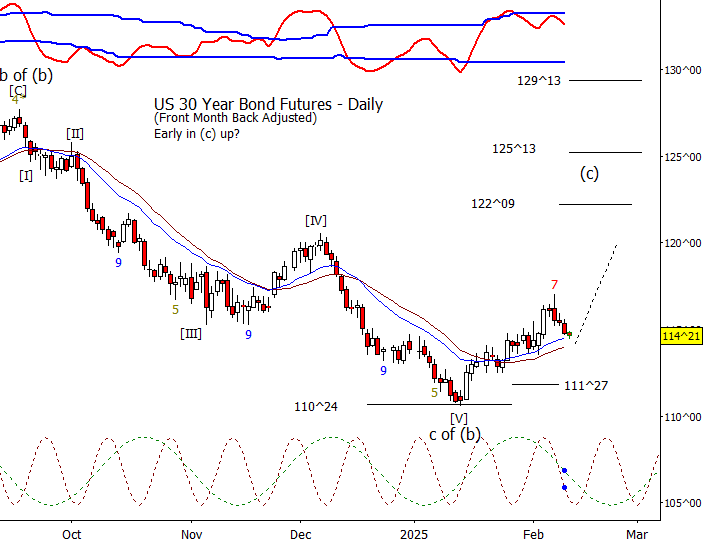

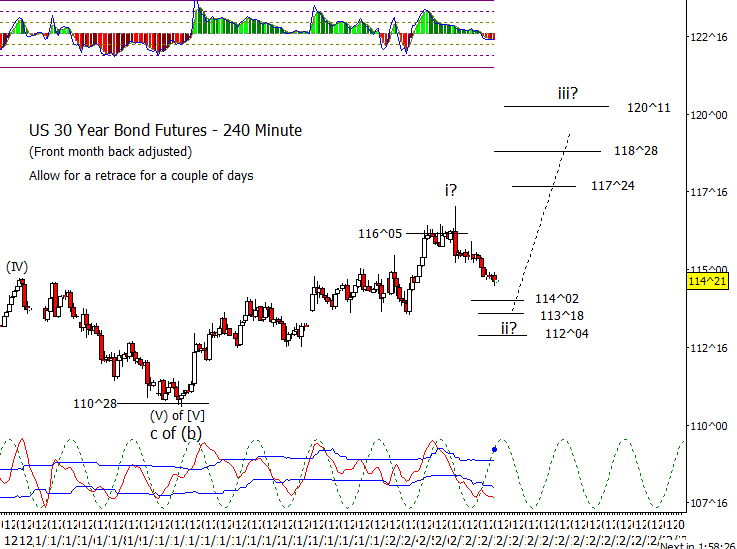

Bonds

Bonds continue to correct which is expected. I am allowing for a slightly deeper retrace than previously, but I don’t see anything disturbing at this point.

