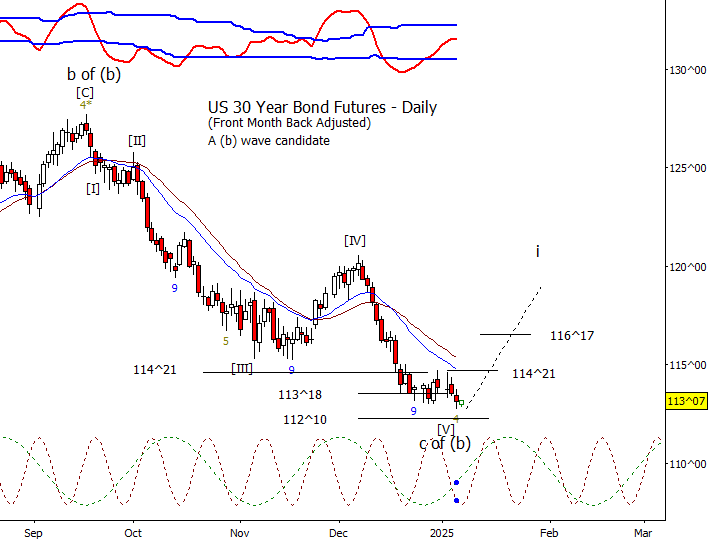

Bonds

The minor new low today answers the question if a new low was needed. Other than that, the outlook is the same, ZB should be at or very close to a (b) wave low. First confirmation of a reversal up is recovering 113^25.

Crude Oil

Technically the wave [II] idea is still alive. Might need a tiny wave IV and V to finish the form up from December 6th.

Dollar Index

Finally getting a drop in DX. Under 107.95 opens the way to 106.93 or 106.22.

Euro

I’m assuming Euro is moving up in the first leg of a fourth wave. Overhead targets at 1.0502 and 1.0525. Shouldn’t the count in Euro be essentially the inverse of DX? Mostly yes. I will likely end up bringing them into harmony but I’m not sure which of the two counts is operational. Best to think both of these counts as the two primary possibilities. Net, Euro and DX are going into a consolidation but not clear if a two or a four.

Gold

The move in gold up from 2600 has be pretty choppy and weak making me rethink the count. Perhaps a very bearish ‘i-ii-[I]-[II] is setting up where it isn’t clear if [II] is complete. Wave [II] may become more complex before breaking down below 2613.60 and 2600.95.

S&P 500 Futures

S&P 500 gapped up Monday but didn’t conform to what most bulls were expecting as the rally stalled out in the morning of the day session slipped down the rest of the day. I mentioned in the Slack chat that I don’t trust the morning advance on a Monday to have follow-through and my skepticism proved well founded. That said, I still have a positive bias, but we may have to test support around 5997.00 or 5973.00 prior to the next leg up. Can things fall apart? Absolutely, but I’m willing to let bulls fight their way back so as to hold up into later in the month while above 5862.75.

How can I join the slack chat