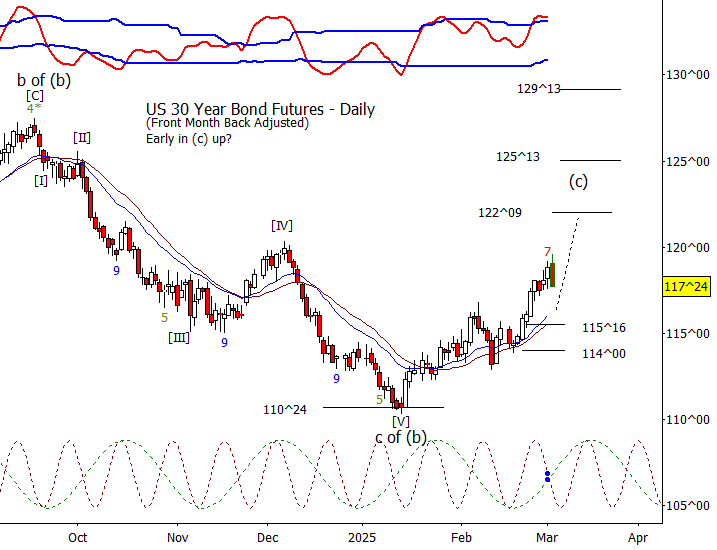

Bonds

Not surprised by the retrace today in bonds as they can use a small rest. Initial support at 117^04, deeper support at 116^02.

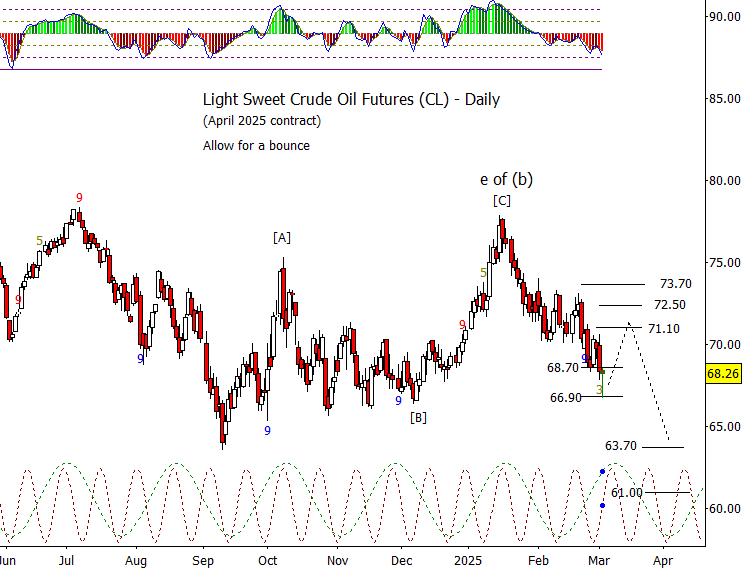

Crude Oil

Well, the good news is that CL did push down to test the next intraday targets and then bounced. The bad news is that I’m less certain about the low being the first impulse down. I’ve sketched in an alternate where the low on Tuesday could be ‘[I] of a iii’ down in progress. The alternate shares the same short-term outcome as the primary, a bounce, but the bounce may be relatively shallow, only making it to around 70.90 or 71.10. Will have to see how CL behaves over the next several days.

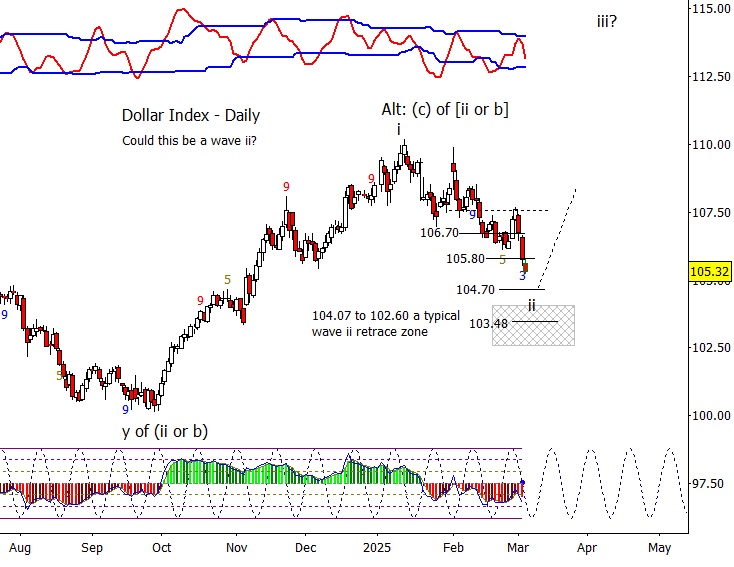

Dollar Index

The drop in DX is now deep enough that I think I need to assume the retrace is a wave ii instead of a wave iv. The most bearish interpretation is that the high in January put in a significant high, a [ii or b].

