Bonds

There was a small retrace to test 117^04 prior to pushing to a new swing high around 118^05. I’d like to see a few days of consolidation prior to continuing the advance.

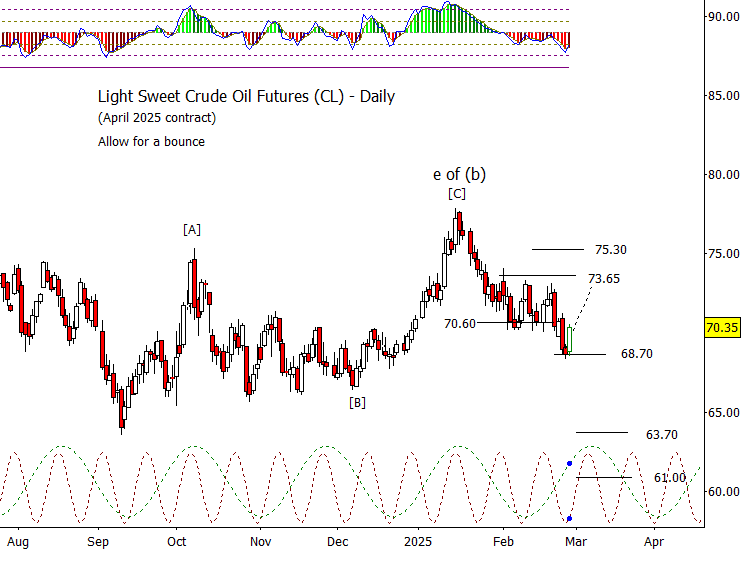

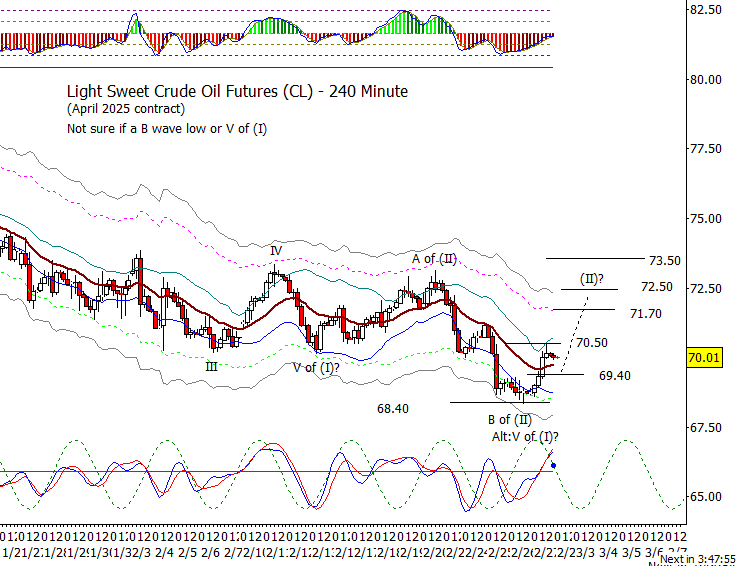

Crude Oil

I’m happy to see CL pop up today but as I have mentioned before, I’m not sure if this will be a three-wave advance or a five-wave advance. If price follows the daily cycles up, it implies about a week of net higher.

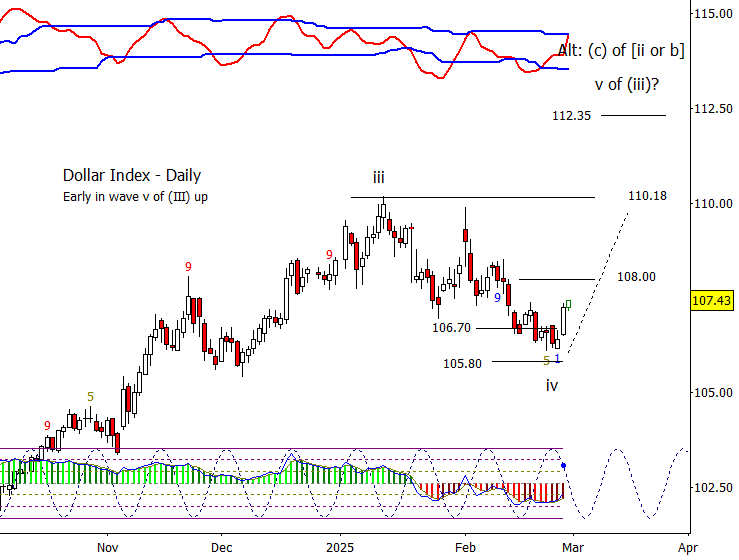

Dollar Index

DX finally starts to climb out of the hole. First minor target overhead at 108.00 but should push to a new swing high over the next couple of months.

Euro

With the drop under 1.0426, I’m assuming that the Euro has started to move down in the early stages of wave ‘v of (iii)’. Might need a tiny consolidation and a new intraday low to complete the first impulse down. Two rough estimates for targets for [I] at 1.0369 and 1.0323.

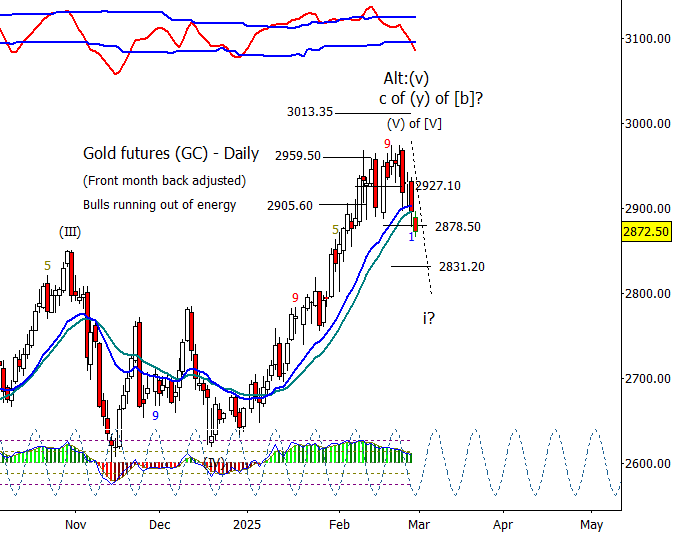

Gold

The drop under the daily moving averages and 2892.10 make for a convincing case for gold to have finally turned down. It takes some squinting but may be closing in on the first impulse down. Next supports at 2862.80 and 2840.90. I suppose the alternative is this is only wave ‘(III) of [I]’ down.

S&P 500 Futures

Interesting day today in the S&P 500. We started off with a bounce overnight and in the early morning to retest 6015.25 which made me think there was a chance to push past it in the day session but instead bears came in and pushed the index back to the low from yesterday. On a lower time frame, the index spent the middle of the day trading in a narrowing range which finally broke lower in the afternoon with some force. For now, I’m going to pencil in the low against 5862.25 as a ‘B of (II)’ though you can make a case to call this low wave (I). From a practical standpoint, it doesn’t matter that much other than the form of the bounce and its height will be different. The latter will take the form of a three and could push to a deep retrace. The former would take the form a of a five and could be fairly swift but not bounce quite as high. Short-term, over 5897.25 is bullish to at least 5921.00 and probably higher.