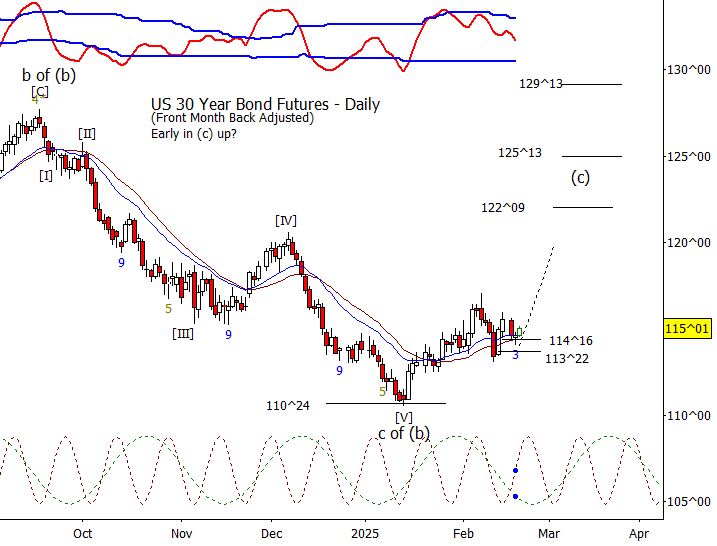

Bonds

I like how ZB is attempting to firm up around 114^16 but bulls really need to see bonds push up over 115^00 to feel good about the correction being over.

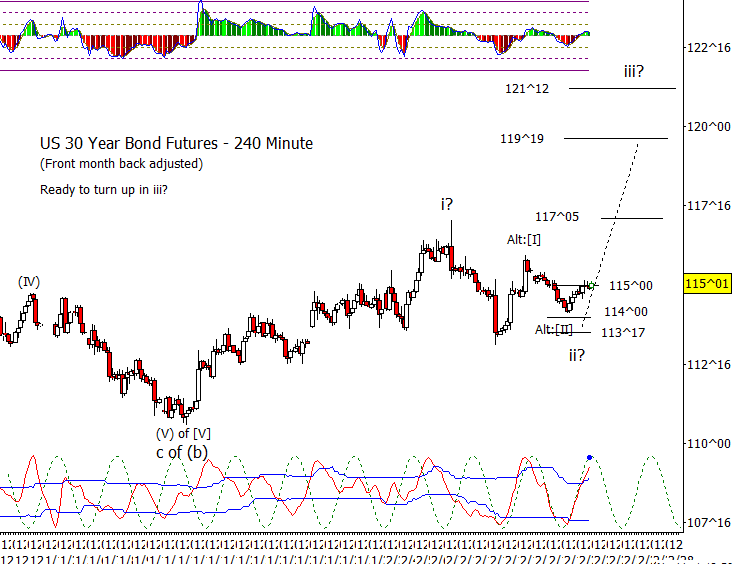

Crude Oil

CL managed a little higher but is having more difficulty with the bounce than I expected. I’m inclined to give bulls a chance for a little higher while above 72.20 but if that fails, we will probably need to assume CL is headed for at least 68.70. As to form, this bounce is pretty shallow for a wave two which has me wondering if this isn’t a low degree fourth. I’ll deal with that if 72.20 fails to hold.

