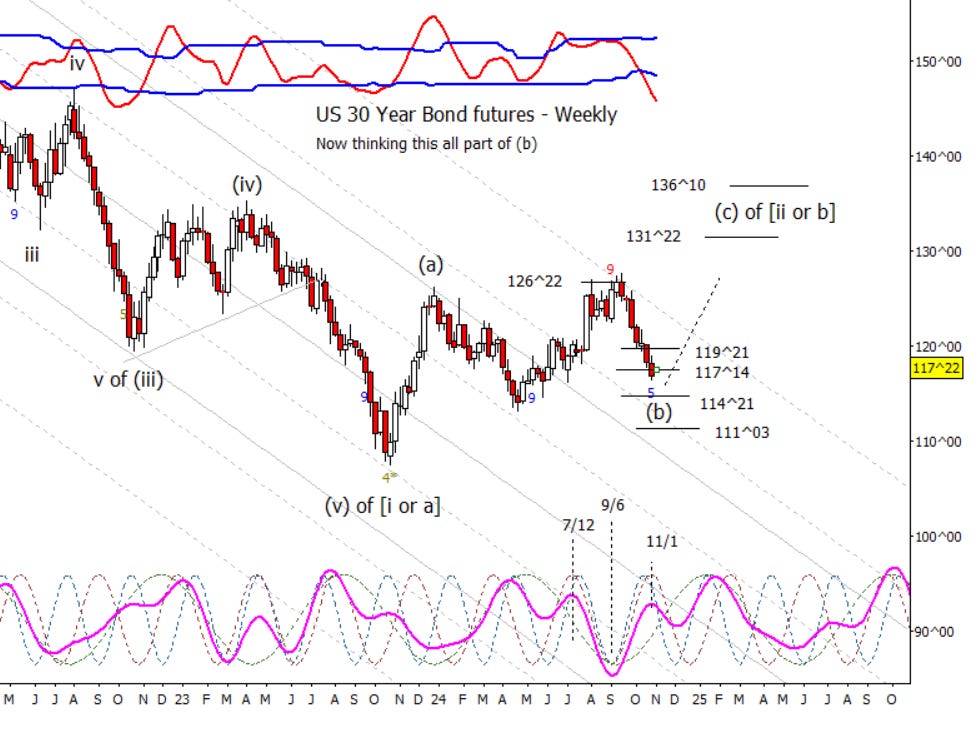

Bonds

There have been some big investments names recently speaking about having a bearish bond bias. I don’t necessarily disagree with them on the overall big picture direction, but I think they are early. I still think the movement pretty much this whole year is a middle of a larger upward correction. I’d also point out that the RSI is oversold at a composite cycle inflection point.

