Bonds

Bonds stalling against 126^22 as per plan. Expecting a month or two of choppy sideways action prior to the next press up in ‘(c) of [ii or b]’.

Crude Oil

CL continues to rise from what I’m penciling in a ‘[B] of ii’ low and on alert for a five wave move up on lower time frames for a possible ‘[C] of ii’ to form a lower high to that made in April.

Dollar Index

If we assume the corrective high in DX was around late April or early May, then we should expect five waves down which we could have now with the minor new low this week. Support at 100.60 and 99.78.

Euro

Euro has yet to make a new high in the swing up from June so I’m open to a new high as that make a five-wave sequence from that low.

Gold

Gold is currently between targets on this time frame which means I should probably be open to a little higher but on lower time frames, I think the count could be complete and thus don’t think higher is a sure thing.

S&P 500

SPX came through with a new high last week. Could it go higher? Yes, but I don’t think we can count on it. Up to this point, I’ve done my best to keep a bullish bias but I just can’t do it now.

E-Mini Nasdaq 100 Futures

I want to point out that while the S&P 500 has made a new high, NQ has not. I think it makes sense to be open to a lower high forming in NQ as intermarket divergence is not uncommon at important turns.

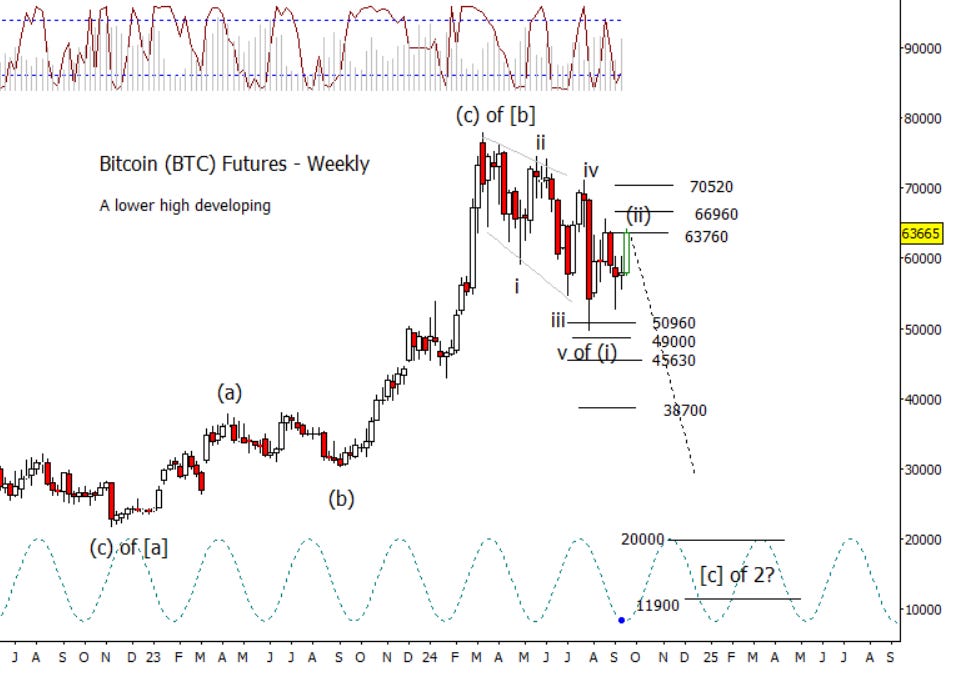

Bitcoin Futures

Interesting that BTC futures are now up against resistance at the next cycle inflection. I can’t rule out a push past 63760 to 66960 in the next week or two but hardly required.