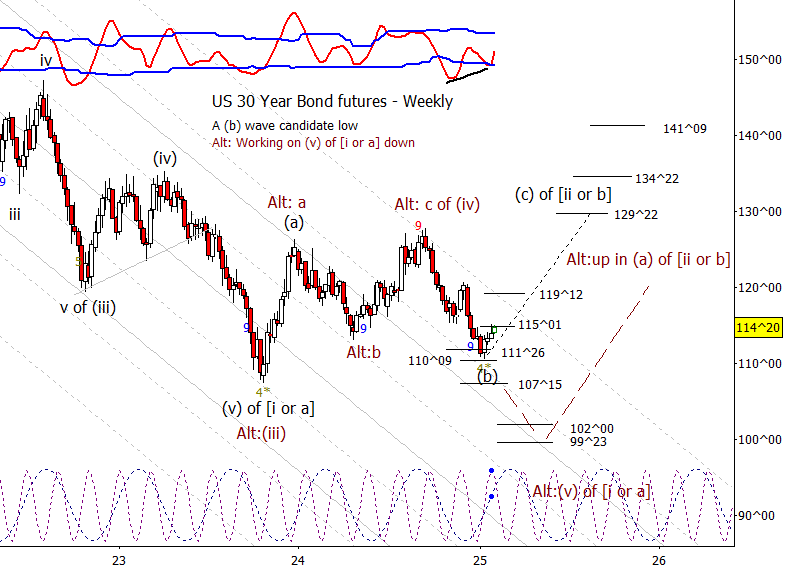

Bonds

Bonds are behaving well as they rise from the proposed (b) wave low and are now working on pressing up through the 115^01 resistance.

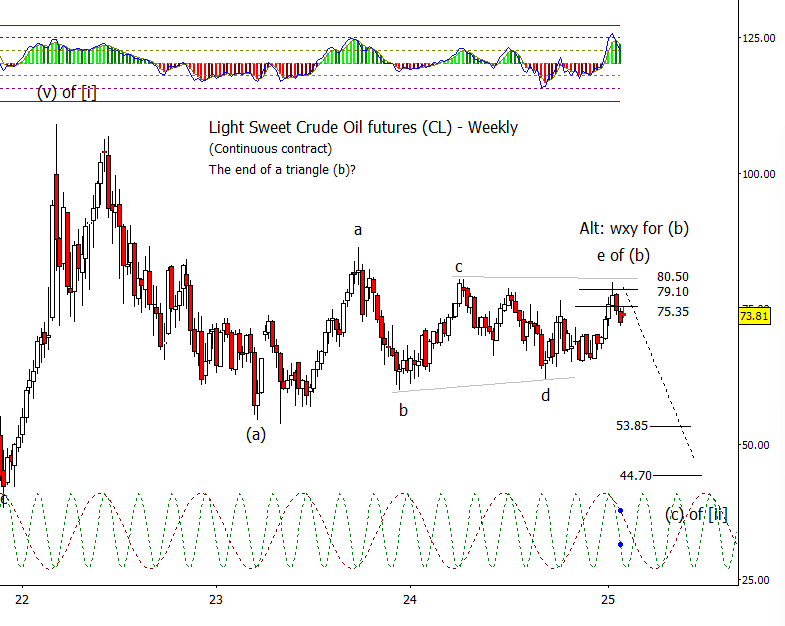

Crude Oil

Crude also looking good as works its way lower. I’m assuming that either the first little impulse down from (b) is complete and now in a small bounce or still working on the first impulse down.

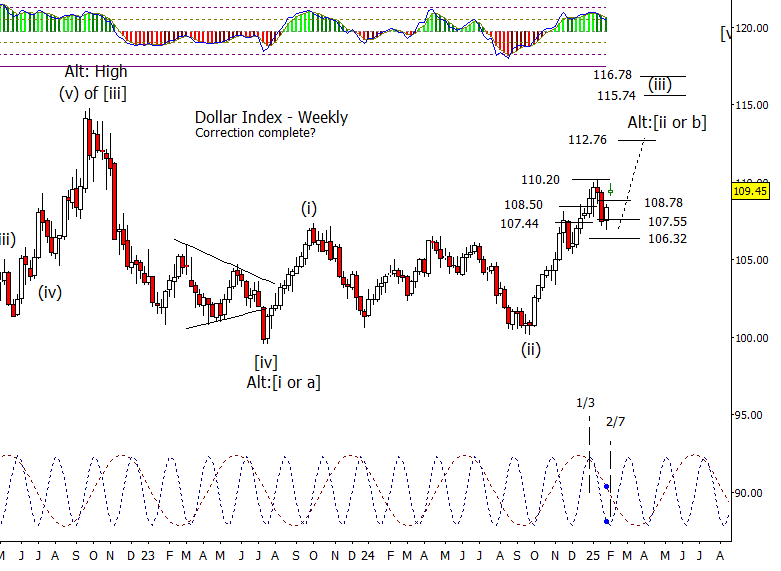

Dollar Index

DX firmed up last week and thus I’m assuming the correction is complete and now early in wave ‘v of (iii)’ up.