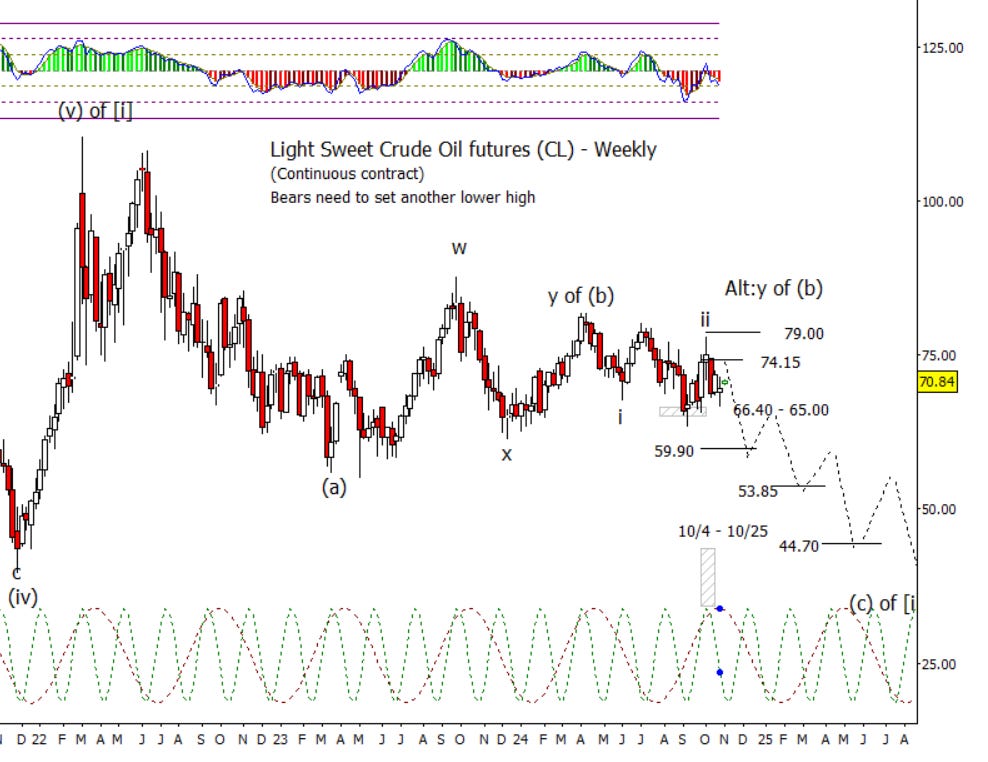

Crude Oil

CL moved lower last week but can’t really say anything conclusive has transpired yet at this time frame. We will see if bears can set another lower high in the next week or two. If not, the whole corrective structure from last year stretches out yet more in time.

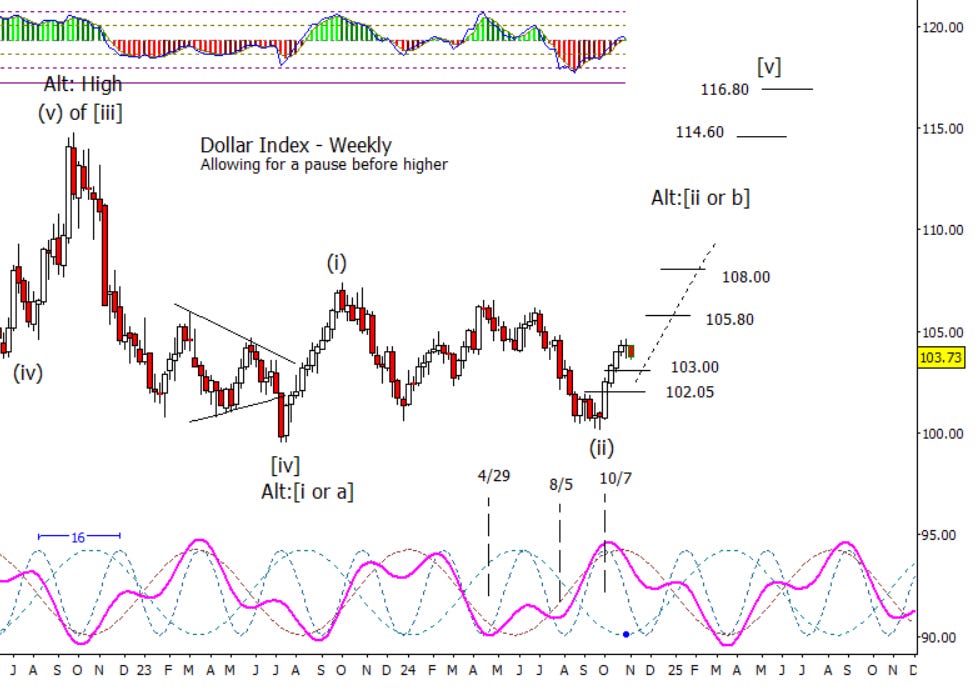

Dollar Index

I have been looking for a minor retrace or consolidation to get started on lower time frames for a week or so and it looks like it is finally starting. I don’t think the retrace needs to be particularly deep, but we will see.

