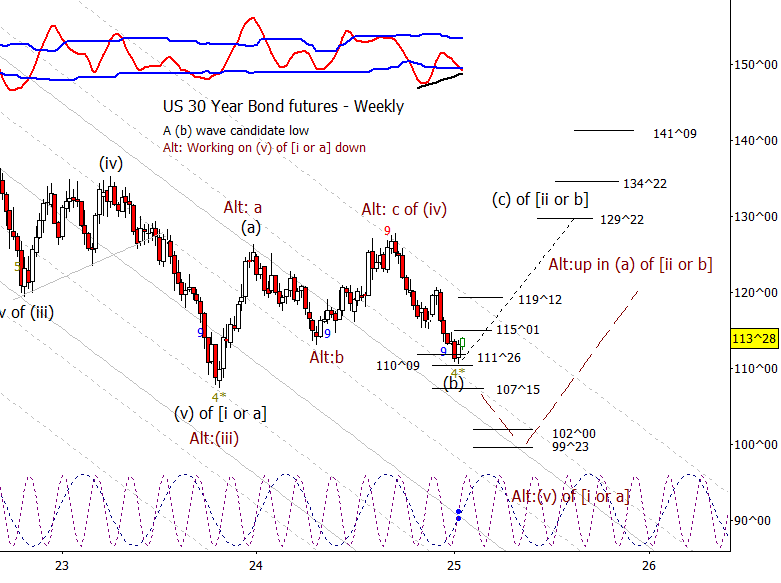

Bonds

Finally have a promising (b) wave low in bonds as they have had a nice lift from just above the 110^09 support level. On the weekly time frame, next goal for bulls is to push up over 115^01 which should cause more bears to cover.

Crude Oil

I have to fall back to the alternate count where crude has been stuck in a complex (b) wave, possibly a triangle. Bears need CL to drop under 75.35 for the first confirmation that the (b) wave is complete.

Dollar Index

DX is finally playing along with the minor correction hypothesis as it reaches about the minimum retrace I would expect though since the fast cycle is scheduled to bottom in the first week of February, I’m inclined to see if it can manage a little lower. Net, I don’t think you can count on lower but might be too early to turn bullish.

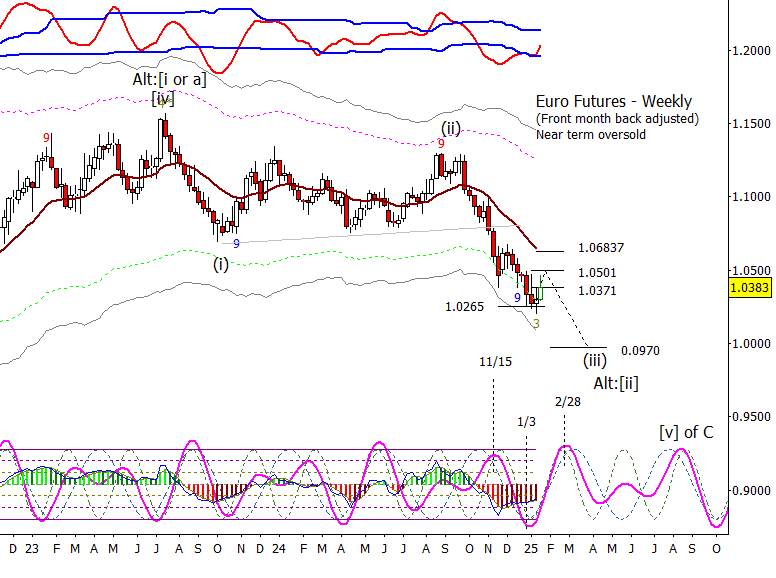

Euro

Likewise, Euro appears to be working on a bounce in a iv. I would like to see a little higher but could easily just move sideways for a couple of weeks prior to extending lower in ‘v of (iii).’

Gold

Gold is slowing the bounce against old resistance at 2756.00. I’m looking for a lower high to form around here but probably best to see confirmation of a reversal like a drop in GC under 2696.00.

S&P 500

There was a pretty strong recovery from a minor push under 5814 which is a short term positive for equities and argues for allowing for another high. That said, I worry about ‘sell the news’ type trade this week with Trump now sworn in as president. Maybe I’m just paranoid, we will see.

Bitcoin Futures

BTC has burst up to retest the prior high. That might be good enough though I can’t rule out a test of 112680 over the next week or two. Net, if holding long, this is a good place to manage

.