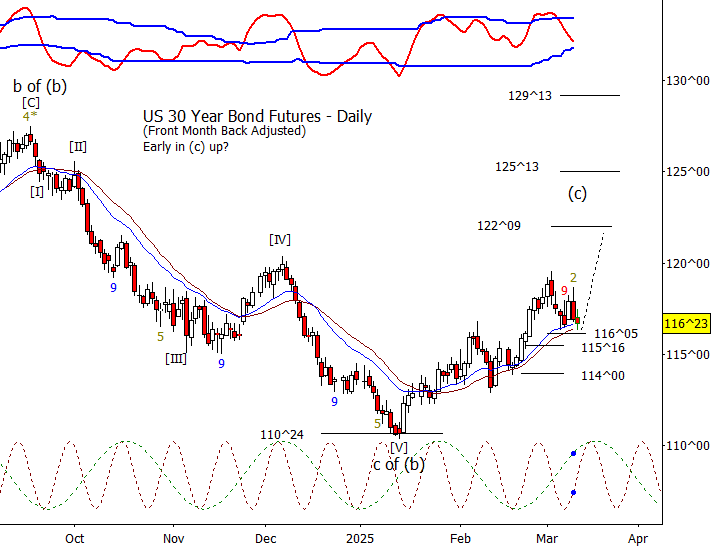

Bonds

Bonds slipped a little under 116^22 today but is holding the daily moving averages. I’m inclined to think the correction is nearly complete as the intraday cycle is due to turn up into Friday. Over 117^06 would be a positive for higher.

Crude Oil

CL stayed on plan on Wednesday with a bounce. Over 67.30 is a minor positive to reach 68.30.

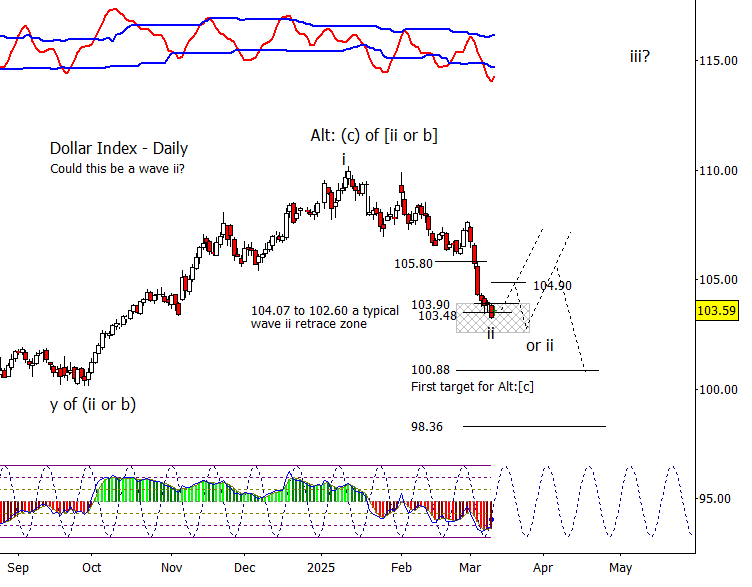

Dollar Index

I’m sticking with the wave ii idea for now but the alternate, that DX is moving down in [c] is something that I’m warming up to. The alternate would fit well with the idea of bonds turning down after completing the (c) wave.

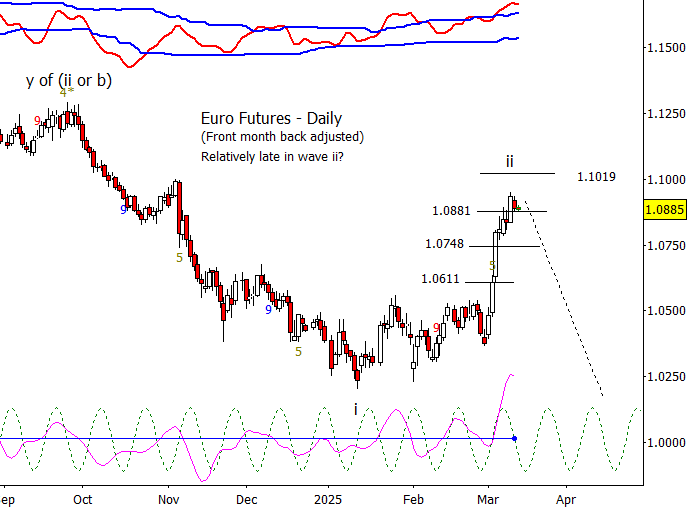

Euro

Euro attempting to retrace but so far quite shallow. I’d like to see 1.0808 at a minimum.

