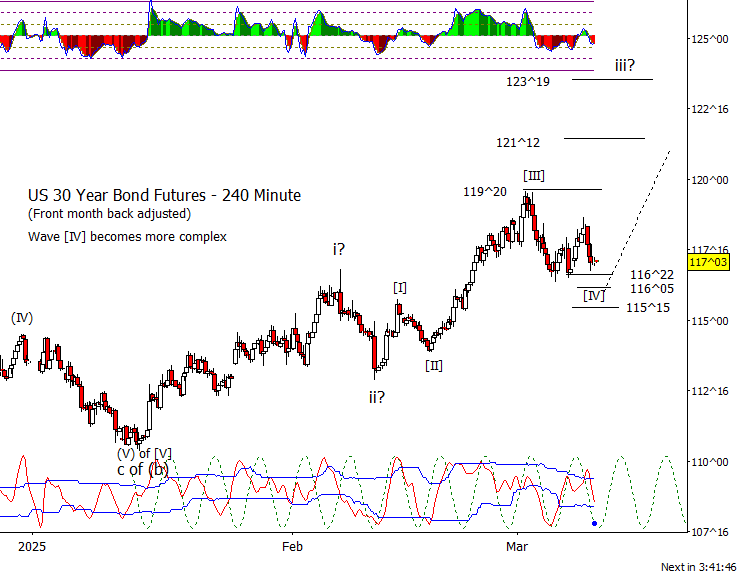

Bonds

I was too quick to call the end of the correction in ZB, which was foolish considering the intraday cycle was due to turn down today. The intraday cycle low should be on Wednesday morning.

Crude Oil

CL followed the plan for a bit of a bounce on Tuesday. I’m inclined to allow more of a bounce but may turn into more of a sideways move instead of up.

Dollar Index

DX was down on Tuesday but nothing particularly extreme as it still attempts to hold 103.48. If DX can get on top of 103.90, best to expect a bounce to at least 104.90. I have a problem with taking a very negative view on DX, but it is possible that the next real serious DX move waits for the (c) wave up in bonds to complete.

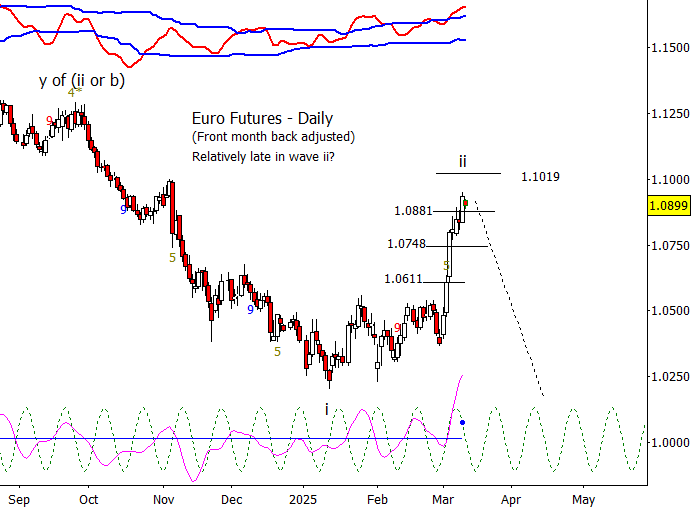

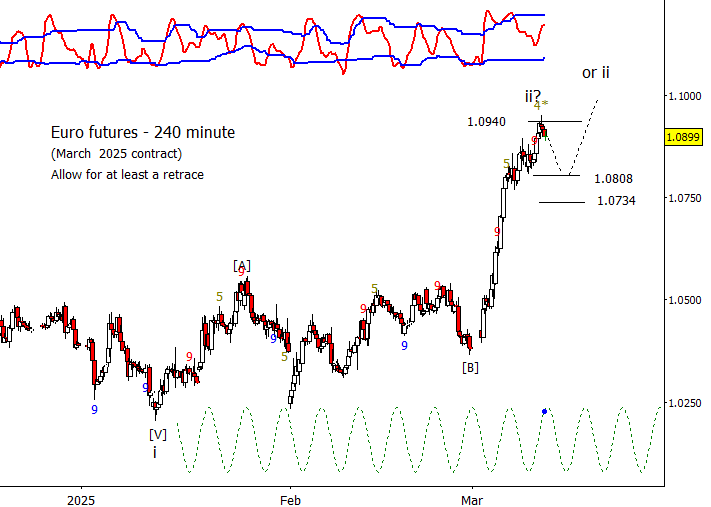

Euro

Euro made a run for the intraday resistance at 1.0940 and looks to be starting at least a retrace. While I think it late in the move, probably too aggressive to short in a serious way while above 1.0734.

