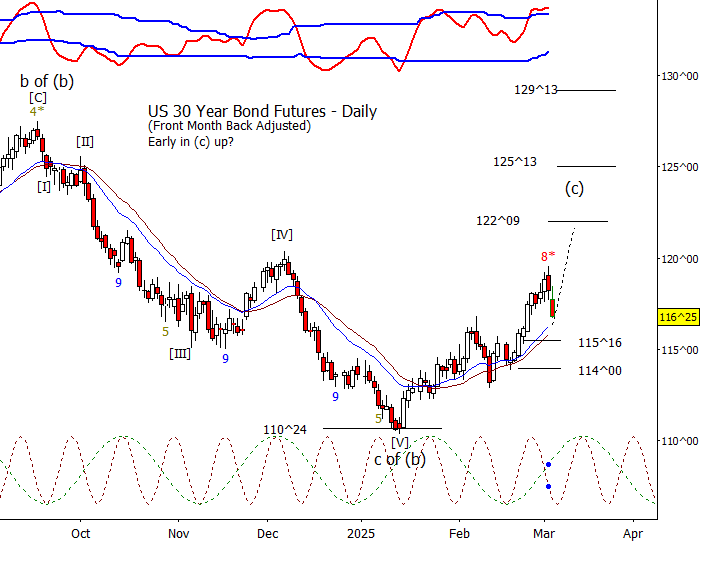

Bonds

Bonds followed the intraday cycle low today. The intraday and daily cycles are projecting a low on the 6th. For price, since ZB is under 117^04, I’m leaning to a tap of 116^02.

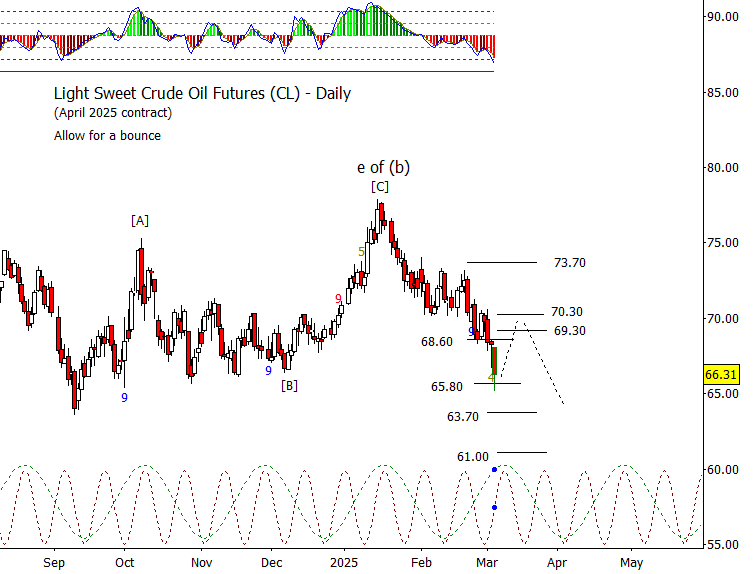

Crude Oil

CL fell again on Wednesday to test the next wave (V) target at 65.40. I have promoted the alternate that I discussed yesterday with minor refinements to the primary count. I’m treating the current low as ‘[I] of iii’ and due for wave ‘[II] of iii’ up. I suppose the new alternate is to treat the move down from (b) so far as ‘[I]-[II]-[III].’ I may switch the primary and alternate at some point, but they imply the same thing in the short-term, a bounce. First minor resistance at 67.20 with more important resistance at 68.30.

Dollar Index

DX pushed down through 104.70 and now is at the top of the typical retrace range for a wave ii. Probably wise to assume DX pushes for 103.48 on Thursday or Friday.

