Bonds

ZB is has been in a holding pattern for the last few days as it rests on both intraday and daily supports. A minor positive that today formed a doji candle. I still think ZB is ready to bounce at a minimum and I think turn up in a (c) wave.

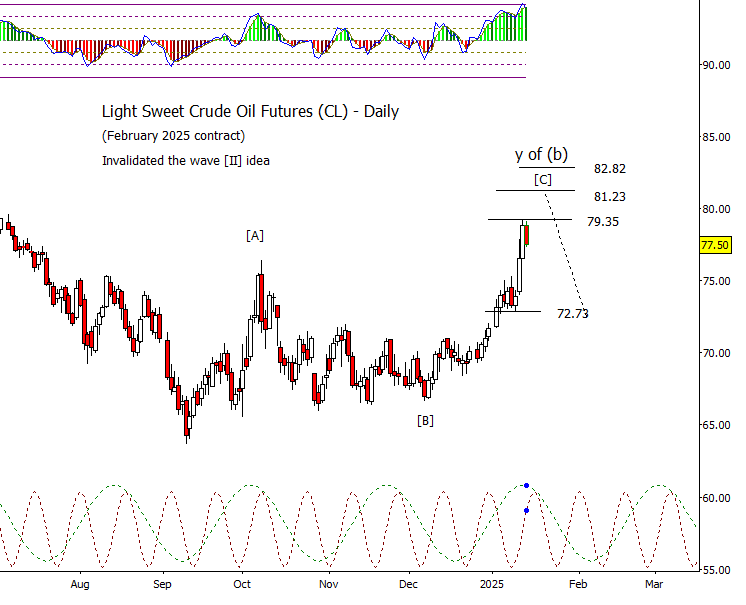

Crude Oil

CL fell back from the 79.35 resistance today but so far is holding above intraday support at 76.95. I’m inclined to give bulls a chance to push crude a bit higher but think it is late in the advance from early December which in turn could be a pretty major high.

Dollar Index

DX finally showing some signs of turning down. First step in getting a correction started is dropping under 109.10

Euro

I’m penciling in the move up out of the low from yesterday as early in ‘[C] of iv.’ If the current low was a [B], first target for a [C] is at 1.0418.

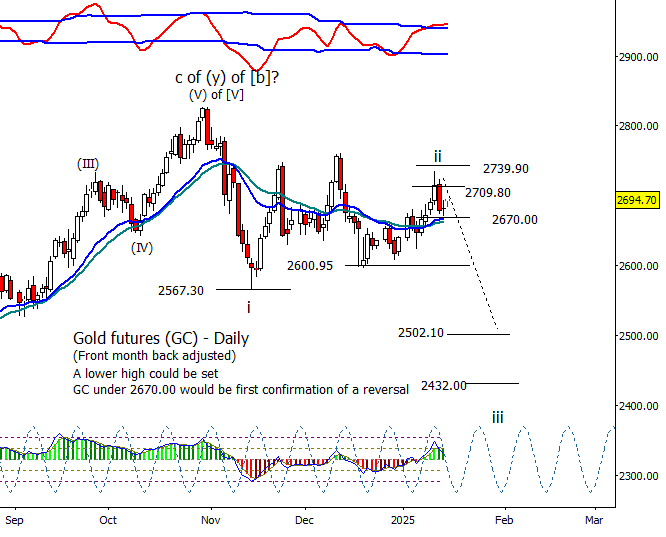

Gold

GC is holding above the daily moving averages and 2670 and thus can’t yet rule out another try at 2741.10 or even a bit higher.

S&P 500 Futures

The S&P 500 did well in the overnight and early morning though it couldn’t push much past 5901.50 which left bears a chance to see what they could do with a push down. That was fair as a retrace was expected. That retrace pushed down into typical wave two levels before being bought. Again, no problems so far. Only wrinkle in the day was a quick afternoon push down to retest support and late day recovery. Now we wait for the CPI on Wednesday morning to see if bulls can give it a push up over 5910.75 which should open the door to 5953.00 and higher. My base case is higher into the 20th or 21st whether as a lower high or retest of the December high.