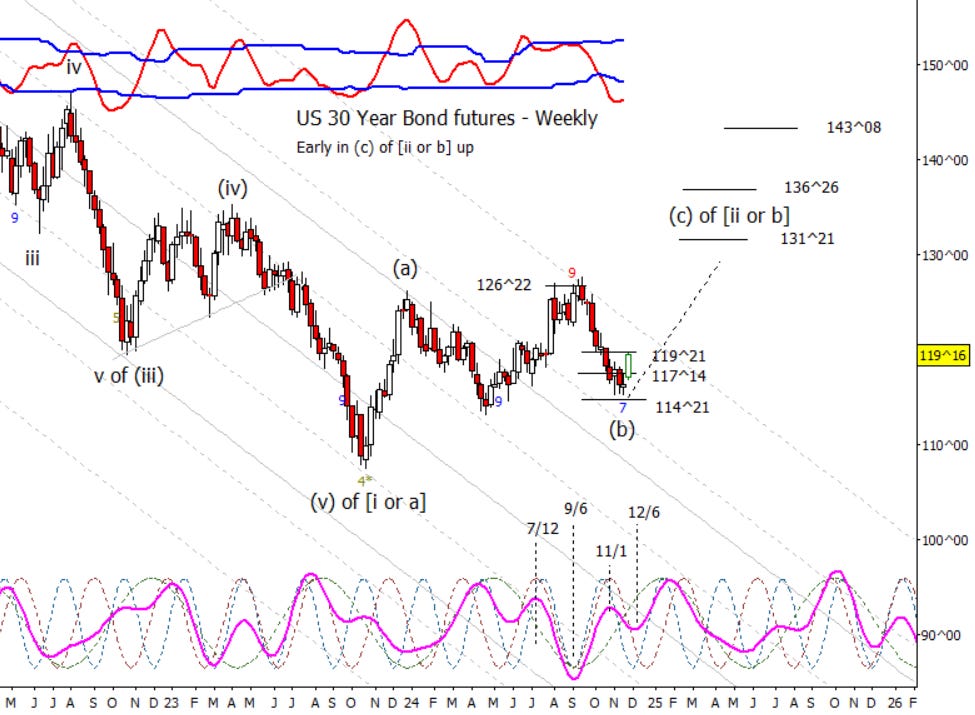

Bonds

Bonds had a good week last week as they recovered 117^14 and nearly made it back to 119^21. I now assume the (b) wave low is set and that bonds are now early in ‘(c) of [ii or b]’ up. I think it fair to think that ZB heads up into at least late January if not net higher all the way out into May of next year.

Crude Oil

While it still is not clear that a lower high to the October high has been set, it sure isn’t looking good for bulls in crude oil. Bears will be back in control if CL breaks under 65.00.

Dollar Index

DX finally makes some progress on a minor retrace. A little too shallow for what I have in mind so far, but this may only be the first step of the retrace. I would think it would eventually make it to at least 104.80.

Euro

Euro made an attempt to get a bounce started last week. We will see if the bounce can continue through the end of the year which would correspond with the next major cycle composite inflection point.

S&P 500

Not terribly surprising that the S&P 500 managed to make a new high last week as the holiday seasonality is positive. Am I confident of higher to test the next daily and weekly targets at 6081 and 6098? No, not at all. I think the advance up from August is late in the tooth at a minimum and perhaps more, the move up from October of last year.

Bitcoin Futures

BTC futures are slowing against 10200 but probably will make a new high after a few weeks of consolidation.