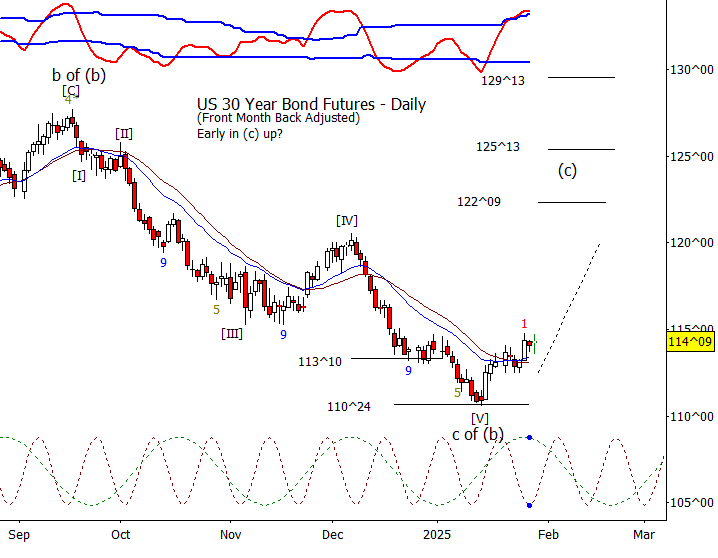

Bonds

ZB attempted to push past 114^23 but failed today. I was tempted to move ii to this current swing but not clear that is what is taking place as it could turn out to be a ‘i-ii-[I]-[II]’ type count. Net, I don’t think bonds are in any serious threat and expect a grind higher from either here or slightly lower.

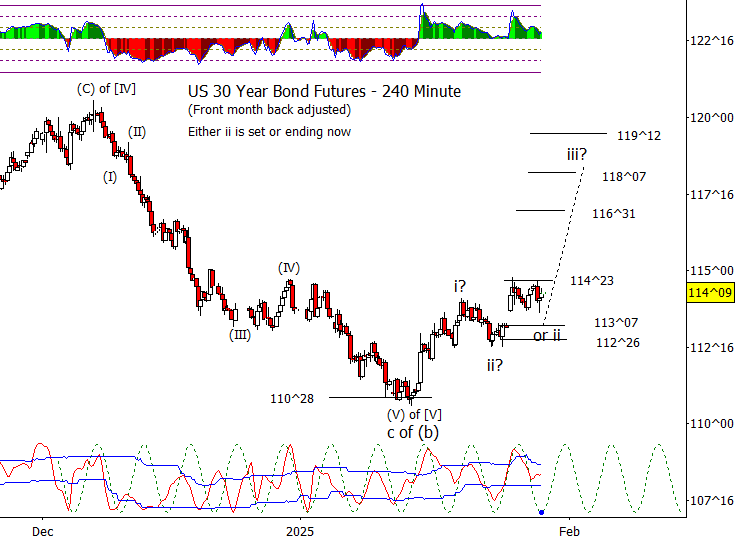

Crude Oil

Crude bounced to tested 74.10 twice but couldn’t make it over. I’m speculating that we get a new swing low in ‘B of (II)’ though a case could be made that my labels need to be moved one swing to the right and a new low would be ‘V of (I).’

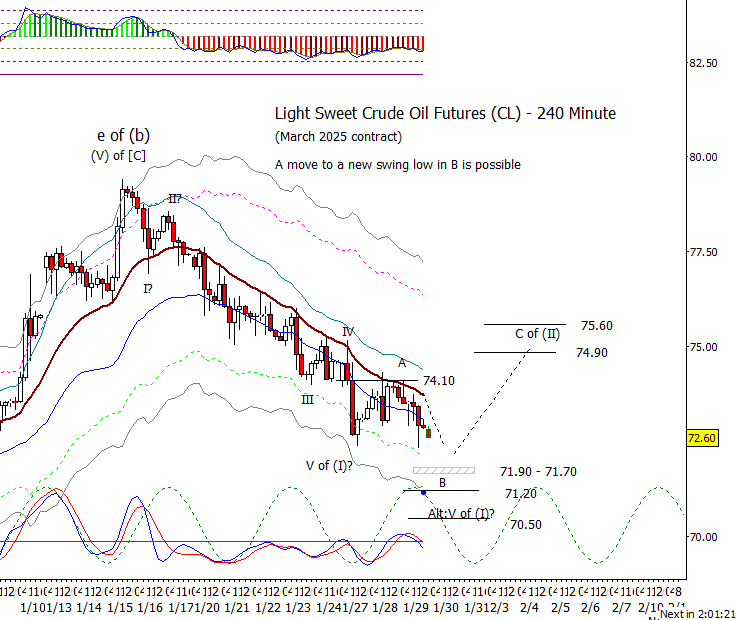

Dollar Index

DX poked past 108.00 today but fell back under. Not especially surprising considering that we still have the ECB rate decision Thursday morning.

