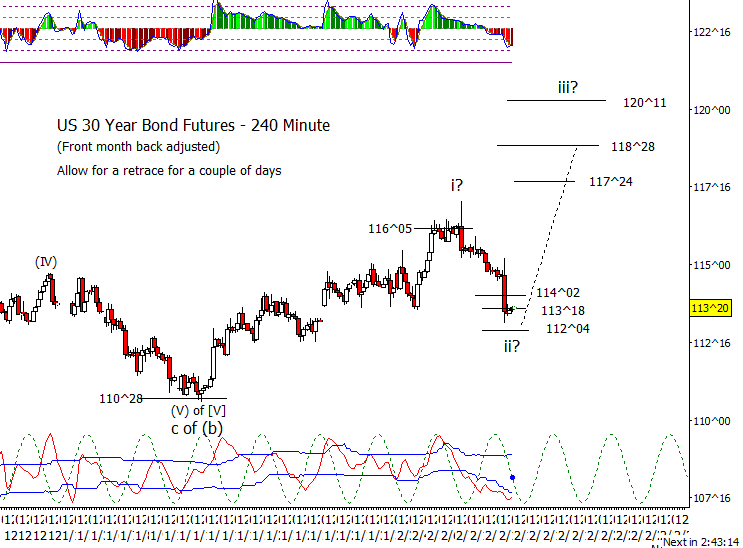

Bonds

The hot CPI helped bonds move lower on Thursday which isn’t a surprise. ZB is now back down into typical wave ii retrace areas. Recovering 114^02 would imply the correction may be over.

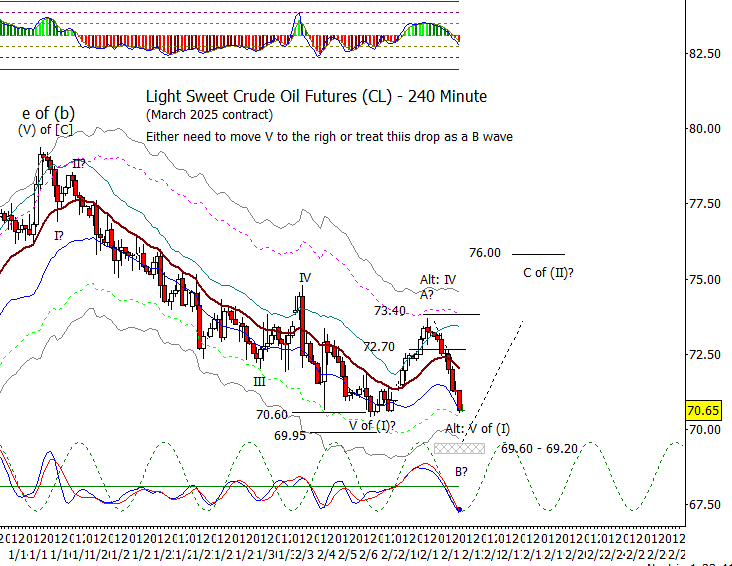

Crude Oil

A drop down away from 73.40 was expected but I didn’t think it would retest the last low. That means either this drop is a ‘B’ wave of a ‘(II)’ or I need to move the labels for ‘IV’ and ‘V’ to the right making this low ‘V of (I)’.

Dollar Index

With DX dropping back under 107.90, I have to conclude that wave iv is still in development.

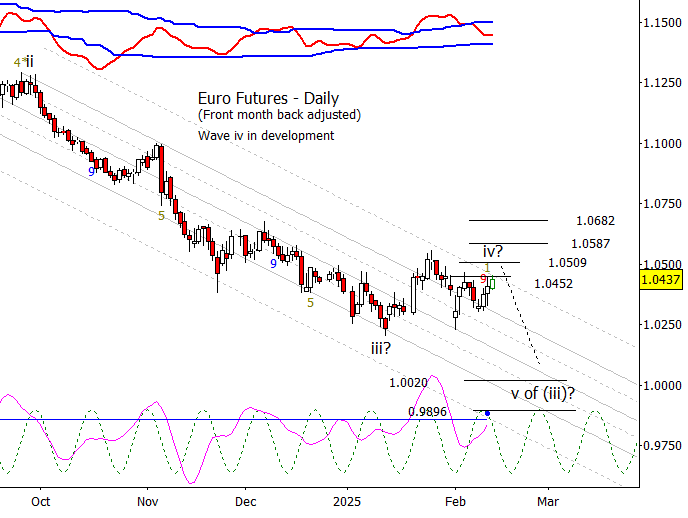

Euro

Euro appears to be late in a 3-3-3 type formation for a wave iv. Overhead resistance at 1.0472 and 1.0515. Any drop under 1.0426 may mark the end of wave iv.