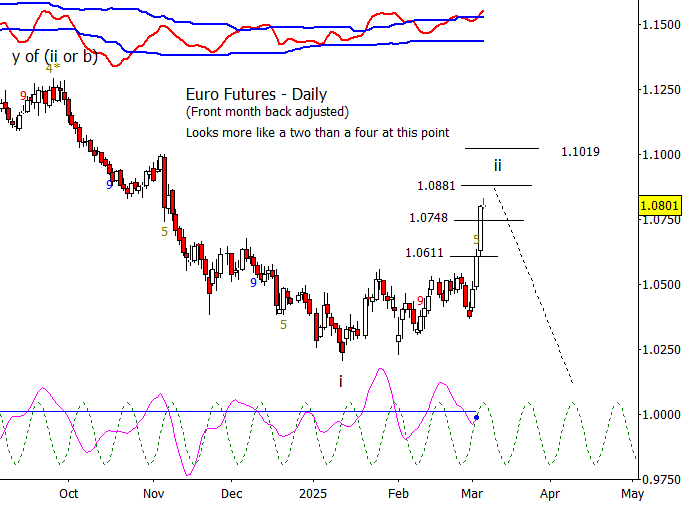

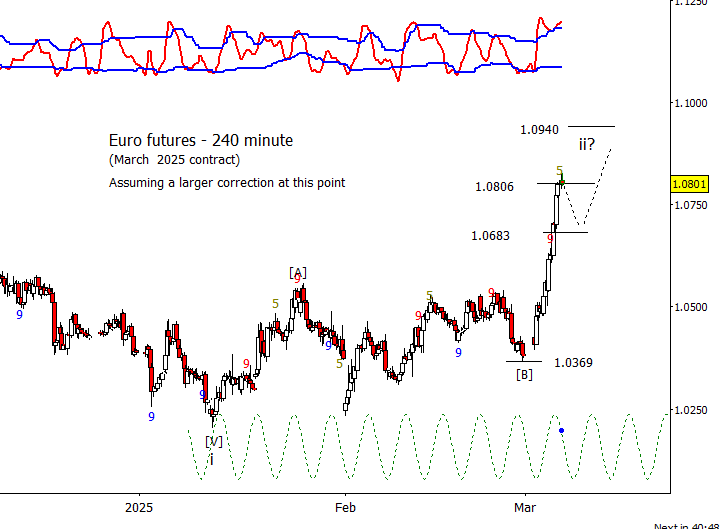

Euro

A big leg up in Euro on Wednesday. I think it a good idea for anyone long to manage against the intraday target of 1.0866. It might extend a little higher but may consolidate first.

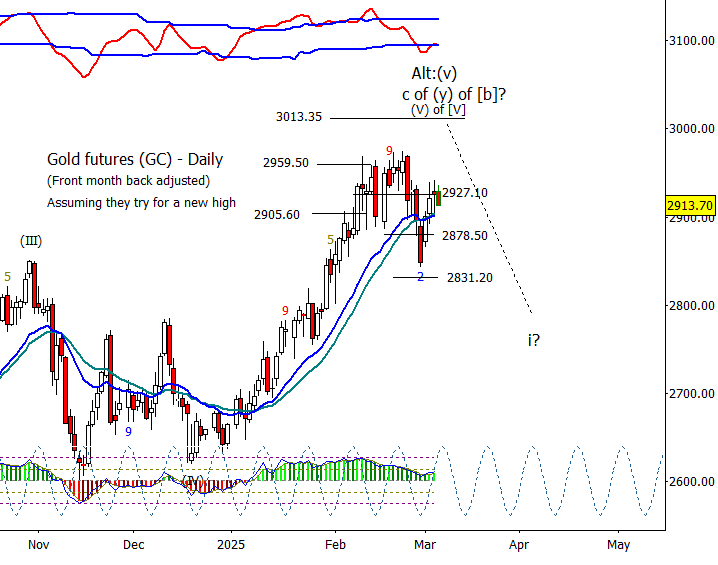

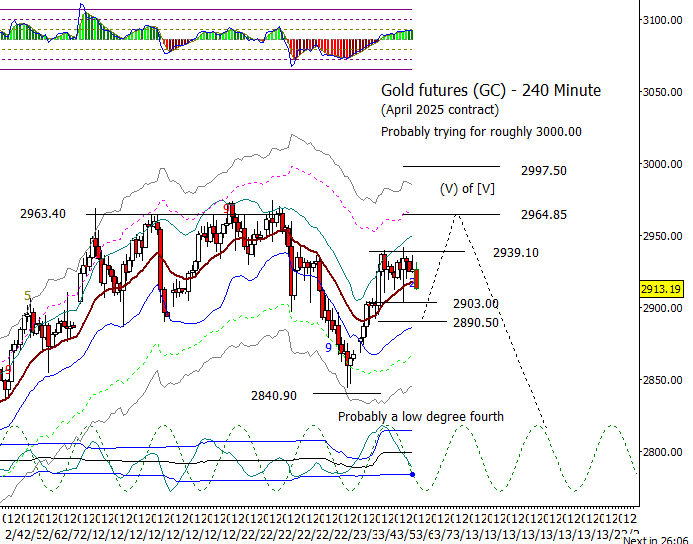

Gold

Gold appears to be consolidating against 2929.10. Next intraday cycle low projected late in the day on Thursday. Support at 2903.00 and 2890.50.

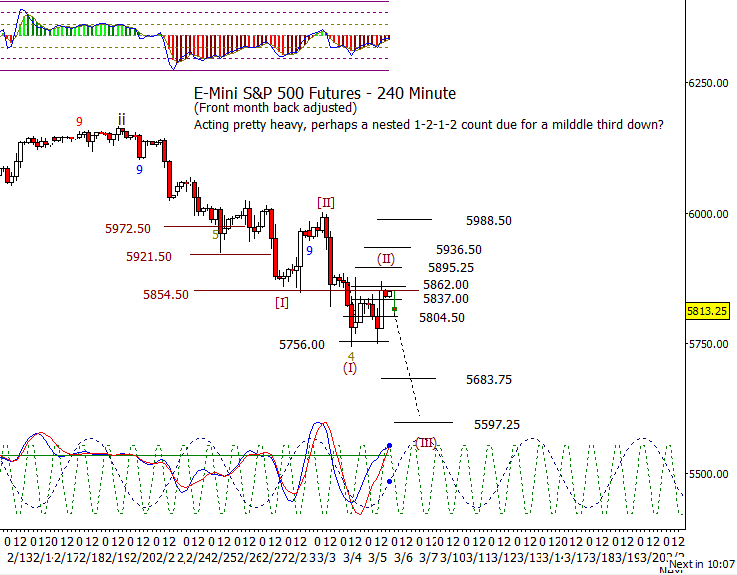

S&P 500 Futures

The S&P 500 started off weak but held a retest of the low from Tuesday which is when the tariff delay news hit which caused a bounce into the close. The thing is that the bounce has been pretty weak. I’m warming up to a nested 1-2-1-2 type count that is due for a middle third down. Under 5804.50 should be bearish and facilitate a push down to at least 5683.75 with the next big support just lower at 5656.75.