The Week Ahead: 2024-07-21

Tesla and Alphabet earnings early in the week, PCE at the end of the week

Bonds

Bonds didn’t move much last week which may be understandable given that the next FOMC meeting is the end of this month. We probably see more of the same this week.

Crude Oil

There is a reasonable chance that the ‘y of (b)’ high is set as CL has been under pretty steady selling pressure. I’ll feel better about a reversal down once crude drops under 77.35.

Dollar Index

DX was soft last week as the 104.92 support failed and it pushed for the next support at 103.88. It is interesting that in the early hours of Monday as I type that there was a brief break lower and a quick recovery. I lean toward higher though we need to see 104.92 recovered for proof of a reversal.

Euro

As I have been writing about recently, I think need to treat everything from the low last year as a corrective formation. So far, Euro has been stuck in a range for nearly four months between 1.0985 and 1.0748. I still think there will be a resolution lower but so far nothing a bear can sink their teeth into.

Gold

On this time frame, we might have seen the expected high set in gold last week. On lower time frames, there is still a chance for a minor new swing high but my confidence in it is waning. Gold under 2389.50 argues for the reversal lower taking place.

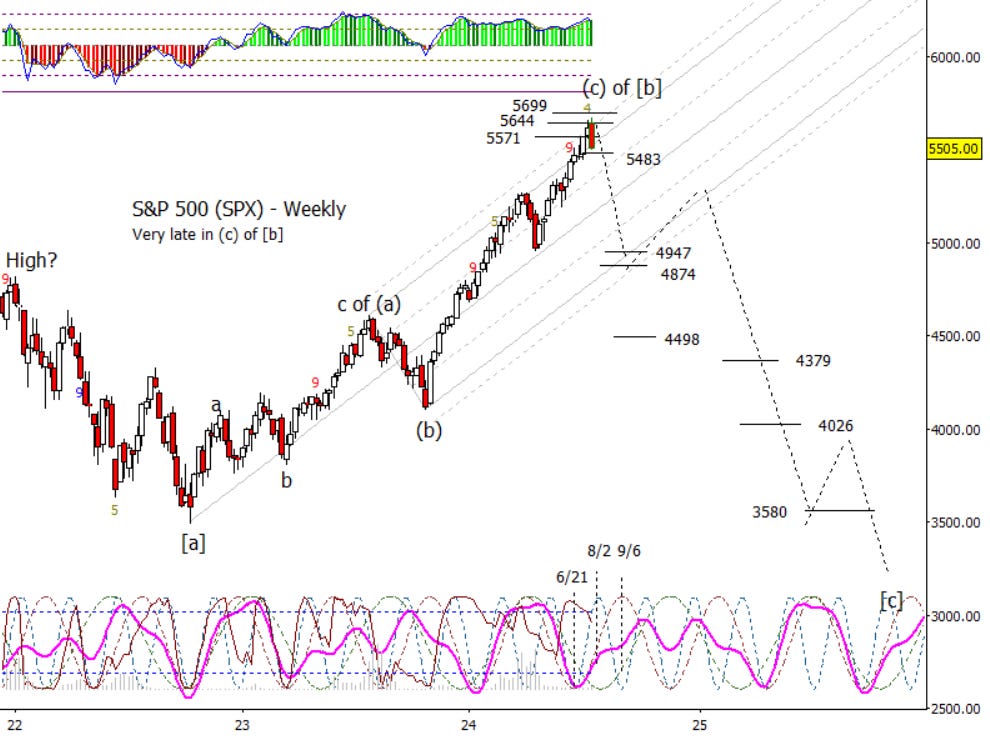

S&P 500

First really soft week in the S&P 500 since the drop in April. Is the expected high in? Maybe. I hate to equivocate, but I just don’t know. While above 5483, bulls have a chance to achieve a new high. I do think we are very late in the advance from October of last year if the high hasn’t been set. I’m leaning to a bounce into the FOMC meeting which could bleed into early August, but we might see a test 5483 early this week first. We will see if that bounce leads to a new high or a lower high.

Bitcoin Futures

Bitcoin is continuing its move up out of the 57140 to 54395 support zone. I think the form would look best with a new high over that of March of this year but admit that the correction from March to early this month is rather large in price and time but hasn’t broken any rules thus far. Bulls need to keep pushing and not let BTC stall at 69450 lest a lower high form.