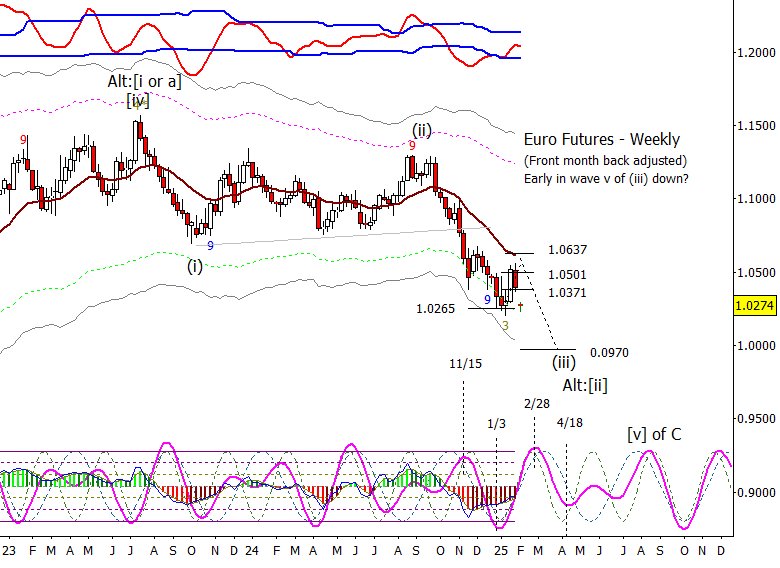

Euro

Same story as DX but the inverse in Euro. I had originally thought it best to allow for a tap of 1.0637 but instead it pushed down last week from 1.0501. Next major stop should be just under parity.

Gold

I had originally thought that Gold would put in a lower high to that of last year but alas that was not to take place. That said, I still think gold is much nearer the end of something instead of the start of something. Yes, I think gold will do well several years down the road, but I think it needs a pretty sharp correction first. Near term, probably too aggressive to fade with any seriousness prior to GC falling back under 2797.80.

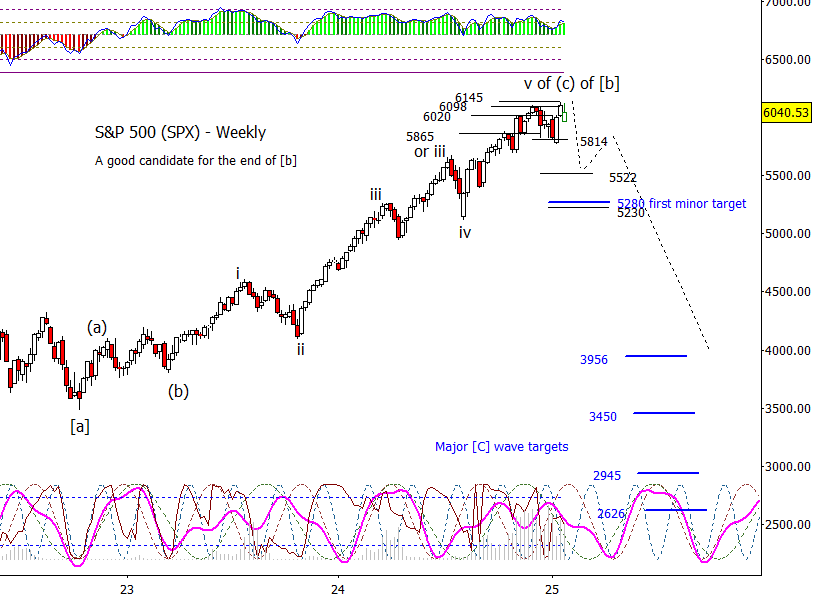

S&P 500

The S&P 500 didn’t quite make it to my pet number at 6145 but I don’t think it wise to get hung up on 17 points on such a long-term target. If SPX follows one of the component cycles, it implies lower into March or April. Net, I think we should be alert for things going wrong.

Here is the 240-minute futures chart as I type in the early hours of Monday. A gap down to a small 1x1 at 5934.50. I’m inclined to give bears a chance to push lower while under 6016.75.

Bitcoin Futures

A bit of a mini bloodbath in the crypto space over the weekend. BTC futures fell to initial support at 91110 prior to bouncing. I’m inclined to treat this as a double top and early in developing the first impulse down. Will see if bears can keep the pressure on this week and try for 85770.