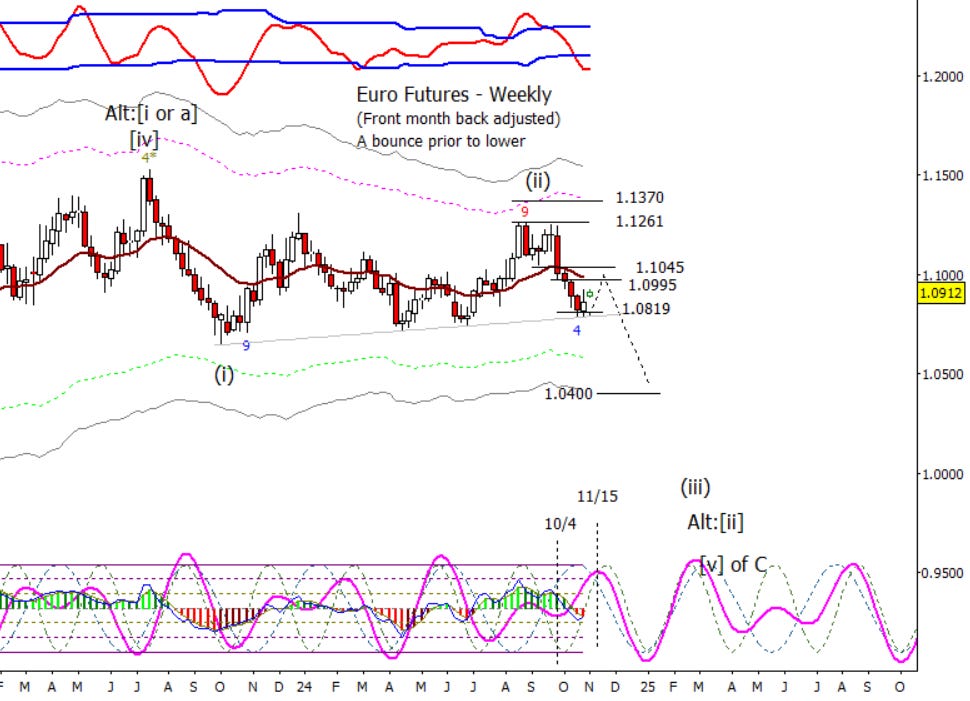

Euro

As you would expect from the above forecast, I think Euro is due for a bounce prior to breaking lower. Watch overhead resistance at 1.0995 and 1.1045 over the next couple of weeks.

Gold

I’m assuming the high last week was the penultimate high to be followed by a few weeks of sideways consolidation prior to the ultimate high for this swing.

S&P 500

Has the high been set? I’m not sure. While SPX is above 5866, the market can still push to a new high. I certainly think the market is extremely overbought but that doesn’t preclude it staying that way longer than I think it should.

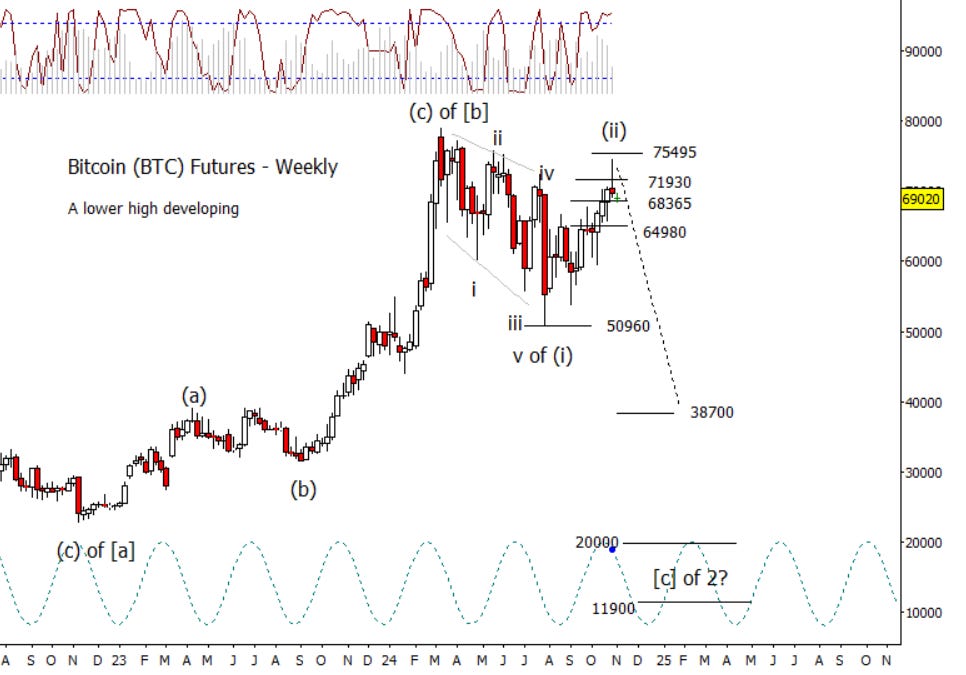

Bitcoin Futures

Well look at that, a possible lower high in BTC futures. Probably need to see price spend time under 68365 prior to getting overly excited about a reversal.