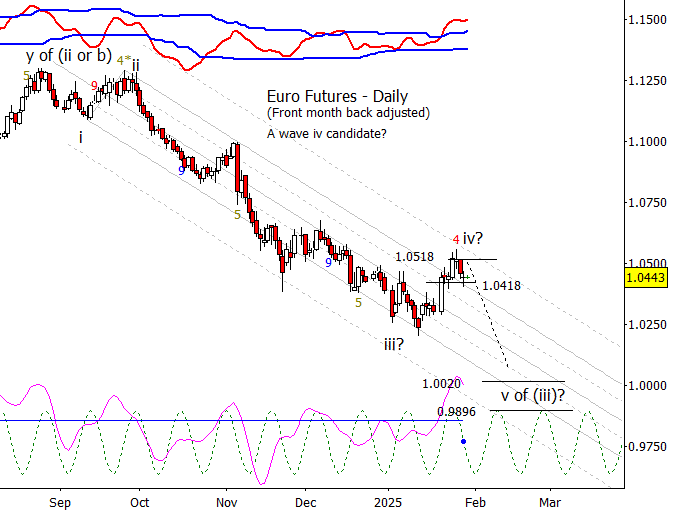

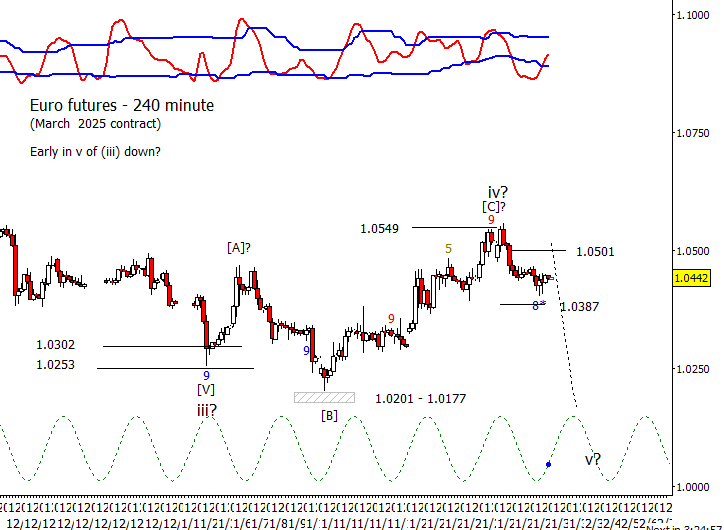

Euro

Good to see Euro putting pressure on the 1.0418 support but will feel better about a move down in v starting when it breaks under 1.0387. Will see what happens after the ECB on Thursday morning.