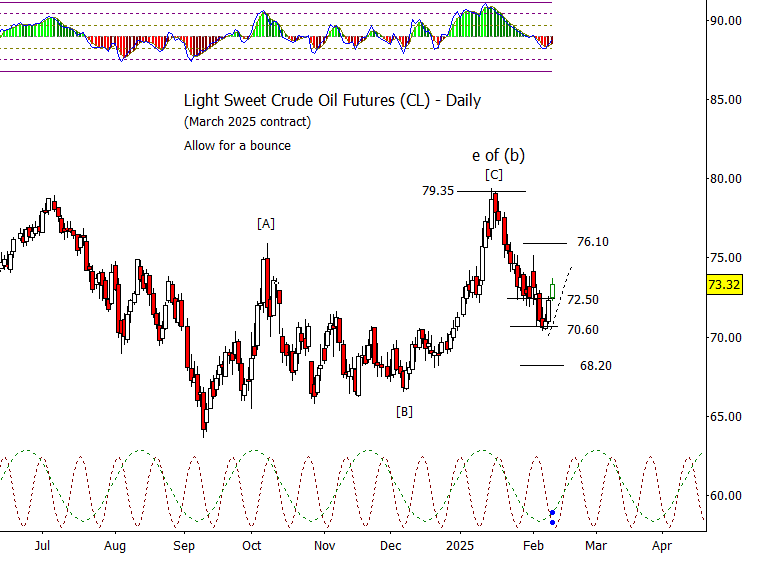

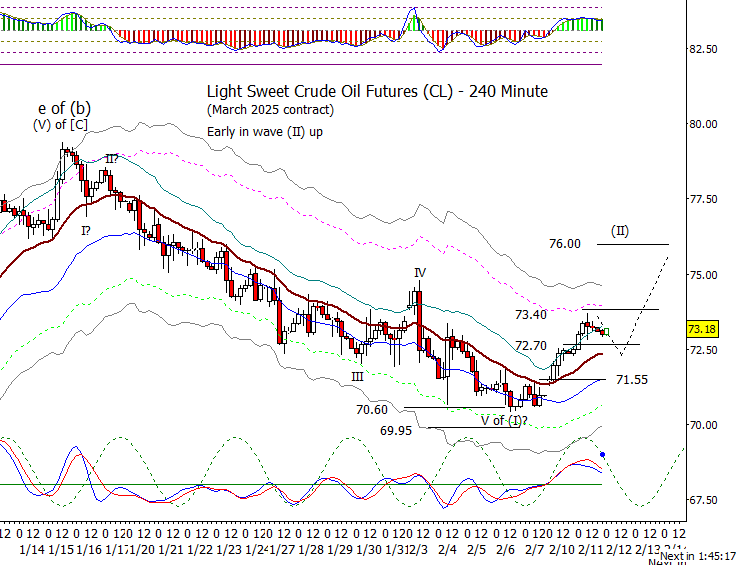

Crude Oil

CL acting reasonably well. Crude came close to the 73.40 level on Tuesday which would be a good place for ‘A of (II).’ Probably should allow for a choppy ‘B’ wave to form prior to the last leg of ‘(II).’

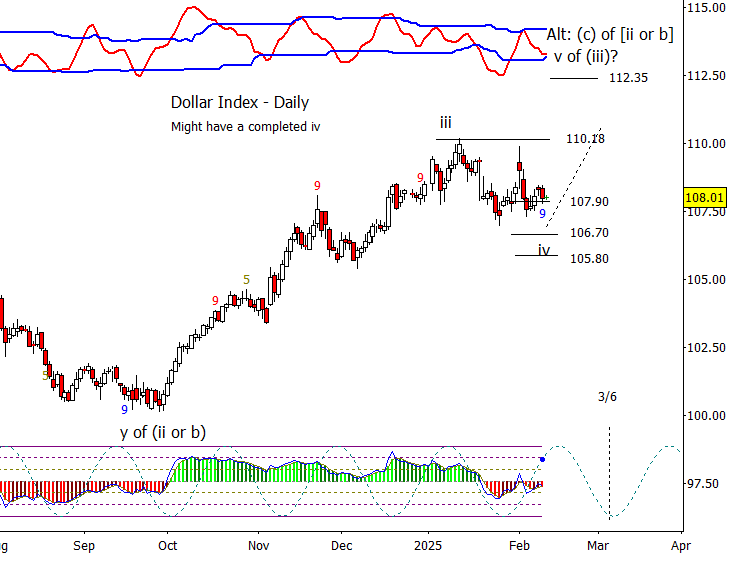

Dollar Index

We will see if DX can hold above 107.90. If 107.90 fails to hold, wave iv is still in development. If 107.90 holds for a day or two more, odds favor wave iv being complete.

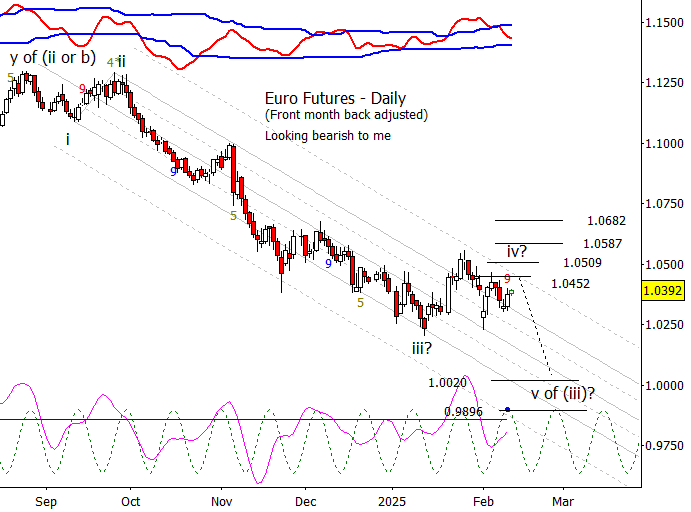

Euro

If the proposed wave iv has already been set at the February 5th bounce high, the current bounce in Euro should set a lower high soon. The alternative is the iv becomes more complex and could result in a push to retest 1.0457 and perhaps higher.

