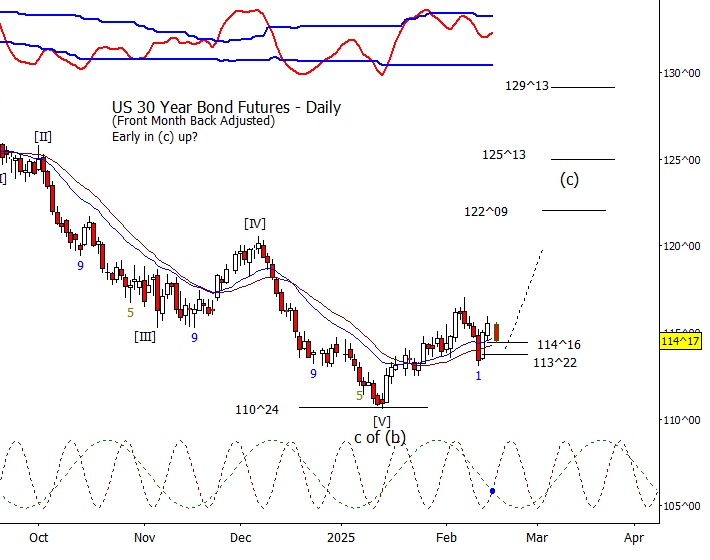

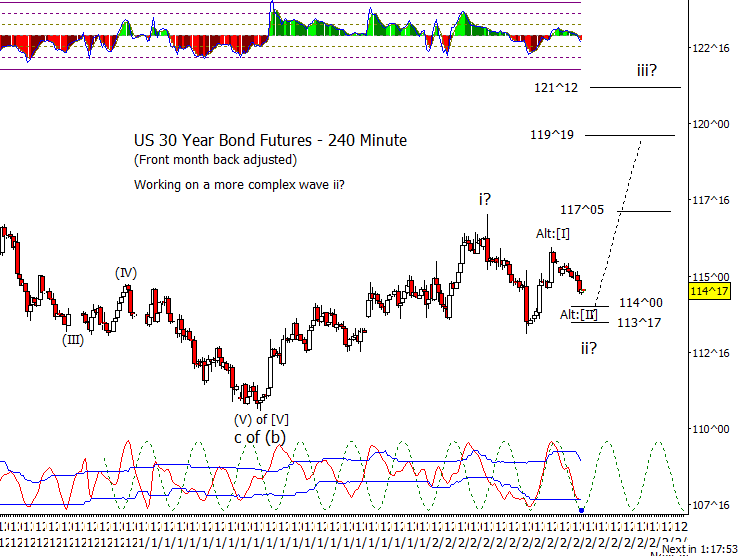

Bonds

I may have jumped the gun on the end of wave ii in bonds as ZB was under pressure today, following the intraday cycle down to the next cycle low. Now we will see if bonds firm up as the intraday cycle turns back up into Thursday.

Crude Oil

The good news is CL is working on climbing out of the hole. The bad news is that I still don’t know if I should treat this move as the second phase of the bounce or the first. We will have to see what it looks like over the next few days. Either way, we should see CL make a better retrace up for a lower high.

Dollar Index

DX bounced a little from 106.70 but you can argue that the form would look better with a minor new swing low to achieve five waves down from the February 3rd bounce high.

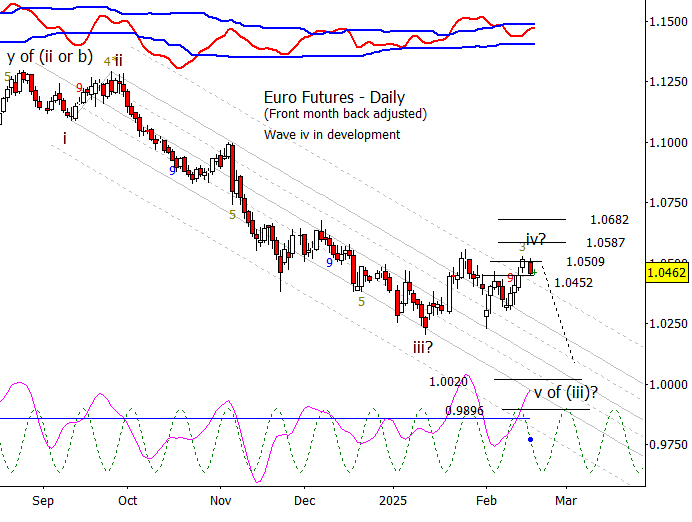

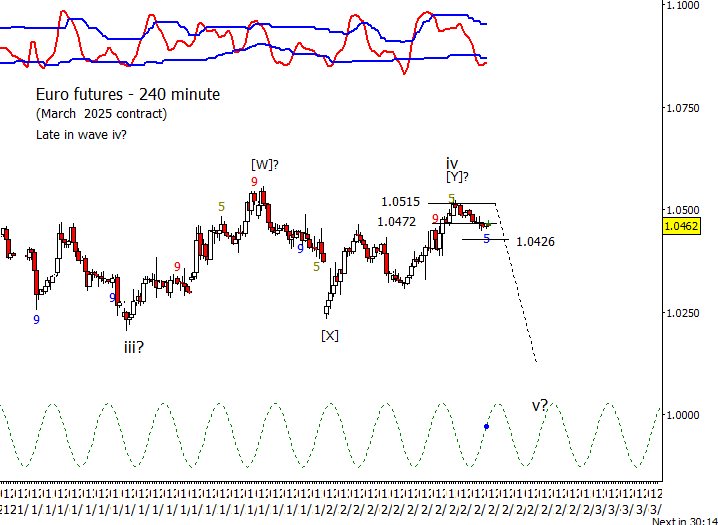

Euro

Conceivable that the wave iv is complete in the Euro but better when the Euro drops under 1.0426.