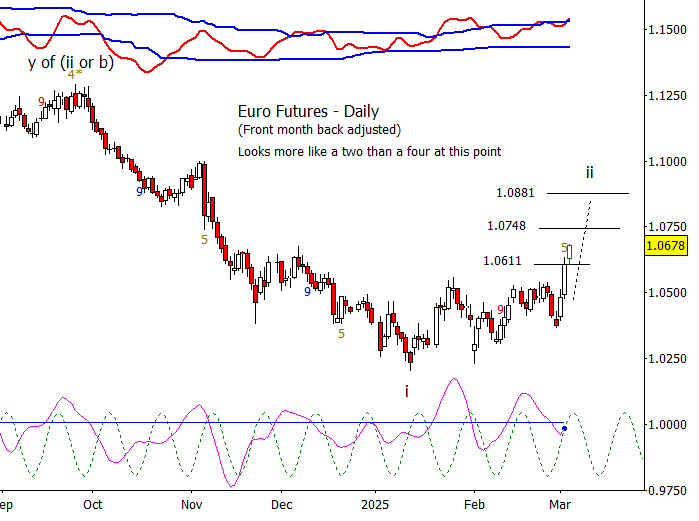

Euro

Basically, same idea as DX above but in reverse. Working on a wave ii. Some intraday resistance at 1.0683 but bias is up while above 1.0587.

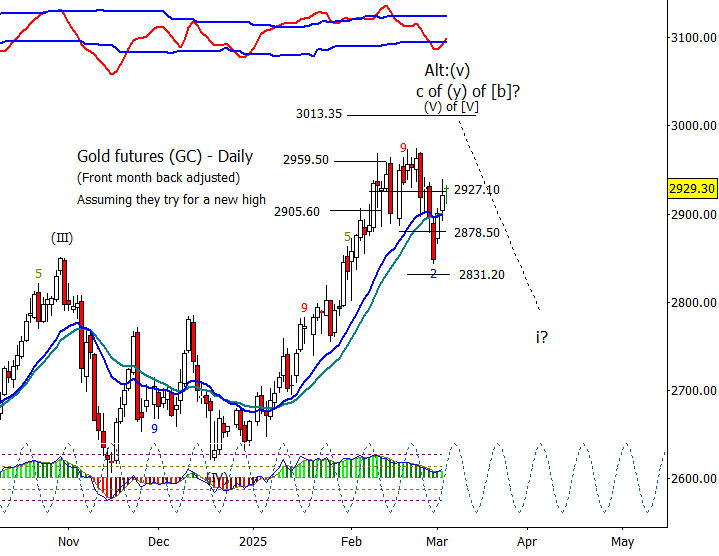

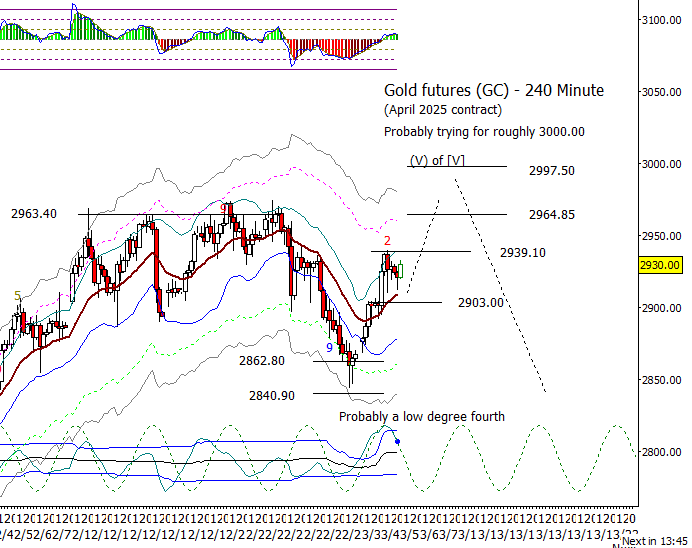

Gold

Gold isn’t really responding to retracement levels on this move up which forces me to assume that we are getting another impulse up from the last low and that we should expect a new swing high. 2939.10 is minor resistance but bias is up while over 2903.00.

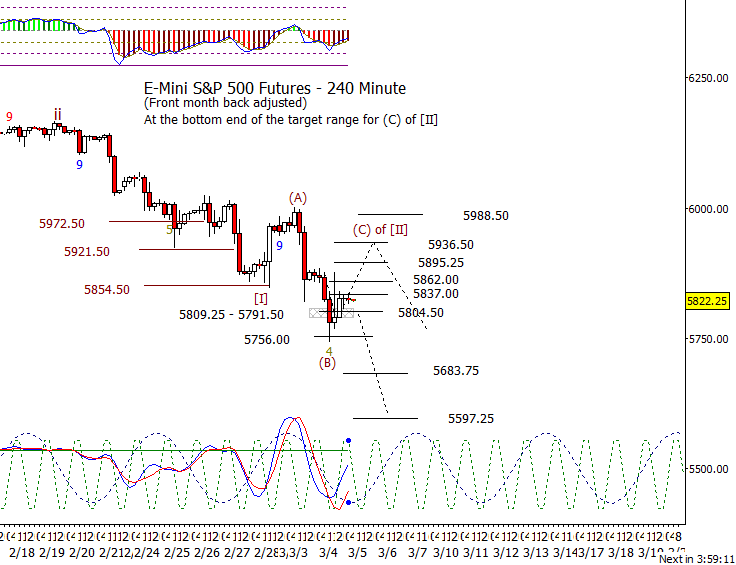

S&P 500 Futures

Tuesday was an exciting day in the S&P 500. The market moved a little lower in the morning than I expected, pushing to the lower target for a possible (B) wave, but did rally in the afternoon from 5756.00 and made it to the bottom of the target range for a (C). There was a swift move down very late in the day, but we have seen some recovery overnight. Net, above 5837.00 is a positive for a deeper retrace up, under 5804.50 is a negative and invites a drop to 5683.75 if not lower to 5597.25.