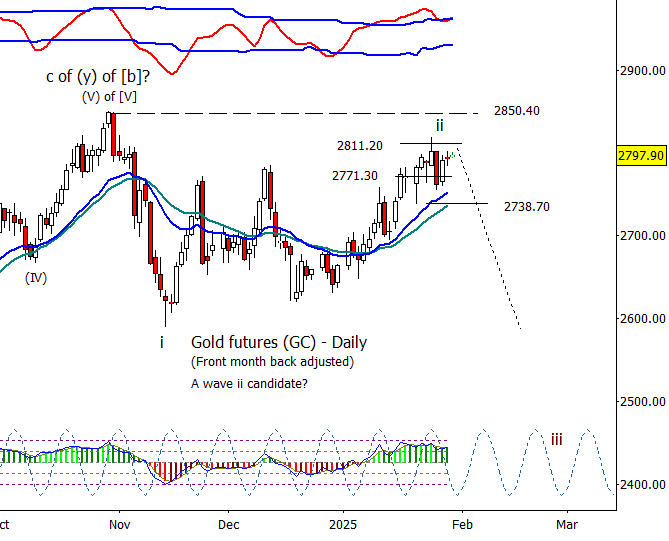

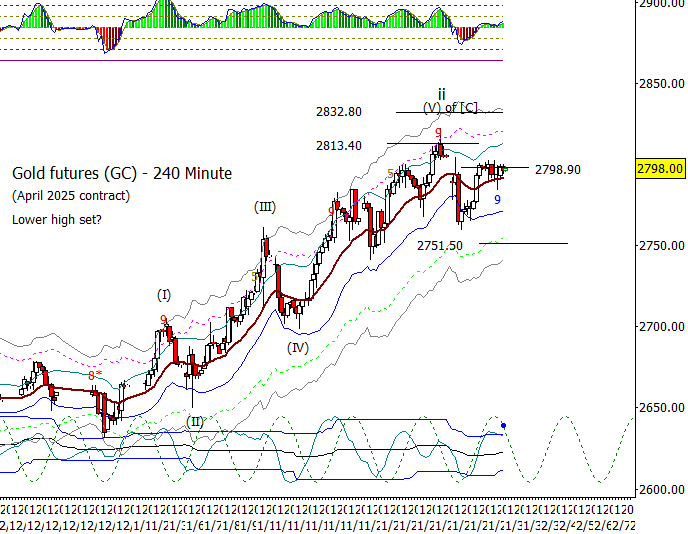

Gold

Gold didn’t do that much on Wednesday, forming a doji candle on the daily. On the 240-minute chart, it is hugging the 2798 resistance. Would be bears need gold to drop under 2751.50 and later 2738.70 for proof that a lower high has been set.

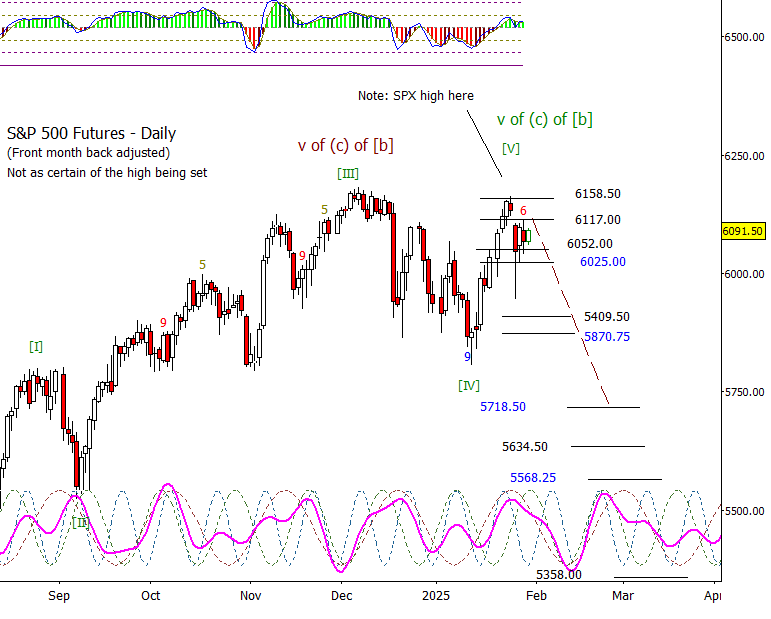

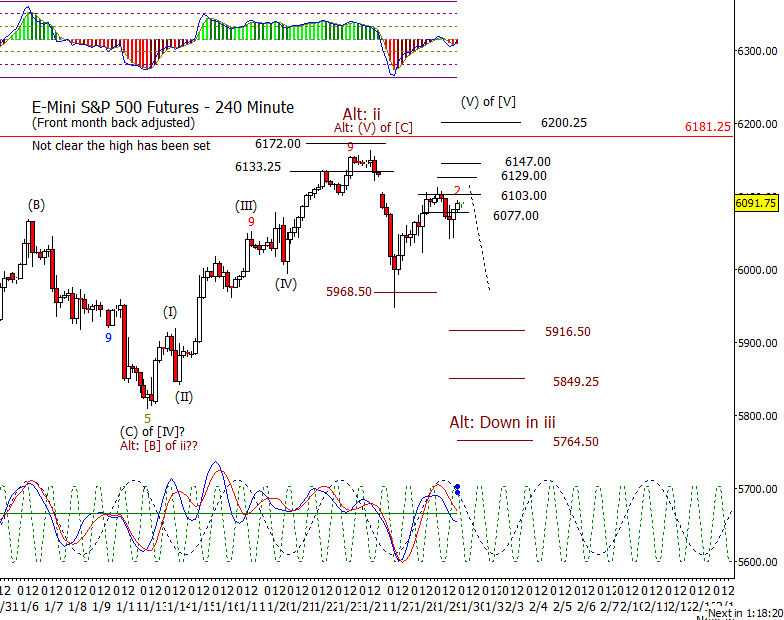

S&P 500 Futures

Another day of essentially sideways movement in the S&P 500 today. Note how the candle bodies on the daily chart have been essentially the same for the last three days. That the market has held up and gone sideways this long is nominally bullish. I still can’t make myself be excited about higher, but that looks like the path of least resistance for now. That need not mean that a new high will take place, but that there is still an interest in some traders to attempt to fill the overhead gap. Very short-term, fair to assume an attempt at higher if over 6103 to test 6117 or 6129. I still advise caution.