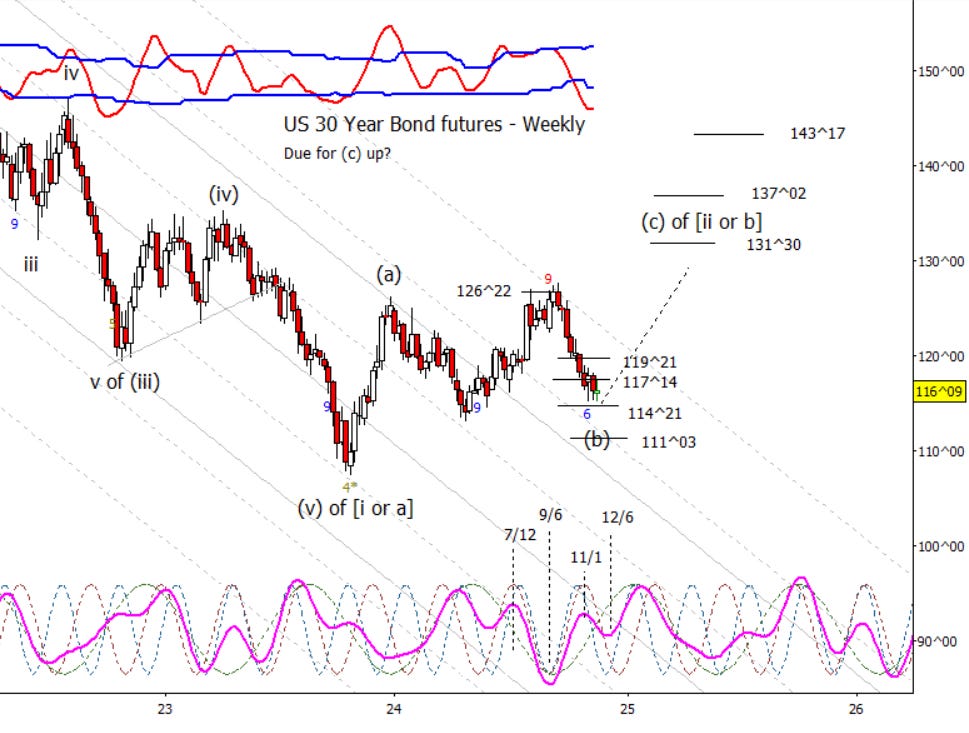

Bonds

ZB has been consolidating just above the 144^21 support level. The next composite cycle inflection is early next month so we might see a minor new low in the next week or two, but I don’t like being short down here as I expect a rather brisk reversal up.

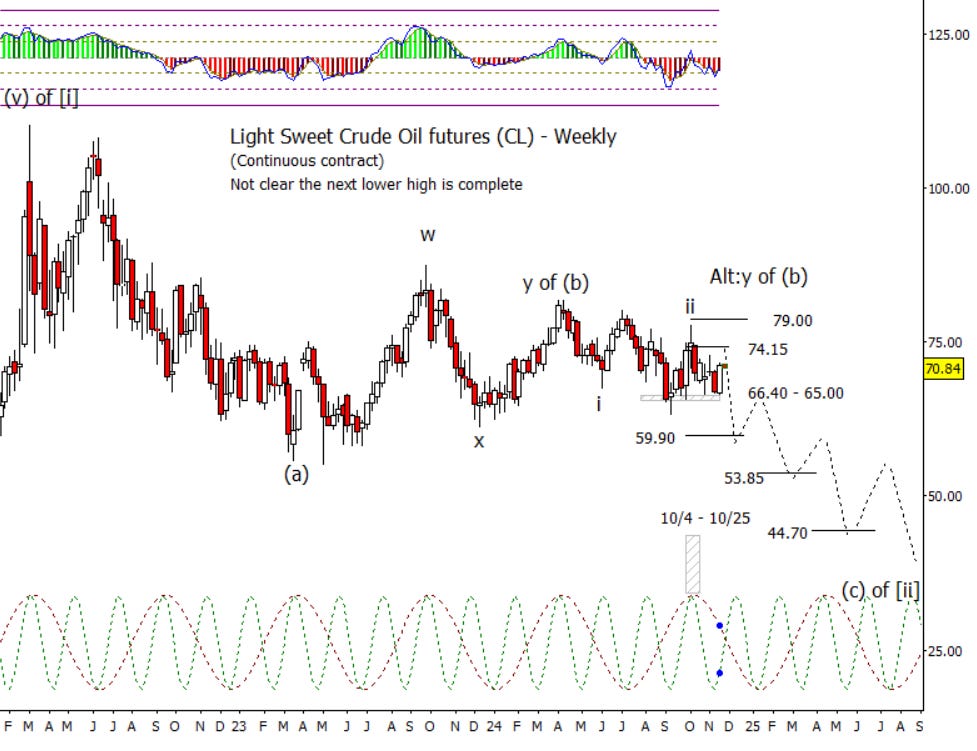

Crude Oil

Crude is on plan so far with the hypothesis for a lower high in development with the advance made last week. Should be looking for the lower high to complete this week or next.

Dollar Index

DX has been on fire as it has avoided in giving me my modest retrace. That said, I am steadfast in my belief that a retrace is needed soon to facilitate higher later.

Euro

Euro has been falling like a rock but is showing some support at 1.0400. While it hasn’t happened yet, I still think Euro is extremely oversold and can use a bounce. Yes, I think it has much lower to go but would like a bounce first, perhaps up to about where the break lower started.

Gold

I was expecting a bounce in gold, but it has been pretty relentless. I’m still thinking a lower high should develop but may need another down/up sequence before the lower high is completed. Net, it looks like the time for bears to strike will be early next year.

S&P 500

I know, I know, I worry too much. Just go with the flow for a melt-up that many expect. Except I just can’t. Even if SPX puts in a new high, which is possible, I can’t see it as anything but getting that much closer to a day of reckoning. Doubtful that anything dramatic happens this week as there is usually a positive bias this week. Net won’t be surprised by a new high but I’m not in the melt-up camp as I think we already have had a melt-up.

Bitcoin Futures

There is always a chart that is a problem child for me and at this point in time it is BTC. I was clearly wrong in trying to count the move from March to August as a leading diagonal down. Instead, it was a corrective move, probably some degree of fourth with the following move an impulse up. That impulse probably has room to push higher though it is wise to assume a consolidation before much longer. We will see if the next major correction, likely next year, is sharp as would be called for in a ‘C’ wave or choppy for a [iv]. I lean to the former but as been indicated, I haven’t very dialed into the moves in BTC of late.