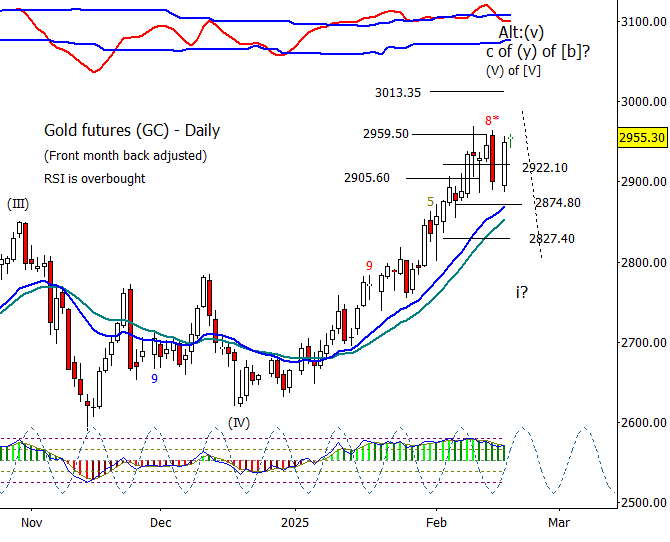

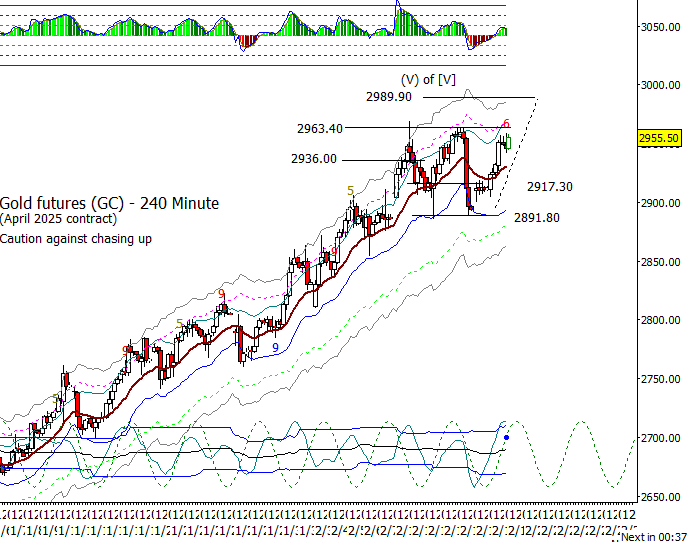

Gold

Gold reversed the drop away from 2963.40 resistance and should now make a new swing high. Note though that I still think it extremely late in this move. I imagine that there will be a spike up to a new high but be aware that gold can reverse hard after a spike.

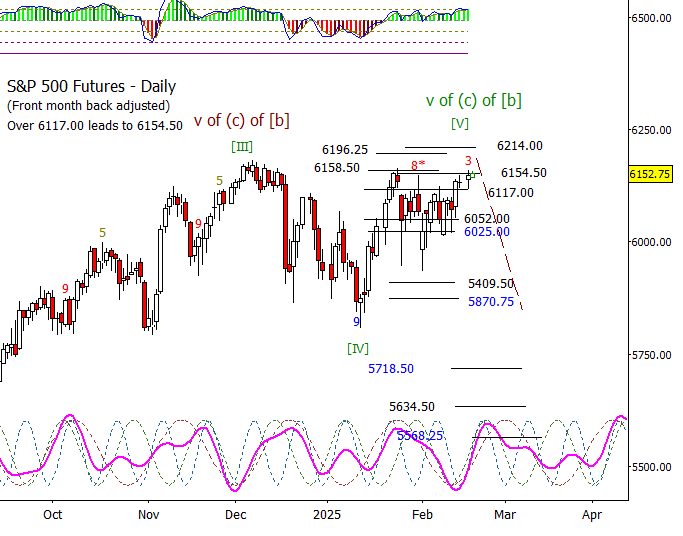

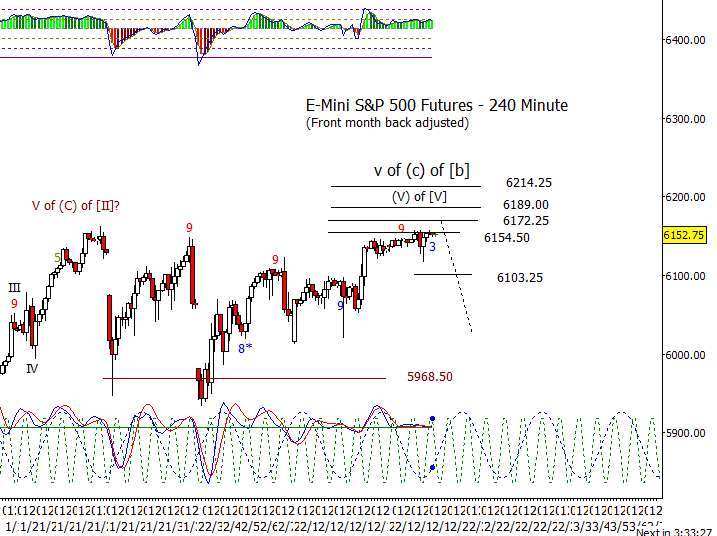

S&P 500 Futures

I know you are all tired of my warnings, so I’ll skip it for now. Short-term, I’m open to futures pushing for 6172.25 to 6189.00 which should allow SPX to reach the area that I marked on the weekly chart.