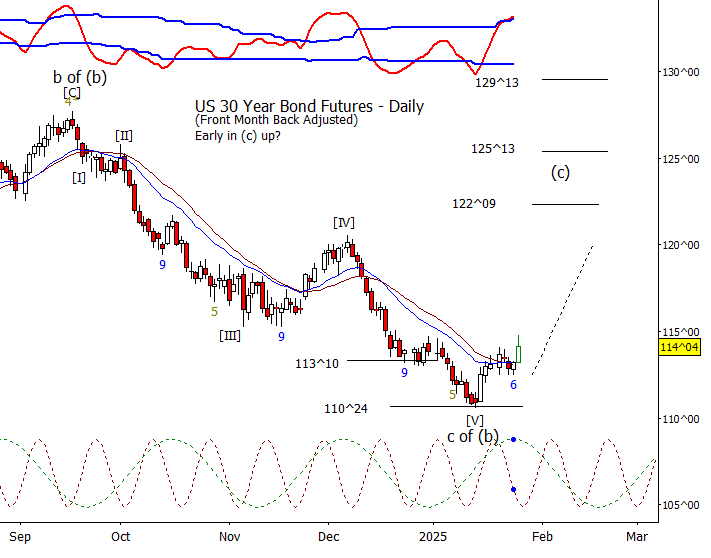

Bonds

Bonds jumped today on flight to safety fears as Nasdaq futures were falling pretty hard overnight on worries of what will happen to the AI related stocks. I’m calling this a small ‘b’ wave type high on the intraday chart and still expect a move down to complete ii for a higher low in ZB. The alternate is ZB is early in wave iii up now.

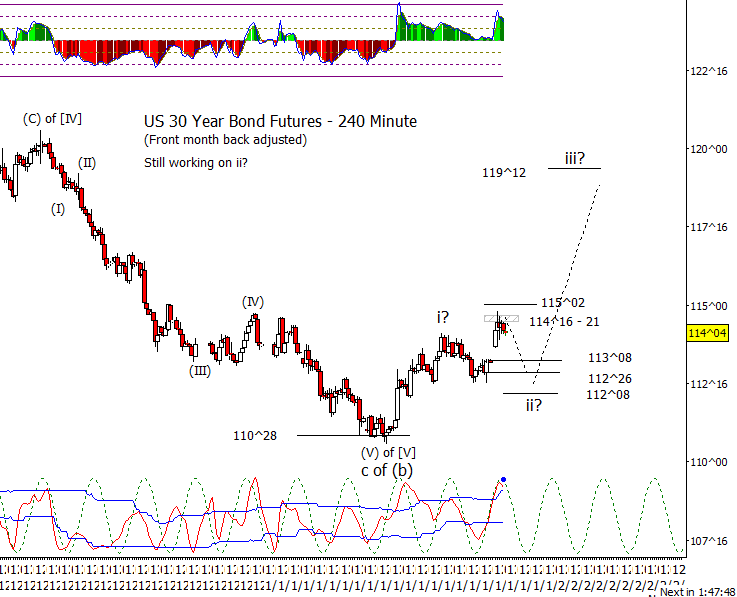

Crude Oil

Crude followed the plan with an early bounce to test the 20 EMA on the 240-minute chart prior to falling to a new swing low. I’m penciling in the low today as a completed impulse down and due for a wave two bounce. Initial resistance for the first leg of wave two at 74.10 and 75.00

Dollar Index

DX also on plan with the drop to test 106.93 prior to a pretty nice bounce. Is the wave iv correction complete? Looking that way at the moment as DX is just about to recover 108.00. Next step for bulls is to base above 108.00 and then to recover 109.10.