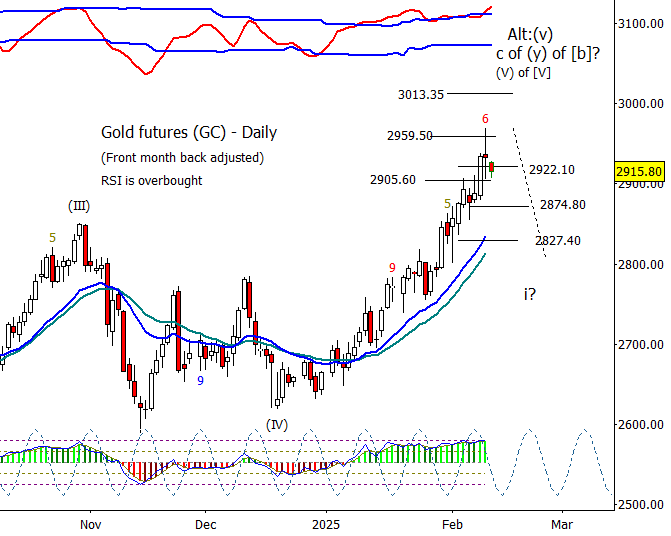

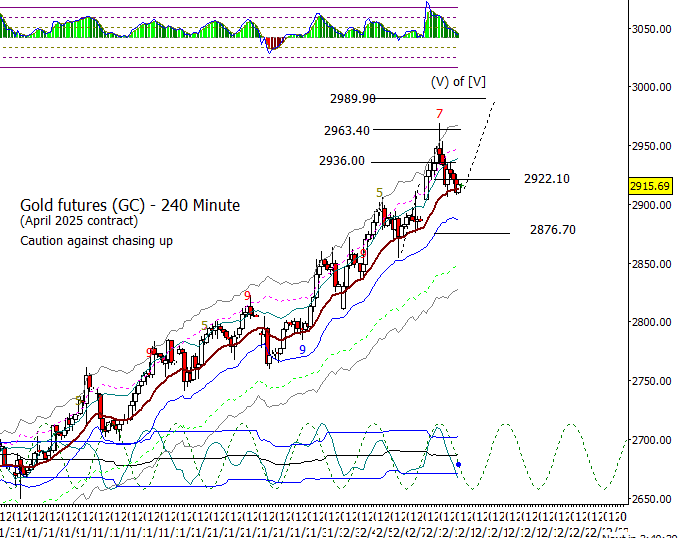

Gold

Gold slipped slightly under the first support at 2922.10 on Tuesday but I think bulls still have a chance to push gold to near the round number at 3000 provided 2922.10 is recovered in the next day or so.

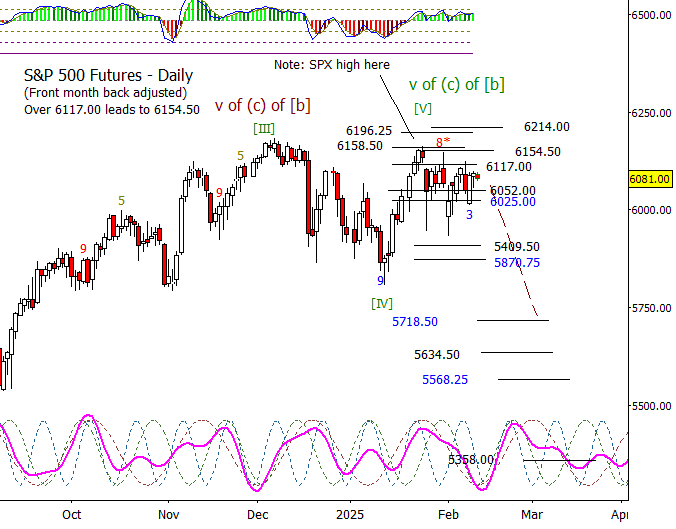

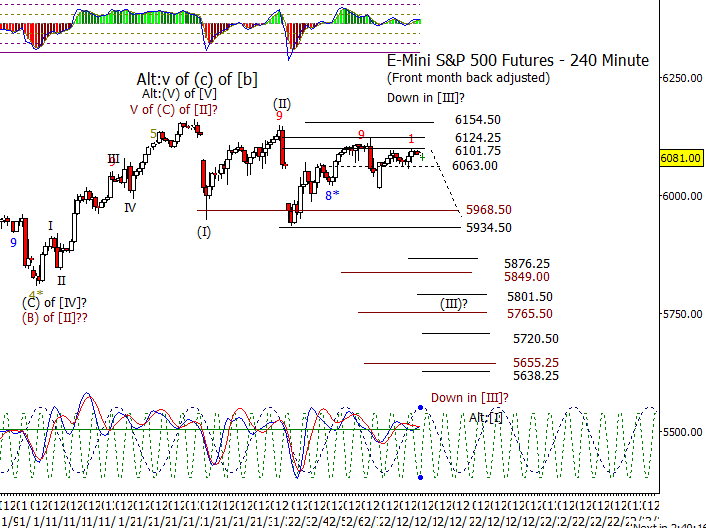

S&P 500 Futures

S&P 500 futures started off soft in the early morning of Tuesday with a move down from the Monday close but firmed up just prior to the day session open. The morning was spent in a recovery of the overnight drop prior to midday drop which resulted in a retrace of much of the decline but bears were thwarted again as that drop was reversed leading to a new high on the day in the afternoon. In the broader context, this is just more of the same probing at the edges of the range that has been going on for the past two weeks. The conventional wisdom is this is just a consolidation prior to yet another drive to a new equity high. As you know, I’m not so certain of that. I worry about a rounded top forming as the market has spent just over two weeks under the SPX high and even longer if we use futures.