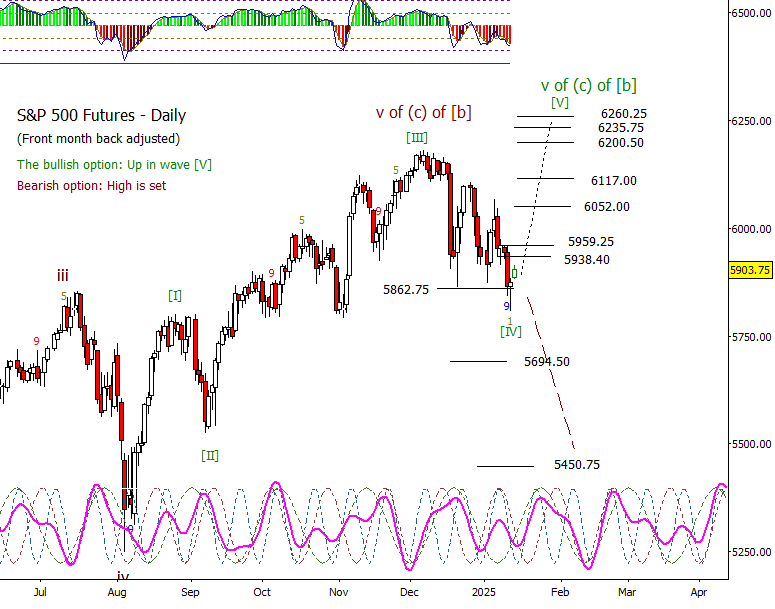

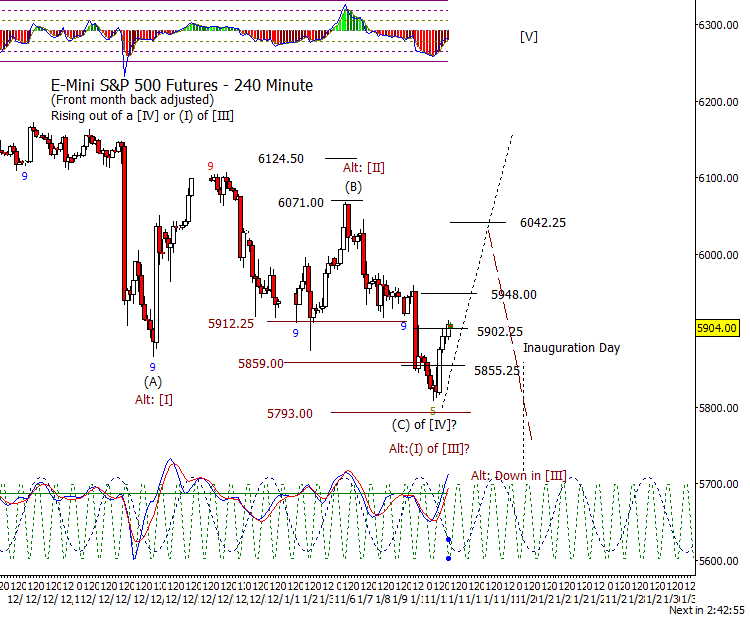

S&P 500 Futures

The drop under 5862.75 today is a minor negative for the bullish case but it was relatively quickly recovered. Either the low on Monday was a [IV] that will facilitate a retest or new high in [V] or, was wave ‘(I) of [III]’ and we will get a lower high under that of January 6th. At this point, I think it makes sense to be alert for a possible lower high though I’m going to give slight preference to the bullish hypothesis. Bulls need to grind up through 5902.25 and 5948.00.