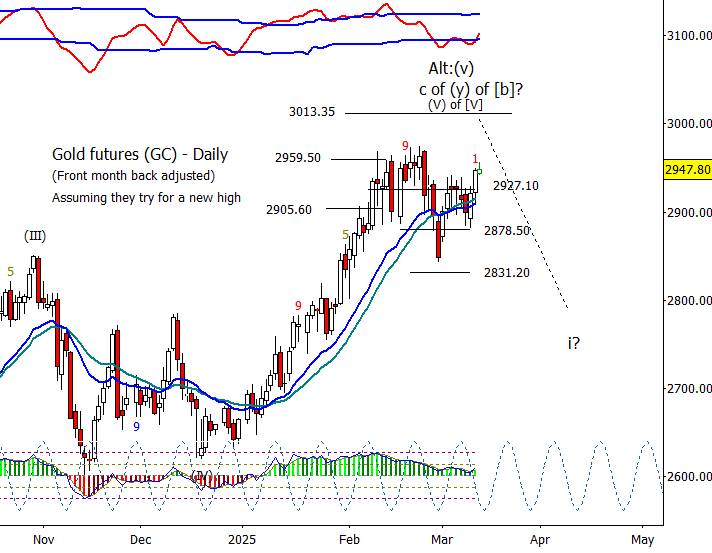

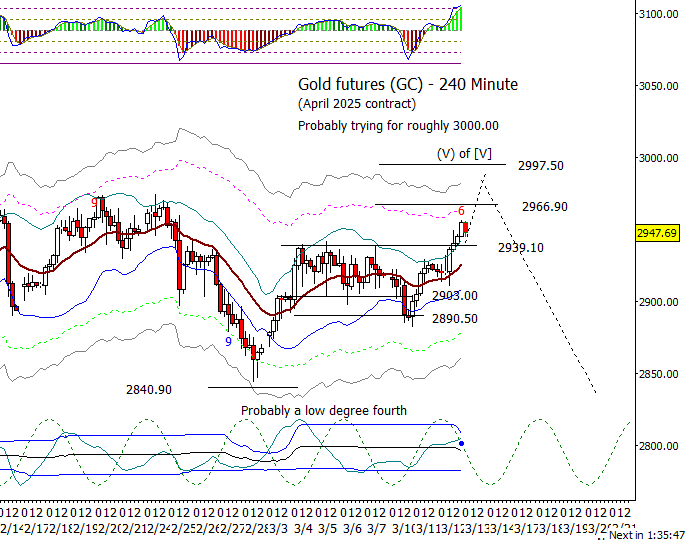

Gold

Gold did move up on Wednesday but I’m starting to worry that this turns into a lower high if GC falls back under 2939.10.

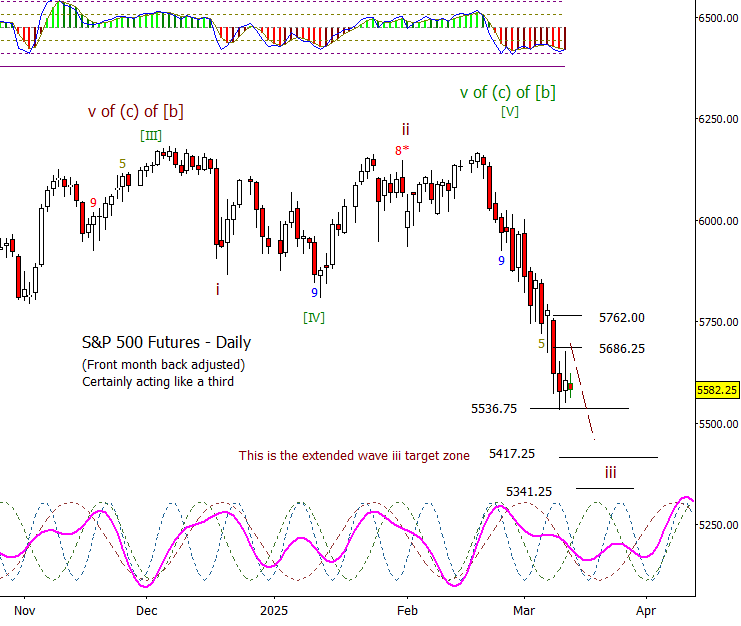

S&P 500 Futures

Wednesday was interesting. Futures spiked on the CPI number but sold from the open to retrace most of the gain from the Tuesday low. At that point, in true wave [IV] form, it rallied back to the day session hourly 20 EMA just to punish overconfident bears. The rest of the day was spent in a range sideways. Is the wave [IV] complete? Difficult to say, I think it a minor negative to be back under 5594.50 but will have to see what the reaction to the PPI Thursday morning is.