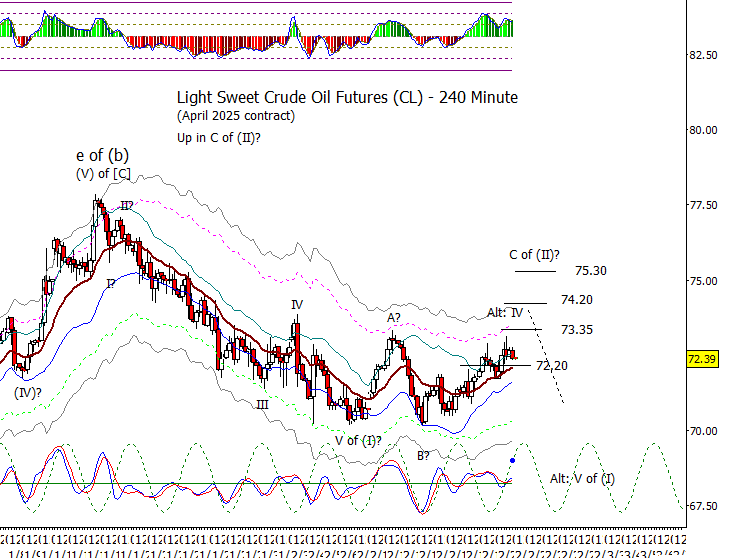

Dollar Index

DX dropped under 106.70 today which is in line with my thinking in the short-term. Next support is at 105.80 though I think the nano form could be complete with this new swing low.

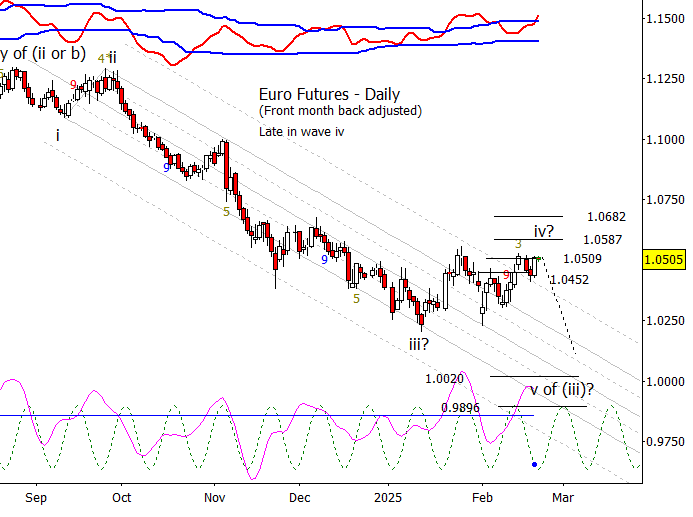

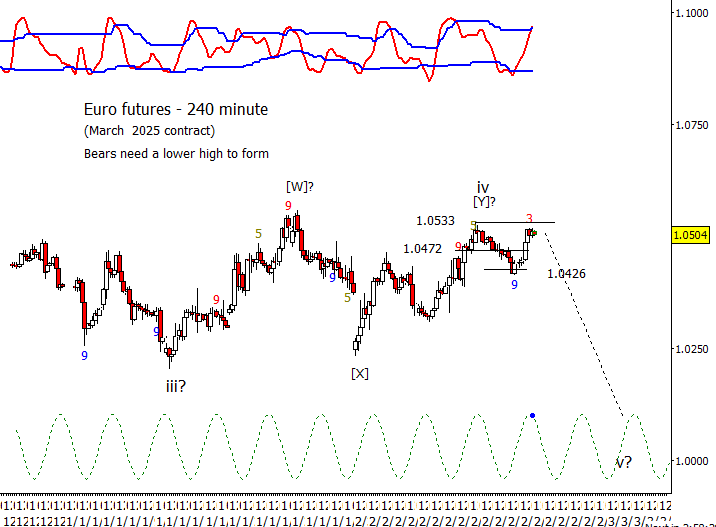

Euro

Euro has bounced enough that it is putting pressure on the idea that the wave iv is complete as it essentially retests the high from the 14th.

