Bonds

ZB advanced again today such that it is now up to the 113^08 resistance on the intraday chart and up into the moving averages on the daily chart. Now bulls need to form a higher low and push over 113^08.

Crude Oil

CL paused today and retraced back to just under 77.80 to test the 20 period EMA on the 240-minute chart. I think it best to allow for another try at 79.58 or higher but note the daily cycles are topping out.

Dollar Index

DX dipped under 109.10 but attempted to recover. I prefer the retrace be a little deeper but as strong as DX has been, might not be very deep.

Euro

Euro is stalling against the first target for a ‘[C] of iv.’ I’d rather see a bit higher, say 1.0418, but no guarantee it will make it there. Seems a bit early to sell in anticipation of a wave v down but may have to chase down if the Euro pushes under 1.0269.

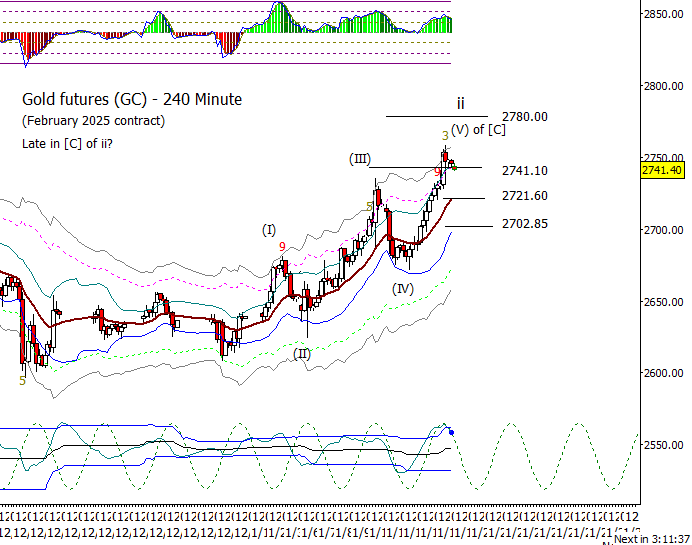

Gold

Gold is stalling under 2761.35. It might be a little early to short but strikes me as too late to trade with a long bias. Best for a bear to see some confirmation of a reversal like a drop under at least 2721.60.

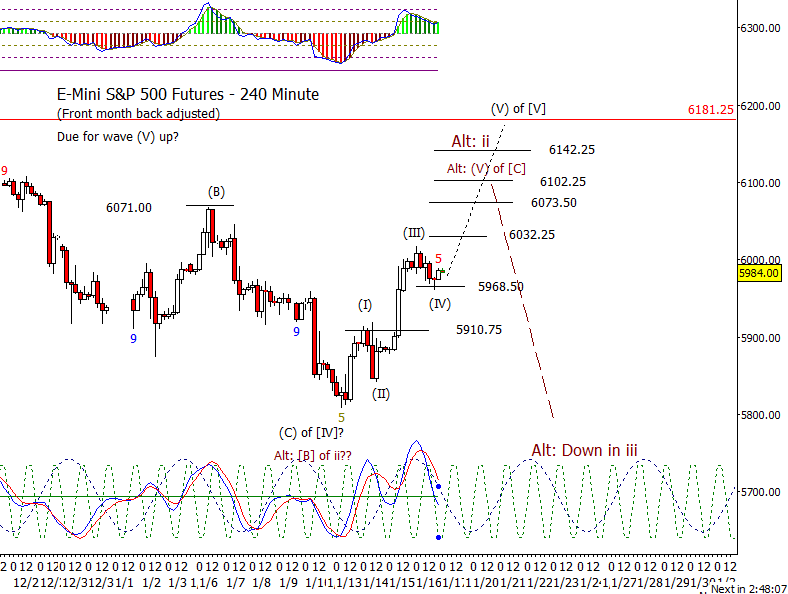

S&P 500 Futures

The S&P 500 spent Thursday in a choppy correction which could fit for a wave (IV). The next inflection on the cycle composite on the daily chart is January 24th hence have a bias up into next week. Whether that turns into five waves of ‘[C] of ii’ for a lower high or five waves to retest or make a new high, I’m not certain though I suggest being open to a lower high.

Note that Monday is a holiday. I’ll post my weekly charts on Monday instead of Sunday evening.