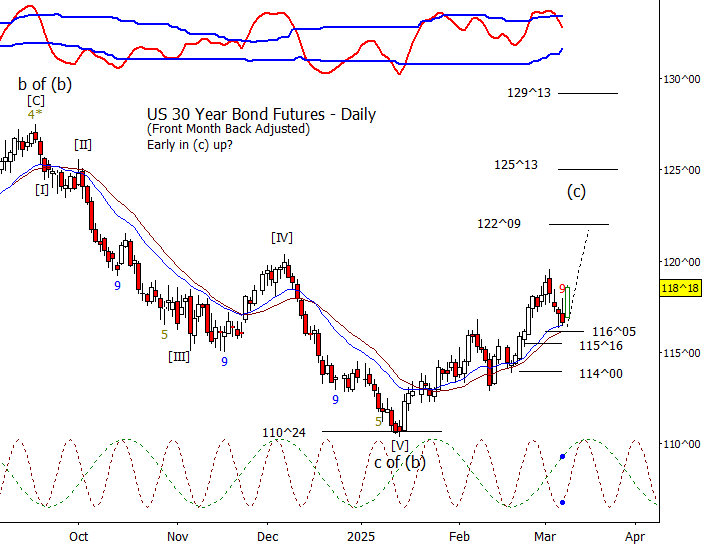

Bonds

ZB woke up today as it pushes up away from the daily moving averages. Next big daily cycle inflection is on March 14th hence expecting higher into the end of the week.

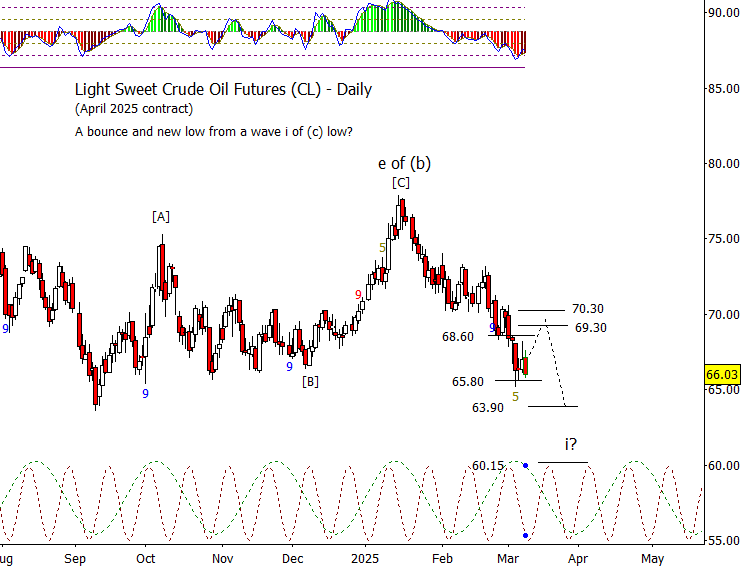

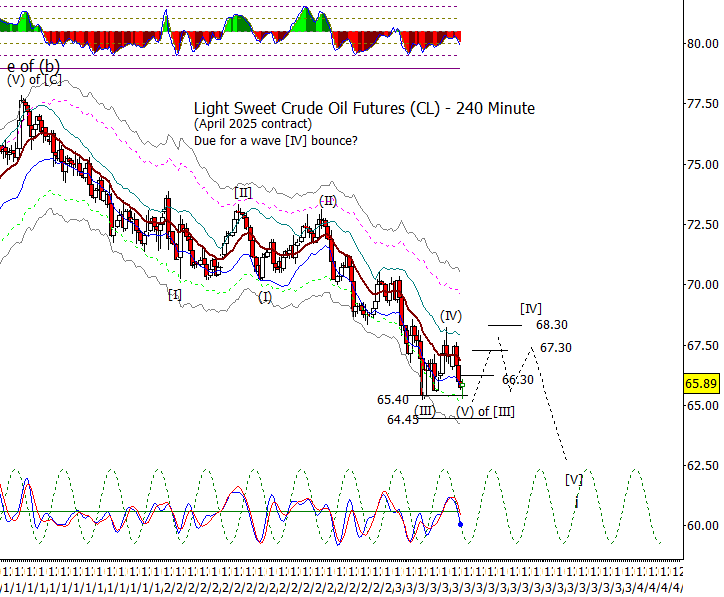

Crude Oil

CL had a down day but only to retest the low from last week. I’m thinking crude is probably only one or two up/down sequences away from the first major impulse down from the January high. Perhaps the wave ‘i of (c)’ low is late this month but imagine is choppy as opposed to pushing that much lower.

Dollar Index

DX making an attempt to hold the 103.48 support. Deeply oversold on the CCI at a projected cycle low.

Euro

Euro was up but only marginally as it runs into resistance at 1.0881. Fade? Probably a little too aggressive at the moment.

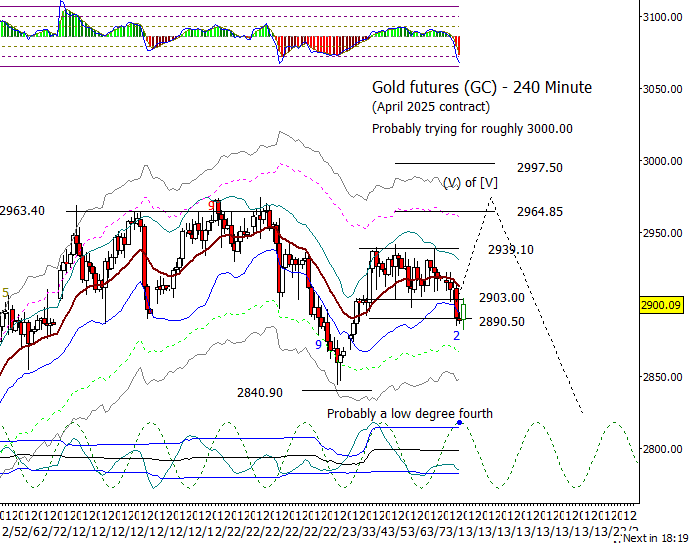

Gold

Gold was down on Monday but note that it is still confined by the range of 2878.50 and 2927.10. I do think we are late in this advance but probably should err on the side of giving bulls a chance to drive to near 3000.00. Short-term bulls need to GC over 2912.00, enough to get over the 20 period EMA on the 240-minute chart.

S&P 500 Futures

The S&P 500 started off soft moving down from the Friday bounce early this morning and continued through the day session. I’m penciling in the low after the close as wave ‘[III] of iii’ and assuming a choppy bounce or consolidation in [IV]. Looking at the daily chart, we see how the market is just above the first set of targets for a wave iii. I’m inclined to allow for a day or two of consolidation at which point we see if bears can drive to a new low in ‘[V] of iii.’ Once wave iii is set, we can see a consolidation that lasts a week or two.