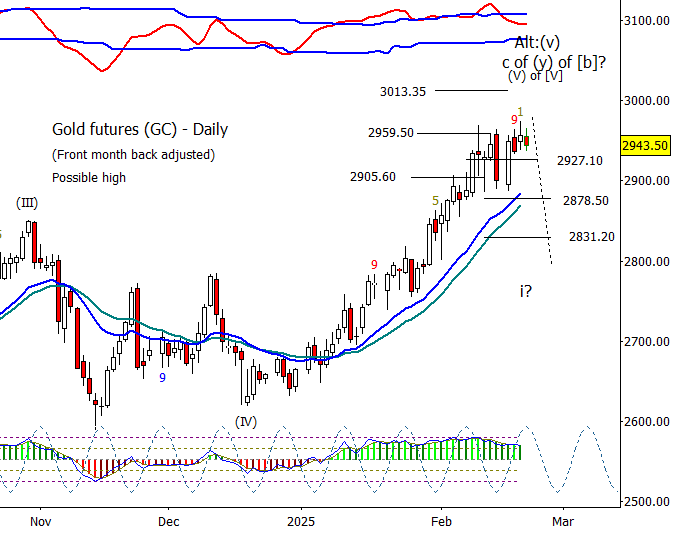

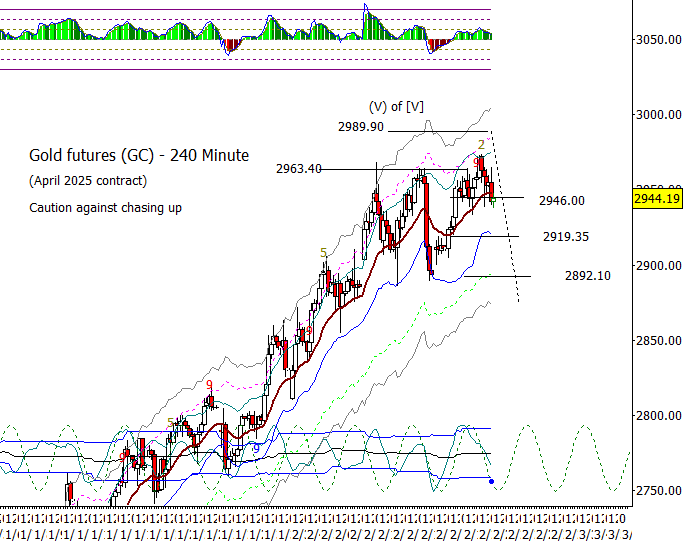

Gold

Form could be complete for a high in gold. Note that there is negative divergence present on this high. Under 2946.00 is the first sign that things are going awry for gold. Best confirmation of at least a correction is starting is a drop under 2927.10.

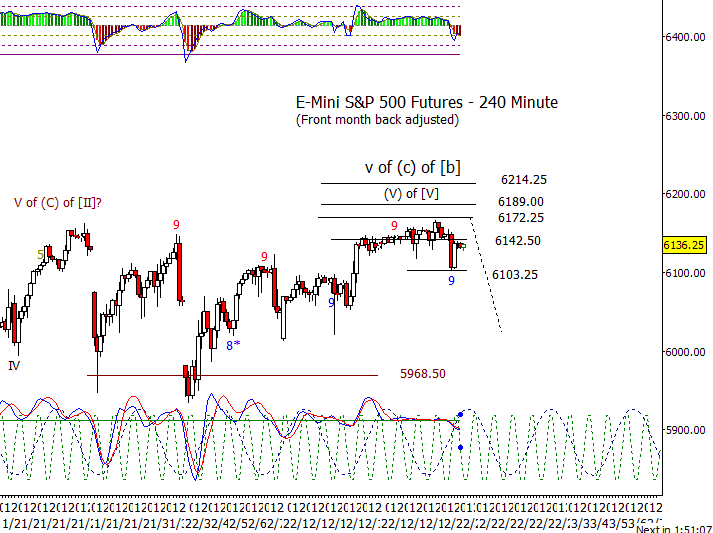

S&P 500 Futures

Guidance from Walmart initiated some selling this morning but lacked follow-through. Bears were unable to force a new low after the midmorning low and eventually gave up and recovered much of the morning drop by the end of the day. I still can’t get excited about higher, but I have to acknowledge that bulls are in control if 6142.50 is recovered.