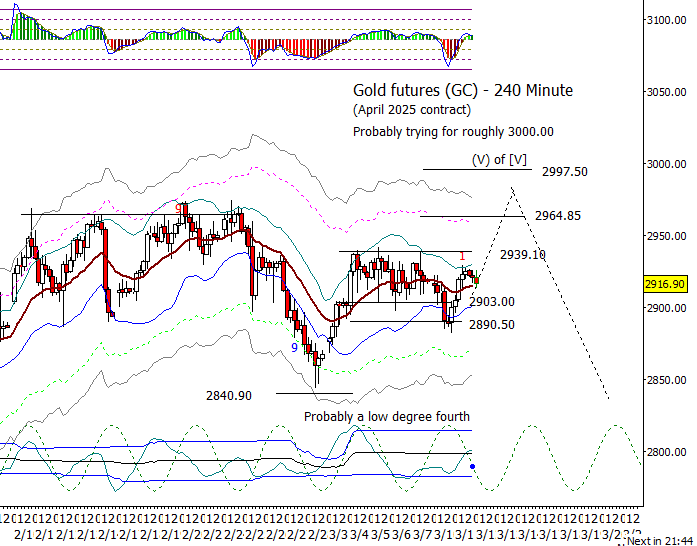

Gold

Gold spent Tuesday climbing up from a test of the 2890.50 support zone and now back at the top of the recent range. Again, probably best to allow bulls an attempt at testing 3000.00.

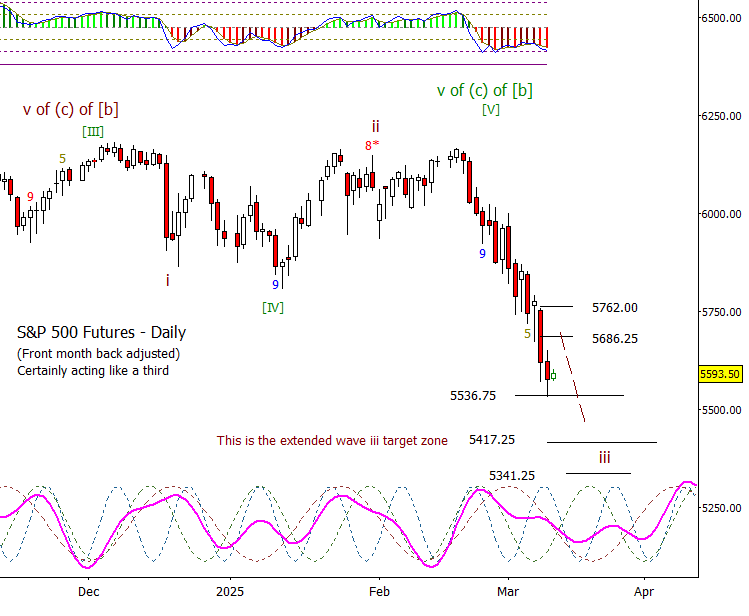

S&P 500 Futures

My call for a bounce today was thwarted as S&P 500 futures fell to the next wave [III] target at 5541.50 and even tested the top of the wave iii target range on the daily chart. I still have a bias to a lower target for wave iii but think there is likely a wave ‘[IV] of iii’ bounce first. Over 5994.50 likely means a bounce is starting. I’d pick either the 5656.25 retrace level or 5686.25 from the daily chart which is derived from and old square of nine support as good places for a short-term bull to aim for. If the CPI is a shock and the market falls apart, aim for 5462.25 or the next wave iii target at 5417.25.