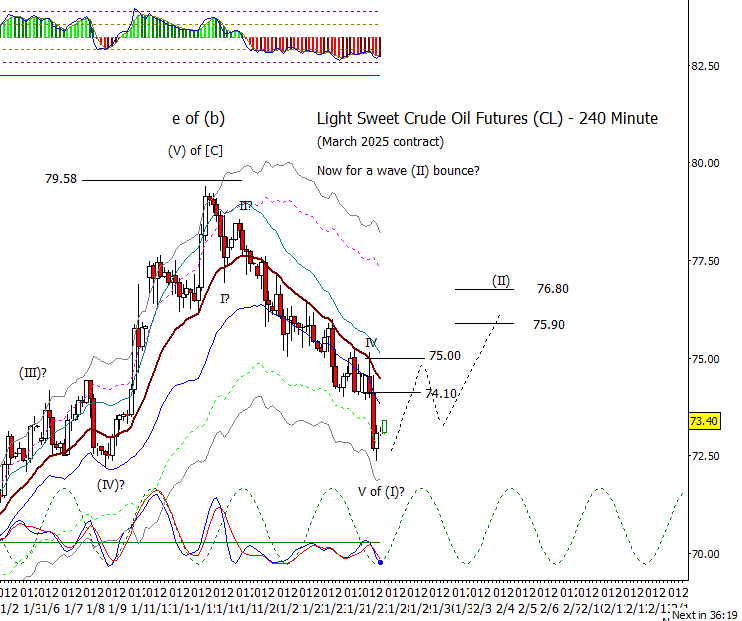

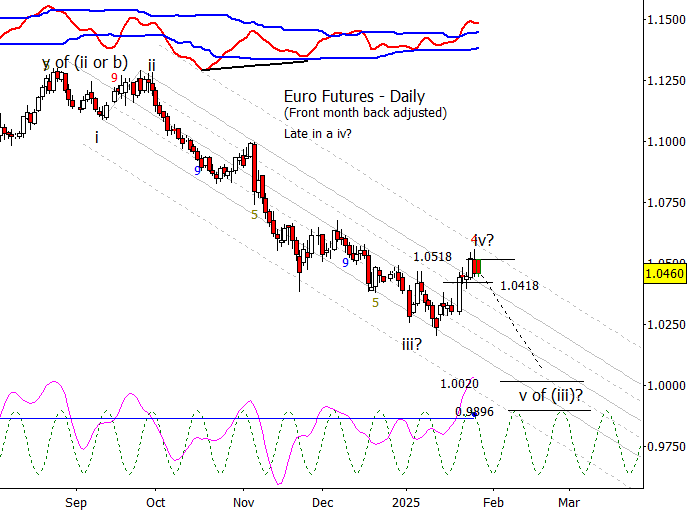

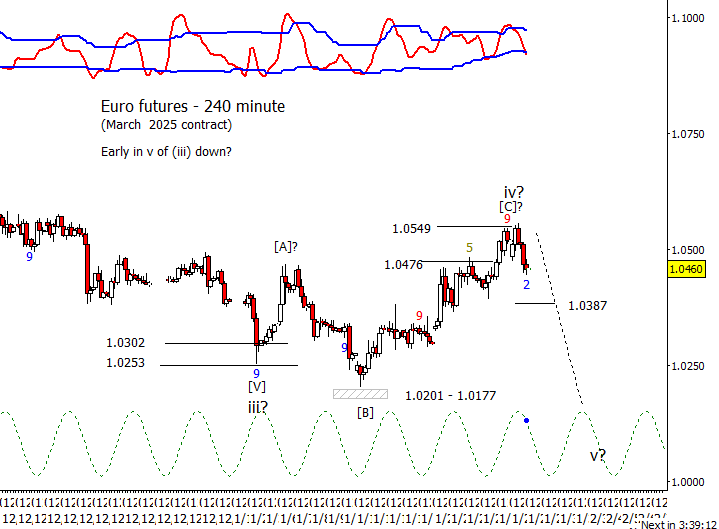

Euro

Promising drop away from 1.0549 in Euro which is suggesting that the wave iv retrace may be complete. Better for bears when Euro drops back under 1.0418.

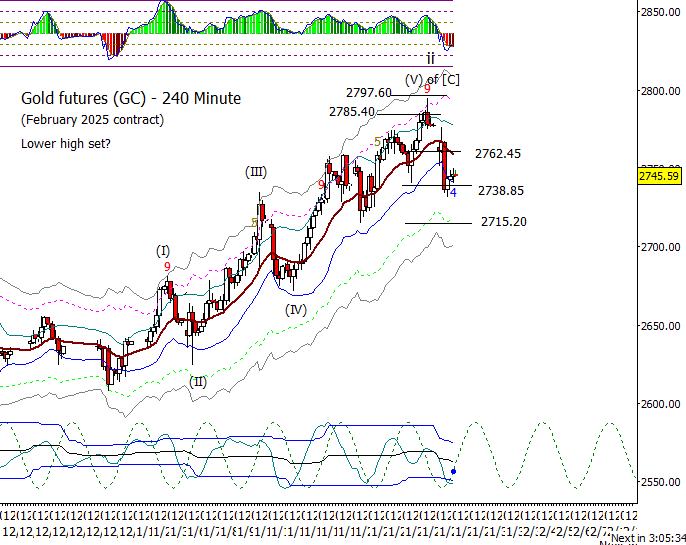

Gold

Gold has been putting pressure on my idea of a lower high forming but is back alive after the drop today. Probably a little early for bears to get excited till GC is back under the daily moving averages around 2728.

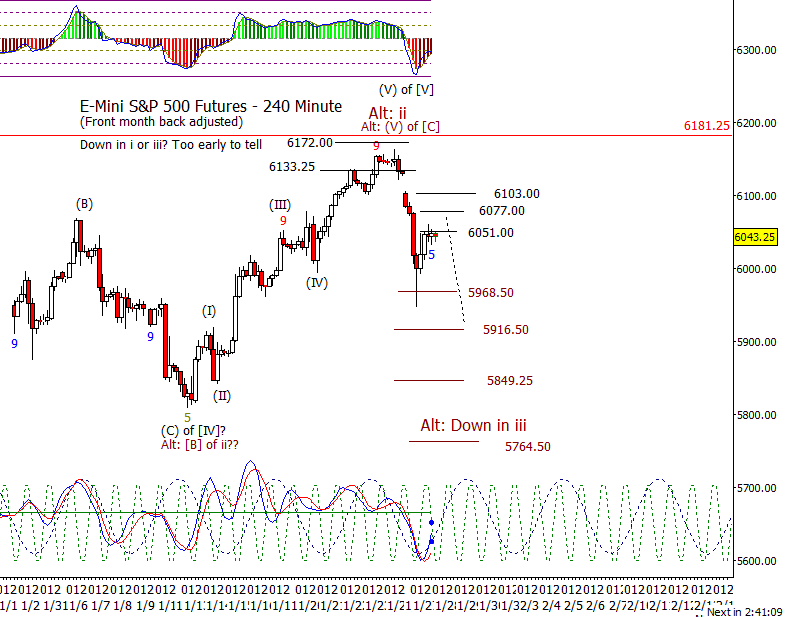

S&P 500 Futures

The day session was relatively dull but the Sunday evening open to early Monday morning was exciting. What is the pattern? I’m not sure. My initial thought is to treat the bounce today as a fourth of some degree, but the bounce is more than is typical. There is some resistance at 6051.00 but I’m not confident that it will hold. Probably best to assume a try to bounce to 6077.00 if not 61.03.00 on Tuesday. Could we actually get a new high on Wednesday after the FOMC? Not my favorite outcome but can’t rule it out while above 5968.50.