Bonds

I have been counting out this recent decline as part of a lower degree fourth but there is another alternative and one that I think I like better, that everything since the high late last year has been corrective, a 3-3-5, an now at the first target for ‘c of (b).’

Crude Oil

Last week formed a doji candle in crude with approximately equal shadows. I think this qualifies as a candidate for a lower high. For confirmation of a reversal, the first step is for CL to move back under 74.15.

Dollar Index

DX is doing well but I think a consolidation would look nice prior to pushing up toward 105.00 and higher.

Euro

It is a positive for bears that Euro is under the 20 EMA on the weekly chart, but I wonder if it is retested, say 1.1045, before breaking under 1.0945.

Gold

Since the 2616.75 support held, it is likely that gold will push to a new high on the swing around 2727.

S&P 500

The S&P 500 pushed through 5773 to just above the next round number. The next little step up is at 5845. Will it be tested? I don’t know.

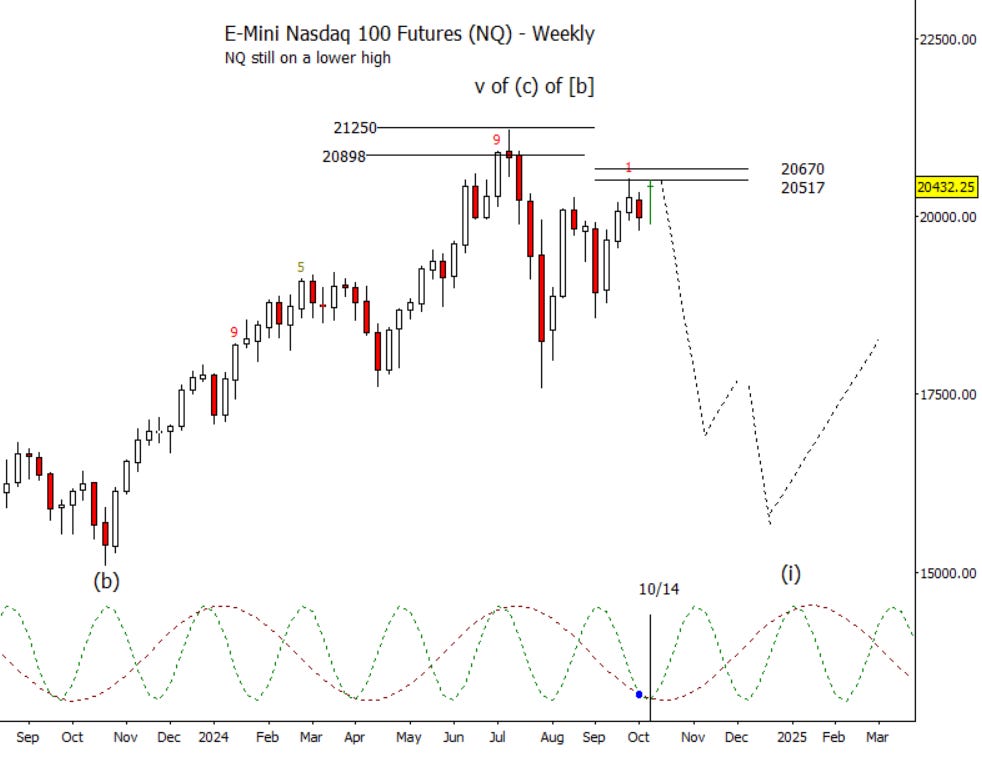

Nasdaq 100 Futures

Note that NQ is still on a lower high. I can’t see this lagging behavior as being a good thing. Maybe we have to wait for NQ to poke a new high over that of September into the 20517 to 20670 zone.

Bitcoin Futures

BTC looks like it needs to retest 66960 or perhaps just over it to put in the lower high for wave (ii).