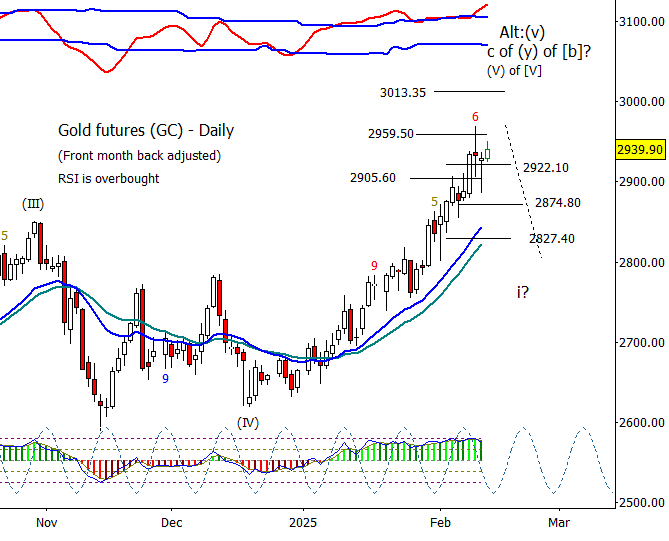

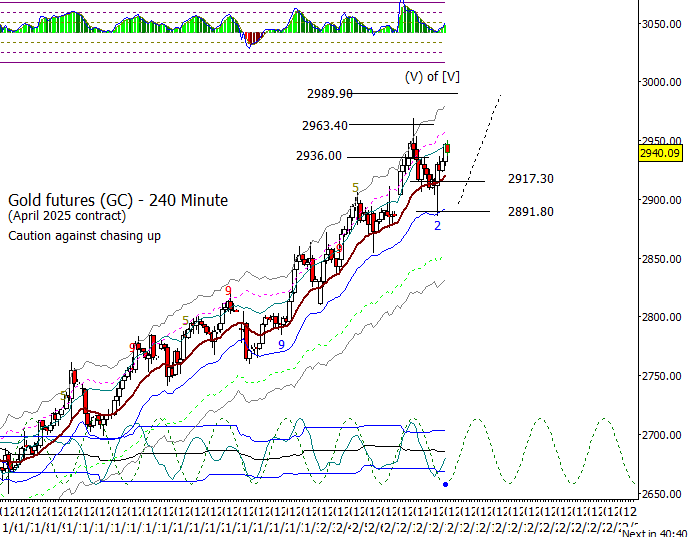

Gold

Gold responded well to the 2891.80 level and rose, but I wonder if gold travels sideways for a few days prior to pushing near 3000.00.

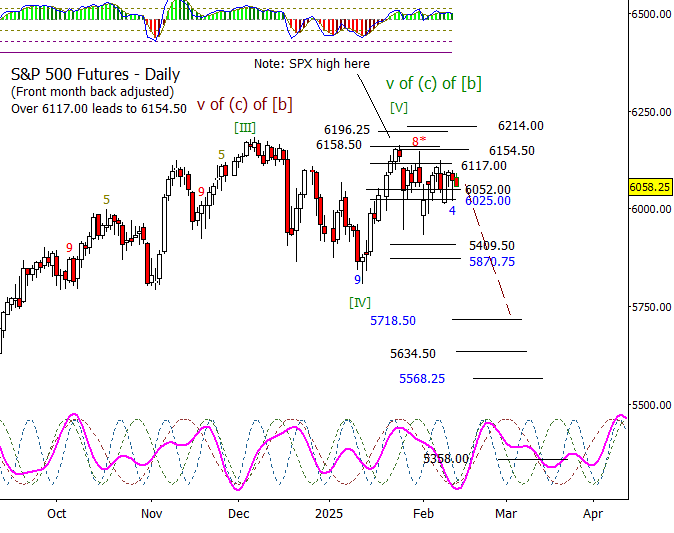

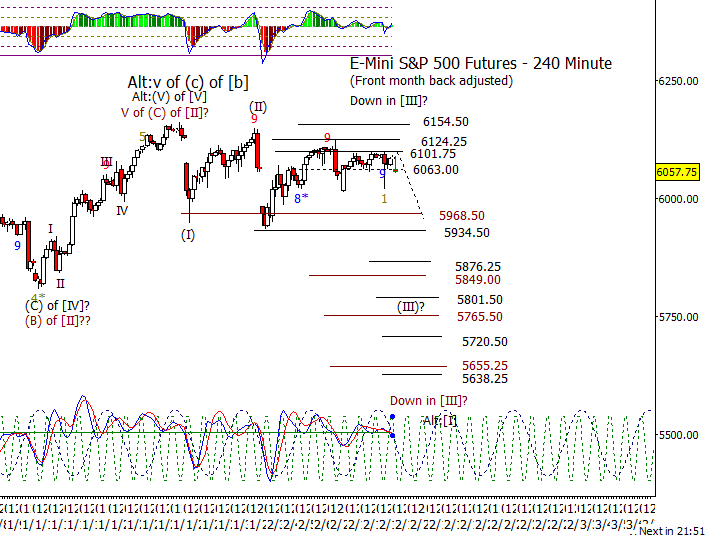

S&P 500 Futures

An exciting day with the market down after the CPI number but so far, the range remains undefeated as buying started at the open and ended up reversing most of the drop. I still think traders need to be open to falling out the bottom of the range.